01 Mar Analyzing your Trading stats Month 9

#fintwit #orderflow #daytrading #tradingforex #forex #tradingjournal #daytrading #tradinglifestyle #daytraderlife #trackyourstats #tradingstats

So you’ve been trading for a while. How do you know what to look for? How do you know what you are doing right and wrong? Which setup works best? What time of day works best? How long do I let winners and losers run? How much is my expectancy? What is my risk to reward ratio? In other words: how much money am I putting on the line to make how much? Just by looking at these stats you will get real insight into your strengths and weaknesses. Do not overlook this. Do not be one of those people that just trade and trade and trade but never review and wonder where they went wrong. You need to know what to improve upon.

Thank you for following my progress

First off. For those of you that have been following my journey I’d like to give a big thank you! Almost everyday I upload trading plans and a Daily Report Card. I sincerely hope my journey somehow adds to your own. Keep in mind that this is my journey and might not fit yours. It is up to you to decide what you’d like to take away from this and what to ignore. This is not advice whatsoever. Having said that… Let’s get it on!

Process

The stats that I am about to share with you help me track what I deem to be important. These mostly focus more on my process than actually making money. Process is king. Money is just a result of performing well on your process. Let’s get to some stats.

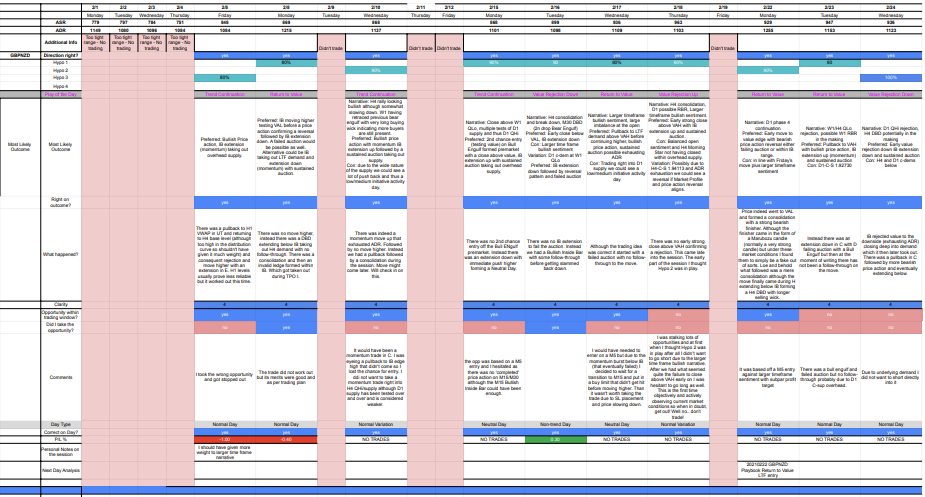

DRC Tracking Stats

Here you can find the details of my DRC tracking sheet. DRC stands for Daily Report Cards. If you would like to take a look at some examples you can do so here. Every trading day I recap my notes, trades, and performance. I grade myself on how well I executed my plan as this is the most important. Living in a probabilistic world of trading making money is a side-effect of trading your plan. No one real trader in the world has a 100% win rate (if they are please run away quickly). If you like to know more on how I track my stats just hit me up. I freely share this information.

Here you can download the raw data I track everyday.

Trades

February was definitely better than January. Looks like things are picking up again. The dust has settled and we might be in for some fun until the Summer months come knocking. So I took 7 trades in total. I am still trying to decide what the balance is in me actually not having any opportunities or perhaps feeling less confident taking trades. More on that later. But yeah… 5 winners and 2 losers. Since I rarely look at the winners (as they will take care of themselves although I do review etc.) I will focus on the losses. Before we get to that I like to look at if I missed any opportunities and if so why?

Opportunities Presented

Please understand that a lot of these metrics have a level of subjectivity about them. In terms of what I determine to be an opportunity for example. Although I use a systematic approach and thus have hard rules to trade. I am also improving my entries and thus my rules are ever slightly changing a bit. So one time I’ll take an opportunity where the next I might not based on these ‘new’ rules as I am gaining confidence on trading the lower timeframes. You have to figure out the framework of which you yourself will grade yourself on a job well done or not. These are mine… With that out of the way.

I first have to make the separation between GBPNZD and Gold. I primarily focus on GBPNZD but when ranges are too tight (thus statistically obliterating my edge) I focus on Gold.

The first week of GBPNZD the ranges were too tight and could not trade it. For the whole month I sat down to observe the market (not trade, we don’t trade for trading sake. We observe, take notes, if an opportunity comes to us we execute) only 8 days. Not going to talk about the days that the range was too tight or I couldn’t, did not want to, whatever reason, not trade that day.

From the 9 days I observed there were 7 days that presented with an opportunity. 2 days I actually took the opportunity. Then another day I took the wrong opportunity and got stopped out. We’ll talk about that in a bit. 3 trades taken. I lost ‑1R and ‑0.4R, then I made 0.30R.

With Gold I also sat down 13 days to observe. Of these days 5 presented opportunities of which I capitalized 4 times. Wins: 0.80R, 1.9R, 2R, and 0.25R. Losses: none. That leaves us with one day that I didn’t act on the opportunity. That day I was very much focused on GBPNZD plus the entry would have been on a M5 which is not my normal timeframe for entry. I need to earn the right to trade more off M5. For now, as I will explain later more, I focus on M30/M15 combinations. Meaning a pattern might be forming on M30 so I look for M15 to confirm that transition to take an earlier entry (if possible).

Let’s talk losses. Noooooo I NEVER LOSE!!! Oh I do indeed….

- Friday 2/5 (-1R): It was my first day of trading for the month as ranges were still too tight on Wednesday and Thursday. Friday the range was slightly tighter than I like to have but still statistically okay. There actually might be a correlation between tighter ranges and price action adhering more to H1 price action than the normal M30. This time we had, what I thought was a valid reading of context based off M30 price action, but turned to disregard that and ‘respect’ H1 price action more. Usually I look at the H1 to ‘supplement’ the M30 price action within a H4 narrative (within a larger timeframe narrative, I know complex shit but it’s not really). But under certain market conditions I find the market disregards the ‘normal’ market behaviour and slightly skews it. This is one big point I need further research on as this is still a fairly new realization. Surely, more on that in the future. SO because of a ‘false’ reading of the narrative I got stopped out quickly (this is when I know I shouldn’t have been in the trade to begin with) and lost ‑1R.

- Monday 2/8 (-0.40R): 2nd day of trading and another loss. I’ll dive into a possible scenario later on. I took a trade based on my trading plan but it simply didn’t work out. Nothing to see here folks. Moving along.

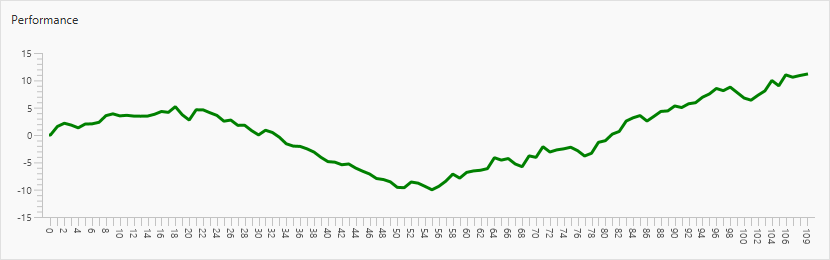

Equity curve

Started the month with +7.18% and currently I am at +11.33%. Up by +4.15%.

February

Overall Evaluation

Monthly DRC Tracking Stats

I thought it was about time to dive a little deeper into some stats. I don’t want to focus too much on these every month as I need a larger data sample for these stats to have more value. These stats I simply look at outliers. Stats that stick out rather than look at its entirety because they don’t matter as much. The outliers give me more insight in where I still need improvement or to tell me where my edge is slightly better.

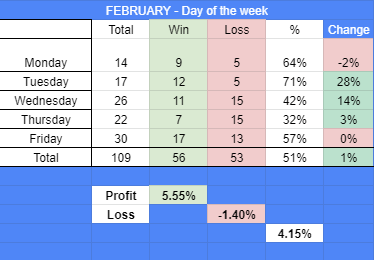

Day of the week

For example here you can see I take more trades Wednesday to Friday more than on Monday and Tuesday. Although, win rate on Mondays and Tuesdays are higher. With Tuesday taking the cake. This could be due to a correction on Monday to the previous week’s close as markets like to move in swings. Like Fridays we could see profit-taking to the move earlier in the week.

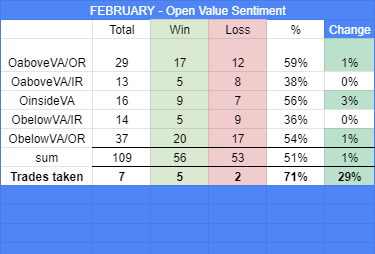

Open Value Sentiment

The second factor I track is the open value sentiment. With this I track the value location of the London open ie. within value, above/below, inside,outside range. All these have implications on the (im)balance in the market. For example an open within (can) indicate the market is balancing.

From these stats we can see the outliers I have a higher win rate on Open Above/Below Value, Outside Range which indicates I like taking mean reversion trades. Which makes sense as I do like going against the grain so mostly I look for reversals or mean reversions. I find it less near to my personality to take a trend-following setup even though I do take those. I am just slightly less comfortable with them.

The rest are about the same to me with a slight outlier in a higher win rate on an open within value.

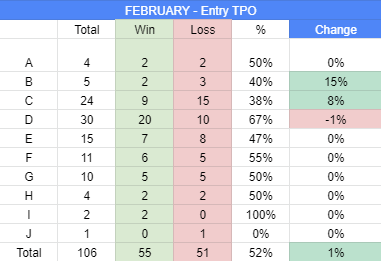

Entry TPO

Here I track during which TPO I take entries and thus get insight where my edge is better. Again we are looking for outliers. I like taking trades during C and D TPOs but what you can also see is that D has a much higher win rate. Thus I could conclude to either eliminate taking trades during C or find a better way to understand why they don’t work. Me being me I like to focus on the latter. Thus for the last 2 months I have raised my win rate during C. 12% increase in January, 8% in February. I reaffirmed (although need a bigger sample size to have a more positive expectancy) the Day Trading Time Zones and understanding market conditions conducive to a momentum trade as taught by Dee. On my low point I only had a 7% win rate during C so with now sitting on 38% I would consider that a significant increase.

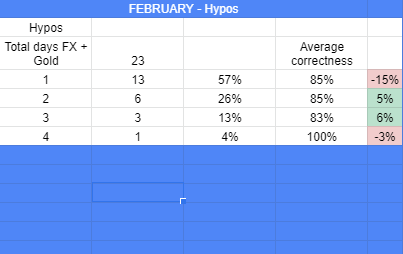

Hypos

Every trading day I formulate 1 to 3, sometimes 4, hypotheses. These give me a framework to what I expect to see in the market on that day. Then during the session I wait for price action to confirm or negate a hypothesis. If price action confirms I execute a trade. If the trade is based on a hypo it is more likely to be a good trade (no guarantees of course, we are simply looking for higher probability outcomes). So win or loss it was a good trade. This is not always the case as I of course make mistakes and execute a trade on the wrong hypo. But by tracking these stats I get better insights into 1) did I formulate the right hypo 2) did I execute based on the hypo and if not I gain insights into why I did not. Using these metrics I keep myself in check but also gather data on if I am hesitating more than not or if I am not aligned with market conditions.

Here you can see that most of the times I am correct in my first hypothesis (hypo 1) of what the market is more likely to do. Then I also started tracking (this month) to what extend that hypo played out. If you look at my hypotheses here you can see that I also hypothesize what price action or orderflow event I prefer to see. Then I grade myself on the correctness of said assumption. So 1) was the hypothesis a valid one 2) to what extent was it valid? No real outliers here as hypo 1 to 3 are 83% to 85% again there’s a good level of subjectiveness in tracking these. Hence the stronger need to focus on outliers as it is in the extremes that we can potentially find valuable information.

Objectives

So, one thing I learned this month is that I feel I am putting unneeded pressure on myself by sharing profits etc. Trading is already hard as it is and any extra pressure is definitely not needed. Therefore, for one, I decided to take away my P&L posts in my daily report cards that I post daily. Also, I’ll be focusing on what I call my main fund. I trade a smaller account and then use FX synergy to copy my trades to a bigger account. This kind of helps with not looking at a bigger amount in terms of P&L. Although I feel it is not so much a big factor I will only find out when testing in real time. Thus I just simply have to do more of it to create a larger sample size for me to base conclusions on.

One thing I noticed is that I take more trades using my smaller account than I actually trade with my ‘main/bigger account’. Which you could argue which one is the main then… I need to focus on trading my bigger account (which I dubbed my main account from now on). This way I hope to: 1) feel comfortable trading bigger size, 2) don’t have convoluted statistics on my trades. Hence, I expect next month to even take less trades as I am a bit more picky trading this main account.

I am trying to get into the flow and am not forcing myself to trade unless I feel comfortable taking a trade. I know that I am not shy at all when it comes to taking an opportunity. So I don’t expect turning into some owl waiting for a myriad of confluences before acting. I want the trades to come to me. BUT… by having these two accounts I easily take trades I might not have taken on the main account even though they are good trades. It kinda became a crutch. So because of this my main objective for next month is to only trade the main account (in conjunction with the smaller account as I copy trades over but always together).

I will use both as I also use it to gather statistics with. But if a trade is worth trading I will trade it on both accounts otherwise not trade. Because now I am up on my smaller account but broke even on my main fund. Which is obviously not the goal here.

I am not going to share too much about my main account at the moment until I have a larger sample size. For example, It is not doing anyone any good when I have taken one trade and it was a winner (yaaayy 100% win rate). So hang tight I will share in due time.

Previous Monthly Goals

- Continue tracking hypos

- I love this exercise and it really makes me focus more on the process than focusing on making money. Money is a mere side-effect of following your process (with statistically viable edge) well.

- Focus on my own progress and less on others

- I have been doing well on this part BUT I am going to add something to it. I find I look at Twitter too much and am sometimes negatively impacted by seeing other people’s stated profits. Real or not. I will still post my trading plans and daily report cards but refrain from checking other people’s tweets too much. Kinda going into hiding to focus om my own performance kinda thing.

- Feeling okay with NOT trading

- I do well here but I will keep this for next month as well. One good metric I have is that trading is my passion. My love (don’t tell my gf). My precious. So when I am even thinking if I want to trade that day I basically already know I shouldn’t be trading. I need a little break. Which is perfectly fine. Although on certain days I do still sit there and observe but I just do not make as much of an effort to look for opportunities as I normally do if that makes sense. I focus on taking notes. Don’t always focus on the screens. Catch up on other work etc. You get it.

- Don’t trade during TPO C, unless there is a momentum trade

- I already addressed this above. My performance has been increasing 7% to 38%!

- Have ‘quieter’ weekends

- Doing well here. I do go on trips more as my gf is an outdoorsy type and I am not so much. I can be behind my screens all day every day. I know I need time away from the screens. Chill. Hang out with friends. Be social. Re-center and get back fresh. This also reminded me of one ‘new’ thing: don’t talk to people about trading. Most cases people don’t know what we go through. If they have been trading they don’t know what they are doing and it kinda gets frustrating. Frustrating to hear a person who just opened a trade to have more confidence than me who has been trading now over 4 years. I will add it to topics I will refrain from. Along side politics, religion and cryptos…. Oh my god crypto traders… Please understand I have nothing against cryptos. I even hold some. It’s just in trading the majority of people are simply muppets (which I am still at times). With crypto attracting even more people means this majority of muppets has amplified. It’s like your average Joe telling a surgeon: “you see Doc. You’re doing it all wrong! You cut here. You put this here. Then you stitch that fucker right up and you’re done”. Haha it’s amusing but also sad that the average Joe has a bigger than normal potential for huge losses in the markets.

- Minimum of 3 days of working out, aim for 5.

- Have been neglecting this somewhat due to holidays and such but have made an effort again.

If you have made it all the way through… Here is a FREE LAMBO!!!

Sorry no Lambo. Nonetheless, I greatly appreciate your interest in my journey. I’m sure it is not an easy read as I tend to get long-winded. If you have any comments or suggestions feel free to let me know. Even though I do like writing I don’t consider myself to be much of a writer. Get in touch if you have any comments or questions or just come say Hi!

No Comments