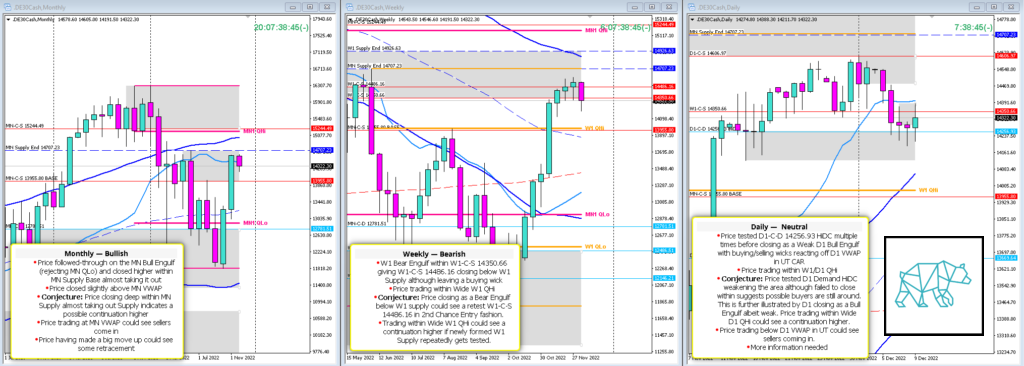

11 Dec DAX 2022 Week 50 Trading Plan

#Fintwit #DAX #DE30Cash #MarketProfile #Orderflow #TradingPlan

This is my weekly outlook on DAX. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, get in touch with me.

Monthly — Bullish

- Price followed-through on the MN Bull Engulf (rejecting MN QLo) and closed higher within MN Supply Base almost taking it out

- Price closed slightly above MN VWAP

- Conjecture: Price closing deep within MN Supply almost taking out Supply indicates a possible continuation higher

- Price trading at MN VWAP could see sellers come in

- Price having made a big move up could see some retracement

Weekly — Bearish

- W1 Bear Engulf within W1-C‑S 14350.66 giving W1-C‑S 14486.16 closing below W1 Supply although leaving a buying wick

- Price trading within Wide W1 QHi

- Conjecture: Price closing as a Bear Engulf below W1 supply could see a retest W1-C‑S 14486.16 in 2nd Chance Entry fashion.

- Trading within Wide W1 QHi could see a continuation higher if newly formed W1 Supply repeatedly gets tested.

Daily — Neutral

- Price tested D1-C‑D 14256.93 HiDC multiple times before closing as a Weak D1 Bull Engulf with buying/selling wicks reacting off D1 VWAP in UT CAR

- Price trading within W1/D1 QHi

- Conjecture: Price tested D1 Demand HiDC weakening the area although failed to close within suggests possible buyers are still around. This is further illustrated by D1 closing as a Bull Engulf albeit weak. Price trading within Wide D1 QHi could see a continuation higher.

- Price trading below D1 VWAP in UT could see sellers coming in.

- More information needed

Sentiment summary — Neutral

Additional notes

- N.A.

Focus Points for trading development

- Monthly Goals

- Use SL scaling

- 1st DTTZ Gold

- 2nd DTTZ DAX

No Comments