#dailyreportcard #daytrading #tradinglifestyle #daytraderlife #grasshoppersanonymous #tradingforex #tradingcommodities #NEXT

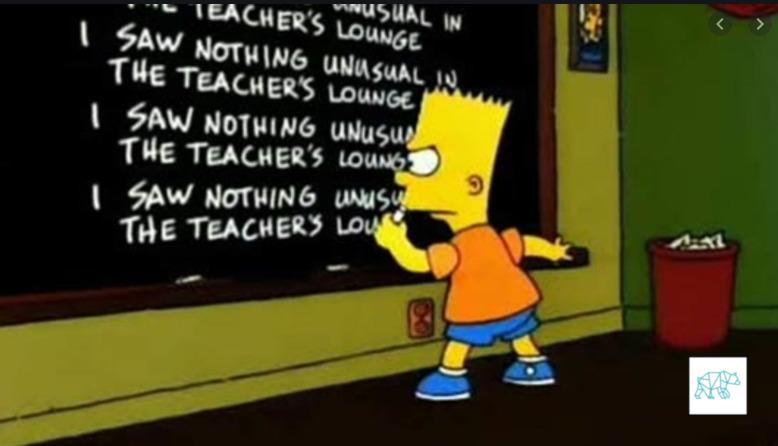

Summary: Bart Simpson

Every trading day I recap my trades, including more than entries and exits. Why did I take the trade? How did I manage the trade, my emotions and cognitive function? All the good stuff as well as all the ugly of being a day trader. As always, feel free to reach out to me.

My weekly goal: Formulate hypos in order of likelihood and track with actual development on the day

Good Pre-market routines

Good Session PECS

Bad Trade selection

Bad Trade sizing or SL placement

Bad Trade Execution & Mgmt.

Good Risk Adjusted Returns

Yes Daily review

Muppet meter (1 being best — 5 being worst): 5

Summary

- GBPNZD

- IB traded up, still within range, H1 RBR knocking at H1 supply

- C: Closed as an M30 inside bar, no IB extension (yet), M15 consolidation

- D: Closed as M30 Three Inside Down, no IB extension yet

- E: Short 1.95512 SL 1.95869 TP 1.94784

- Closed as inside bar, not the strongest M15 three sinde up (against my position) letting M30 guide me which for now is just an inside bar

- F: M5 Bear Engulf formed at VWAP, followed by a bull engulf taking out previous LTF supply so cut the trade at ‑0.6R loss.

- Closed as a consolidation and H1 doji. No real clarity on direction here.

- G: Made LLs and closed within value

- H: Value acceptance short 1.95232 SL 1.95537 TP 1.94637

- Will monitor for a sustained auction a contingency could be a close in H around these levels and I taking out single prints which could mean I close off this trade and go long for a single print fade.

- H retraced back to VAH and IB edge and took out my stop for ‑1R loss

- I: Consolidation

Hypos

- Which hypo played out and how did I hypothesize it playing out? How did it actually play out? What did the profile and price action show?

- GBPNZD

- Hypo 1 – Reversal (short)

- H4 c‑sup, ADR 0.5, H4 QHi

- Preferred: PA reversal within IB, otherwise an extension up followed by reversal and failed auction, value acceptance

- 100%

- M30 Three Inside down and I entered on an IB extension down for extra confirmation since I was thinking to wait on a value acceptance first.

- Hypo 1 – Reversal (short)

How accurate was my assessment of market context? Was I aligned with market context?

- Initially good as my hypo 1 played out perfectly. I got confused later on when price acted jumpy and because I didn’t wait for a value acceptance even though I was thinking of it. Then when Dee mentioned the same I looked down to LTF price action for a possible exit. When I saw M5 bull Engulf and consequent taking out of supply I got out thinking I can always get back in later. At this time M30 only showed an inside bar and thus still could have gone either way. I grasshoppered.

- Lo and behold if I had stuck with the trade I would have been in 1+R profit at the time of this writing and not down ‑1.6R.

- The 2nd trade I did not account for the spread on top of my SL. Another big minus.

How did I feel before, during, and after the trade?

- I initially felt okay. Then noticed small mistakes and got a little jumpy but still tried to follow my exit rules but forgot to base them on the M30.

How well did I follow my process?

- I messed up today

- Doing the Bart Simpson exercise: “I will not use weak patterns on low timeframes for trading decisions” — write out 50 times before bed

How well did I manage my physical, emotional and cognitive states?

- I did fairly well here actually considering

What did I learn today?

- I learned that when I have a trading idea and act on it I have to let the trade play out based on hard exit rules. Entries M30/M15 based. Exits M30, profile or time-based.

- I can let go of making mistakes. Everyone makes mistakes and I don’t have to be an expert on everything right away. As long as I learn from my mistakes. Progress, not perfection.

- It’s just the first trade of the month for me and it is the end of the month that matters.

What’s one thing I need to do more often?

- Stay committed to a trade regardless if I think it might be wrong. Use exit rules to cut a trade. They are there for a reason.

What’s one thing I need to do less often?

- Grasshopper

Under the circumstances, did I perform at my best?

- As outlined above I could have done much better

For my trade plan(s) on this particular day, go here: