10 Jul GBPNZD 2021 Week 28 Trading Plan

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #GBPNZD

This is my weekly outlook on GBPNZD. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

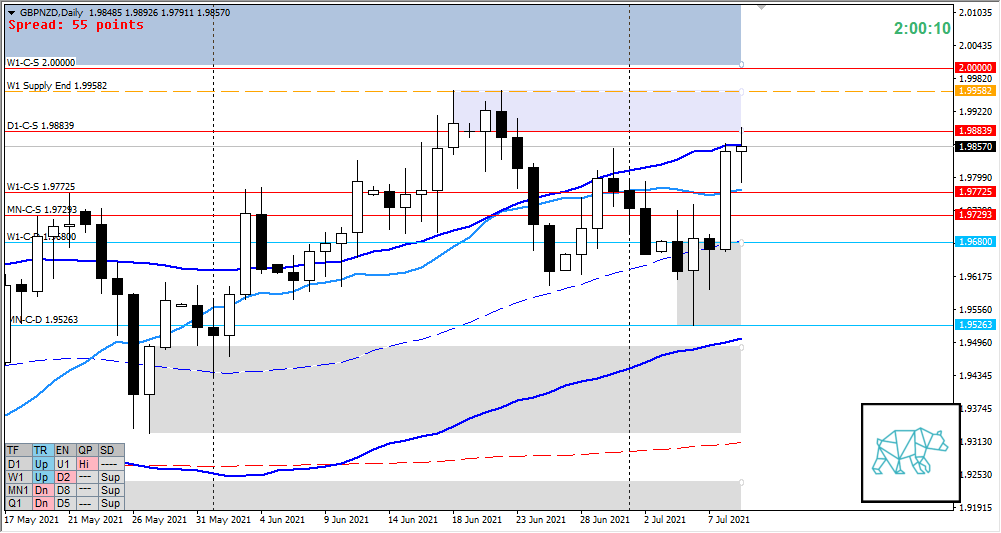

Monthly — Bullish

- MN Three Inside Up giving MN-C‑D 1.95263 (plus a retracement and test of newly formed demand) with last month closing slightly above the consolidation range within MN-C‑S 1.97293

- Price trading mid MN swing after a rejection of QHi in January

- Price traded higher after rejecting MN-C‑D 1.89782 with price currently above last month’s body but within range

Weekly — Bullish

- W1 Three Inside Up (giving W1-C‑D 1.96800) with longer buying wick reacting off W1 VWAP in UT closing within W1-C‑S 1.97725

- Price trading mid W1 swing after W1 QLo rejection

Daily — Bullish

- D1 RBR formed giving new demand at D1 50MA in UT with price having arrived at D1-C‑S 1.98839 taking out D1 supply. Friday closed as a bullish spinning top

Sentiment summary — Bullish

- MN is trading above last month’s body but still within range

- W1 did not follow-through on the Bear Engulf but instead formed a W1 Three Inside Up closing within newly formed W1 Supply. Supply is still intact and the way to W1 QHi is not clear especially with W1 Supply at the round number 2.0000

- D1 Consolidated at 50MA in UT before rejecting through a Bull Engulf. Although price would still need to take out supply. If it fails there could be a shift in short term sentiment.

Additional notes

- Jul 11, 20:10, EUR, ECB’s President Lagarde speech

- Jul 14, 10:00, NZD, RBNZ Interest Rate Decision

- Jul 15, 00:00, USD, Fed’s Chair Powell testifies

ZOIs for Possible Shorts

- W1-C‑S 2.00000

- D1-C‑S 1.98839

- W1-C‑S 1.97725

- MN-C‑S 1.97293

ZOIs for Possible Long

- W1-C‑D 1.96800

- MN-C‑D 1.95263

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 13 trades by the end of the month

- Weekly Goal

- Weekly Focus Points

- Min. 3 times working out at home + mandatory cardio

- Trading rules

- Focus on taking ONE trade a day. If I missed the first DTTZ then a trade needs to be taken on the 2nd DTTZ unless there is a high/medium initiative activity day.

- Only price-action based exit rules (or if hit time stop comes earlier)

- M15/M30 entries and exits at 1st DTTZ, M5 entries and exits at 2nd DTTZ

- Buffer trades (profit target >1R) are allowed and encouraged

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- No social media / messenger apps / phone calls allowed during the trading window

- Weekly Focus Points

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments