#daytrade #daytrading #forex #FX #Forextrader #INDEX #INDICES #DAX #DE30 #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #tradingforex #daytrading

This is my weekly outlook on DE30 otherwise known as DAX. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me.

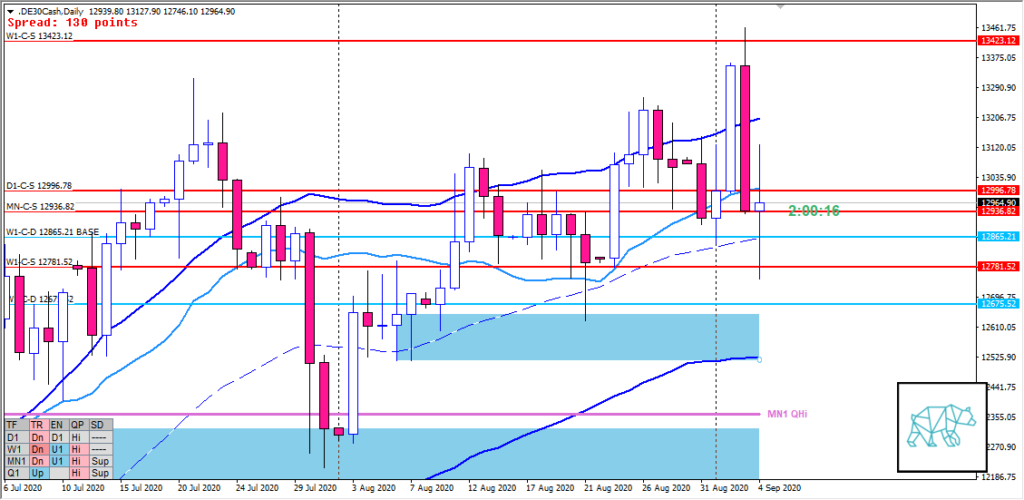

Monthly — Slightly Bullish

- Last month tested but did not close inside supply MN-C‑S 12936.82

- Developing month trading above last month’s body with a move higher into supply testing W1-C‑S 13423.12

- Within MN QHi

Weekly — Slightly Bullish

- W1 RBR with last week a test of overhead supply W1-C‑S 13423.12 closing as an inside bar with longer selling wick. With lower wick extending below the preceding week’s range.

- Price trading above W1-C‑D 12675.52

Daily — Slightly Bearish

- D1 Bear Engulf foming D1-C‑S 12996.78 with Friday forming a near-Doji

Market Profile — Slightly Bearish

- Price still in overall range currently at the bottom of the range with an attempt to dip below but quickly returned.

Sentiment summary — Neutral to Slightly Bullish

- Last two days probably had some profit-taking. Equities being equities and price being at the bottom of the overall range there are grounds for more bullish sentiment. Especially combined with price being above larger time frame demand. A con would be that we are testing the all-time high of last February with the consequent COVID sell off.

ZOIs for Possible Shorts

- W1-C‑S 13423.12

- D1-C‑S 13131.39

- D1-C‑S 12996.78

- MN-C‑S 12936.82

- W1-C‑S 12781.52

ZOIs for Possible Long

- D1-C‑D 13084.69

- W1-C‑D 12865.21 BASE

- W1-C‑D 12675.52

Focus Points for trading development

- Weekly Goal

- Formulate hypos in order of likelihood and track with actual development on the day

- Incorporate profile day type

- Trading Rules

- If Open outside of value consider the placement in relation to ADR/ASR

- FX within value > DAX

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING