My weekly goal

Only take trades when there are at least 4 confluences. Trade location. Market Profile. Price action confirmation. Follow hard entry and exit rules.

Good Pre-market routines

Good Session PECS

Good Trade selection

Fair Trade Execution & Mgmt.

Good Risk Adjusted Returns

Yes Daily review

Muppet meter (1 being best — 5 being worst): 2

Summary: Mean Reversion

- London opened slightly above VA but traded down into VA closing halfway through (during A) taking out M30 Supply. Will need to see a rejection of VA before considering a trade since Value acceptance has crossed halfway there is not much room for profit margin to PVAL for value rotation. For now just sit back and observe

- Price closed below PVAL within M30/H1 Demand. I am monitoring a consolidation on the lower time frames to see if we will see a continuation or reversal

- In case of a continuation we have 50 pips left in the session

- Price is a little jumpy

- First M5 Bull Engulf indicating a possible reversal, but need more confirmation then the weak M15 inside bar

- Buying tail taken out forming a poor low for now, waiting for 4th TPO close and price action confirmation to potentially go long

- M30 DBD waiting for retest new conterminous for entry short after missing the M15 consolidation with bear engulf entry

- M30 retest of newly formed conterminous (M30 DBD) at PVAL after H4 Demand being taken out, TPOs making LLs and 33 pips left in session

- Entry 1.94247 SL 1.94447 TP 1.93847

- Cons M15 Bull Engulf, late in the session but still within trading window

- G made a LL

- H opened in lower extension and continued making a LL

- TP at 1.93914

- Price would have hit my TP but got eager to take the trade off and took profit at 1.93914 (1.7R) instead of my TP level off 1.93849 leaving 6.5 pips on the table. I totally didn’t think of the M15 candle close rule and when it hovered above my TP (btw the spread means I still would have needed the price to go further to actually hit my TP which it in the end did). I was staring at the single print H TPOs and nearing H4 demand (plus session being exhausted) I considered a possible reversal and took the trade off.

- I should have been more patient because of 1) M15 candle close rule not hit 2) No demand on the lower timeframes in the way, just the H4 3) time-based stop hadn’t hit.

- Aftermath

- As pointed out above the trade would have continued in my favor but is showing first signs of a possible reversal. H has created a buying tail for now.

How accurate was my assessment of market context?

- I well going through the charts and looking for clues based on OODA. I was actually waiting for a long opportunity with the M15 consolidation at H1-C‑D 1.94318 but when demand got taken out and the consolidation ended with a bear engulf I shifted to a slightly bearish bias.

- When price retraced to M15 conterminous I was considering to go short but missed my opportunity because I was considering a M30 consolidation as well. When I saw that the M30 inside bar turned to be a DBD formation I waited for a retracement back to M30 conterminous before going short. The rest is detailed above.

How did I feel before, during, and after the trade?

- I felt good before the trade going through all the charts looking for clues to validate or invalidate my initial ‘bias’. When this got invalidated I decided to look for an entry in the other direction.

- During the trade I monitored TPO structure and we were making LLs and M5 was staying nicely below VWAP giving me more confidence. WHen price almost hit my TP I lost my ‘cool’ for a second and took profits too early.

- After the trade I feel good on one side having spotted the opportunity based on good following of my process. On the other hand I know I could have done better by finishing to follow my process till the end. I will keep rehearsing this grow more confident in my ability to read TPO structure combined with the knowledge that price DOES NOT reverse so quickly after a bigger move down so I have the time to reassess and come up with a better exit if need be.

How well did I follow my process?

- Well in the beginning, not too good towards the end as detailed above. Another thing to note is that I did fairly well on sizing my position based on SL size.

How well did I manage my physical, emotional and cognitive states?

- I did fairly well here but towards the end I got too eager to take profits.

What did I learn today?

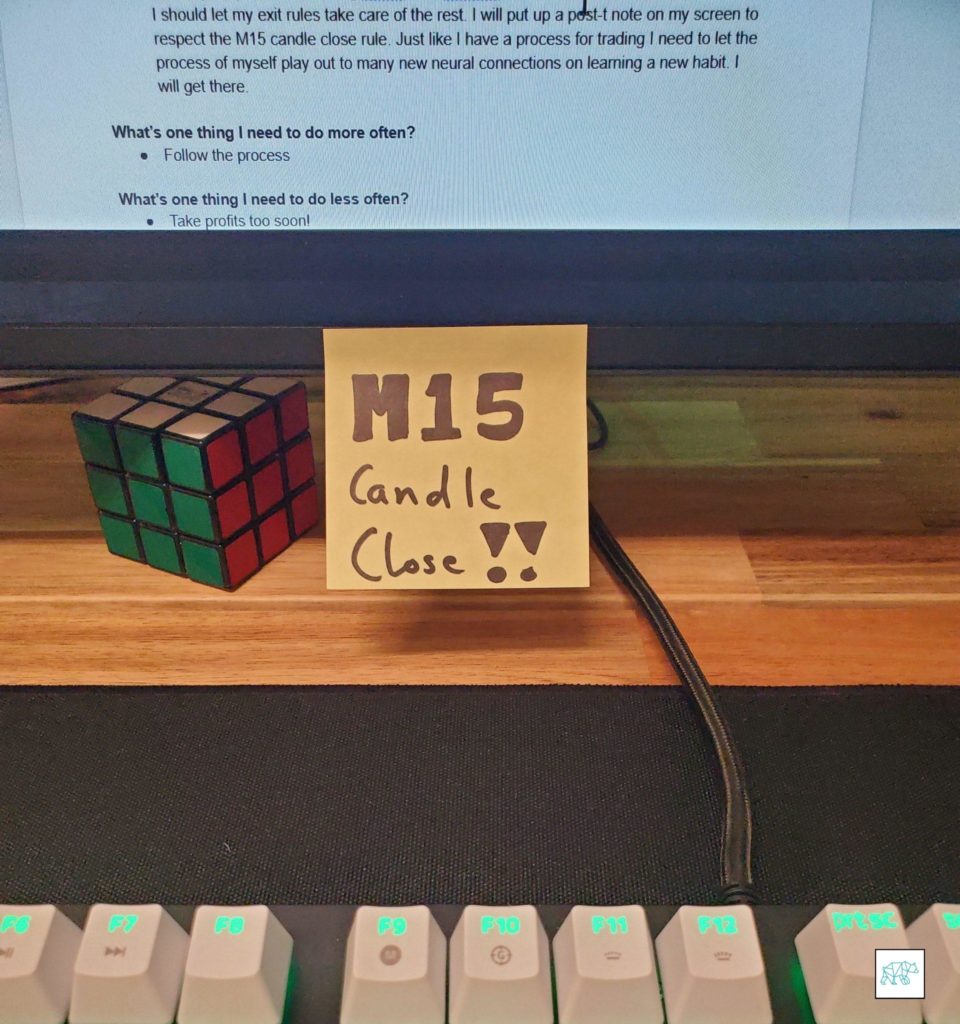

- Follow your plan. After having spent time to come up with a plan and executing it nicely I should let my exit rules take care of the rest. I will put up a post‑t note on my screen to respect the M15 candle close rule. Just like I have a process for trading I need to let the process of myself play out to many new neural connections on learning a new habit. I will get there.

What’s one thing I need to do more often?

- Follow the process

What’s one thing I need to do less often?

- Take profits too soon!

For my trade plan(s) on this particular day, go here: