#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #index #indices #DAX #DE30Cash

This is my weekly outlook on DAX. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

Monthly — Bullish

- Last month ducked below the previous month’s low to then close as a near-Doji with long buying wick. Selling wick not making a HH. Some slow-down through a potential base but need another month to confirm or reject.

Weekly — Neutral

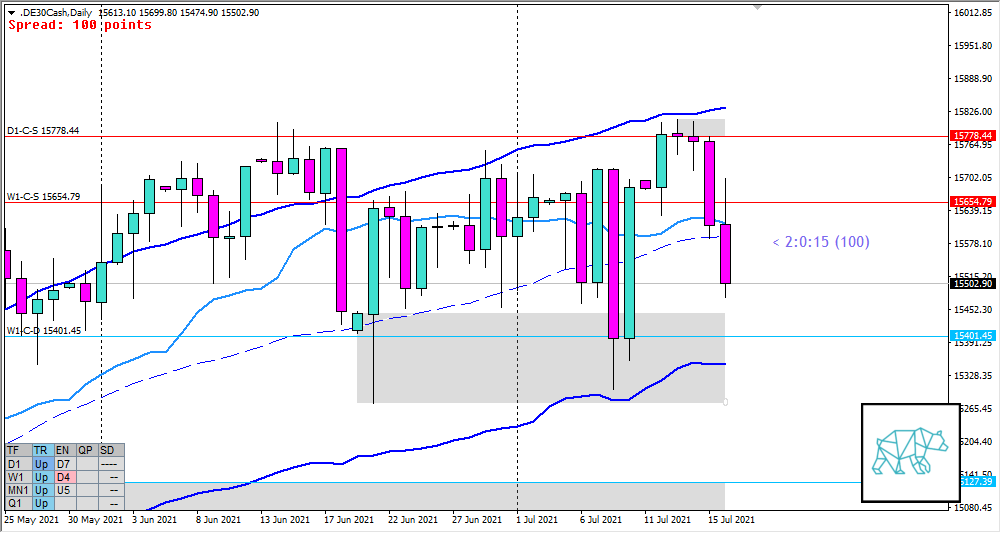

- W1 consolidation possible Phase 1 / 3 below W1-C‑S 15654.79 with reaction off W1-C‑D 15401.45

Daily — Neutral

- V‑shaped correction back to W1 supply before forming a Three Inside Down with some follow-through but then new D1 demand was formed giving D1-C‑D 15547.73 after a selling wick tested W1 Supply

Sentiment summary — Neutral

- MN closed as a possible base (but need more information) with a long buying wick

- Possible W1 Phase 1 / 3, equities being long-biased a phase 1 reaccumulation is slightly more favored although no break from W1 range yet.

- D1 Weak Three Inside Up formed some demand and price tried taking it out but was unsuccessful for now

Additional notes

- Aug 06, 20:30, USD, Nonfarm Payrolls

ZOIs for Possible Shorts

- D1-C‑S 15778.44

- W1-C‑S 15654.79

ZOIs for Possible Long

- D1-C‑D 15547.73

- W1-C‑D 15401.45

- D1-C‑D 15276.33

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 13 trades by the end of the month

- Weekly Goal

- Weekly Focus Points

- Min. 3 times working out at home + mandatory cardio

- Trading rules

- Focus on taking ONE trade a day. If I missed the first DTTZ then a trade needs to be taken on the 2nd DTTZ unless there is a high/medium initiative activity day.

- Only price-action based exit rules (or if hit time stop comes earlier)

- M15/M30 entries and exits at 1st DTTZ, M5 entries and exits at 2nd DTTZ

- Buffer trades (profit target >1R) are allowed and encouraged

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- No social media / messenger apps / phone calls allowed during the trading window

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING