#fintwit #orderflow #daytrading #tradingforex #forex #tradingjournal #daytrading #tradinglifestyle #daytraderlife #trackyourstats #tradingstats

So you’ve been trading for a while. How do you know what to look for? How do you know what you are doing right and wrong? Which setup works best? What time of day works best? How long do I let winners and losers run? How much is my expectancy? What is my risk to reward ratio? In other words: how much money am I putting on the line to make how much? Just by looking at these stats you will get real insight into your strengths and weaknesses. Do not overlook this. Do not be one of those people that just trade and trade and trade but never review and wonder where they went wrong. You need to know what to improve upon.

Thank you for following my progress

First off. For those of you that have been following my journey I’d like to give a big thank you! Almost everyday I upload trading plans and a Daily Report Card. I sincerely hope my journey somehow adds to your own.

Break even-ish

The stats that I am about to share with you help me track what I deem to be important. These mostly focus more on my process than actually making money. Process is king. Money is just a result of performing well on your process. Let’s get to some stats.

DRC Tracking Stats

Here you can find the details of my DRC tracking sheet. DRC stands for Daily Report Cards. If you would like to take a look at some examples you can do so here. Every trading day I recap my notes, trades, and performance. I grade myself on how well I executed my plan as this is the most important. Living in a probabilistic world of trading making money is a side-effect of trading your plan. No one real trader in the world has a 100% win rate (if they are please run away quickly). If you like to know more on how I track my stats just hit me up. I freely share this information.

January

So January was definitely an odd one. As Dee says not through some mystical ways but simply due to institutional traders taking a vacation. There were less opportunities and the ones that were there proved less ‘reliable’. Just weird price action all around to be honest. So I took 7 trades in total. 3 winners and 4 losers. Since I rarely look at the winners (as they will take care of themselves although I do review etc.) I will focus on the losses. Before we get to that I like to look at if I missed any opportunities and if so why?

Opportunities Presented

I first have to make the separation between GBPNZD and Gold. I primarily focus on GBPNZD but when ranges are too tight (thus statistically obliterating my edge) I focus on Gold.

With GBPNZD there were 8 days I sat down to trade (as other days the range was either too tight or I took the day off). Of which there only 2 days that presented opportunities both of which I traded. One day I made 1R, the other days I lost 0.4R, 2R and 0.4R (more on that later).

With Gold I also sat down to trade 8 days when GBPNZD was in a too tight of a range. Of these days 7 presented opportunities of which I capitalized 2 times and 2 others I took paper trades. 1 day I made 0.65R the other 0.90R. The third and fourth day I took a paper trade getting to try out a ‘new setup’ and that one went to 1.8R and 1R. 2 of the presented opportunities I was focusing on FX so won’t count those. That leaves us with only one trading day where I ‘missed’ an opportunity. Which is fine.

- 1/26: I wasn’t paying attention because of stuff IRL

Let’s talk losses. Noooooo I NEVER LOSE!!! Oh I do indeed….

- 1/8: I went against the open sentiment due to perceived bullishness but I should have gathered there would be no follow-through to the move. I thus missed the move I should have been in which was a move off ADR 0.5 high (within value) although this was my first time objectively witnessing this particular market condition. So I give myself some slack for that.

- 1/14: The day I gave myself a full 5 (1–5 scale, 5 being worst) on the muppet scale! Total muppet move that day. I took 2 trades. Both of them hit 1R SL very quick. The first trade I was eyeing a value acceptance play and without price even closing inside (it closed a pip or two outside of value thus FAR from accepted) I went in… Still kicking myself for that brain fart a bit. Although… that is why we have good risk management in place to safeguard ourselves from our inner-muppet. Always adhere to your risk profile. Always adhere to SL. They are there for a reason. The second trade was much better. I stalked a possible reversal, which did come and tranistioned the way I visualised into a failed auction. After which there was no follow-through and reversed and hit my SL. So not the best trade management there as I was observing price action going against me and I could have jumped out but I let the failed auction scenario kinda take lead here. Which not the worst but yeah lesson learned.

- 1/15: There was a value acceptance but then we created a bullish pattern and price moved higher when I saw this I closed the trade at 0.4R loss.

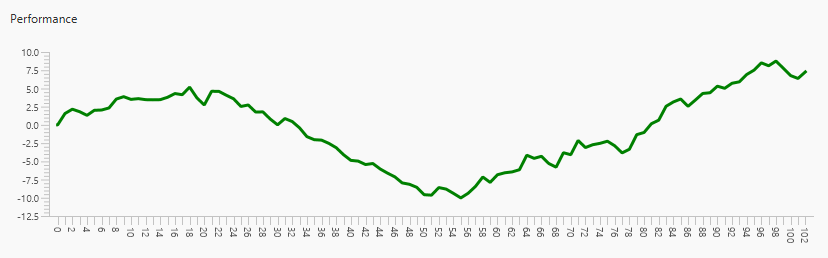

Equity curve

Started the month with +7.46% and currently I am at +7.18%. My profitable trades this month generated +2.55% where my losing amounted to ‑2.8%. So I ‘lost’ this month slightly with ‑0.25% which is about breaking even if you ask me 🙂 ‘Winning Streak’ since September up by 16.83%.

December:

January

Overall Evaluation

Plan

(no financial advice whatsoever, please think of me an idiot or eejit as I recently learned)

So what happened to my plan?! I intended to start a challenge with a prop trading firm. You’ve said that many times come on bro when??!!! WHEN??!! Hold on dude… calm down. This is still going to happen but with January the way it is, it wasn’t a good time to start anyway. Plus, I decided to start my own little prop trading fund. How do you ask? Some of these prop firms (if not all) offer you buying power based off of the ‘package’ you choose. According to this package you are ‘given’ an account to trade with. What they don’t specifically tell you (but you can easily calculate for yourself) is that you are allowed nowhere near the amount of the capital in the account. Your risk guidelines (and these are great that they restrict you as you learn risk management through force…) limit the amount you can trade. So a 100k account is more like a 10k account. The money you pay upfront and or in monthly subscription fees cover your risk. For example if you are allowed a 4% max loss, the fee(s) that you pay cover said losses thus giving no risk to the prop firm. I understand the business model but I find it somewhat of a con. For me, the reason I want to join is for the community. The psychological support some offer. Perhaps some mentoring still. The hard risk guidelines. Because when you trade your own funds you can easily ignore your risk and just keep adding to losers for example. Trading with a prop firm will automatically stop your trading and you are either done for the day or you lose the challenge. Simple as that.

But what if?!… What if you already have good risk management in place? Then, I started thinking, I can use my own capital to provide me the risk allowed and trade a bigger account. Say what now? Let me give you an example.

For ease sake I will use the same example of the 10k account. Let’s say you get a 10k account from a prop firm. Let’s also say you are ‘allowed’ to lose a maximum of 4% ie. 400 bucks. You should already know what your current risk profile is. For me? I risk 1% or 1R to make 2% or 2R as we call it. Furthermore, when I go in drawdown at 4 losing trades I turn to capital preservation and bank 1Rs whenever I can get them. Just so you know this will NOT work if you are starting out and you WILL blow up your account. Moving along… so with this 4% max loss I would need to lose 4 trades straight in a row to blow up, what is in fact, my 400 dollar account. I know from all the stats I have gathered in the last 8 months that this is not likely. Now add to that another measure. Why risk 1% and not 0.5% giving me let’s say for ease sake 8 trades I can lose to “blow up” this account. That gives me even more leniency in the risk department if you will. After having created a big enough buffer (this is where your so-called prop firm gives you a “bigger account”) I can switch to 1% risk. When trading 0.5% of a 10k account that would mean I’d lose 50 bucks on a trade. 50 bucks on a 400 dollar account is WAY TOO MUCH risk. 50 bucks on a 10k account is nothing…. Well 0.5%… if you consider prop firms do this in a similar way by combining it with leverage and combined pool of funds they use it is a similar construct. I believe. Important part is the leverage though. You would need enough leverage provided through your broker though but luckily I am well sorted in that regard. Hit me up to know what broker I use to give me access to more leverage and not be capped at 1:30 etc. And no they are not based in some shady country.

Let me know if I am full of shit here…. Let me know what you think. Understand that a construct like this will place a huge amount of responsibility with you. Nobody else is there to stop you from blowing up. Nobody. I won’t be there either so please don’t come crawling to me.

I’ll keep you posted on how this goes.

Previous Monthly Goals

- Continue tracking hypos

- Did well here. Will continue the exercise as they help me to align with the market.

- Focus on my own progress and less on others

- Not trying to force doing a challenge joining a prop firm. Forcing trades because I see others make bank… I believe I am doing really well with this but I’ll keep the exercise on for now.

- Feeling okay with NOT trading

- Kinda two-fold. Doing really well with this. Even so much so that I kinda start thinking if I am becoming too risk averse. But I feel that when a trade is obvious I have no problem jumping in and all the other times I need to observe and collect stats so that I can take the opportunity some other time. Which is excellent if you ask me.

- Second part is that I used to feel ‘bad’ for taking a day off but that seems to be ALMOST all gone.. Actually that’s not true… I still feel ‘bad’ but I understand that it’s okay. So my understanding has improved 🙂

- Don’t trade during TPO C, unless there is a momentum trade

- I am doing well with this. I actually got slightly better with this. 12% to be exact 🙂 Will keep the exercise.

- Have ‘quieter’ weekends

- Doing well with this. Going hiking this weekend.

- Minimum of 3 days of working out, aim for 5.

- Doing fairly okay with this. There were days I didn’t go or a time I didn’t go due to new cases coming up. But mostly I am definitely more active and enjoy working out.

If you have made it all the way through… Here is a FREE LAMBO!!!

Sorry no Lambo. Nonetheless, I greatly appreciate your interest in my journey. I’m sure it is not an easy read as I tend to get long-winded. If you have any comments or suggestions feel free to let me know. Even though I do like writing I don’t consider myself to be much of a writer. I rather talk or play online games 🙂 Reach out to me. Let’s hang. Talk. Even though I haven’t played in a while I am sure I can still kick your A** in Call of Duty Modern Warfare or some Sim Racing or Sim Flying perhaps? 🙂 Let’s team up. Contact me for my Discord channel details.