#fintwit #orderflow #daytrading #tradingforex #forex #tradingjournal #daytrading #tradinglifestyle #daytraderlife #trackyourstats #tradingstats

So you’ve been trading for a while. How do you know what to look for? How do you know what you are doing right and wrong? Which setup works best? What time of day works best? How long do I let winners and losers run? How much is my expectancy? What is my risk to reward ratio? In other words: how much money am I putting on the line to make how much? Just by looking at these stats you will get real insight into your strengths and weaknesses. Do not overlook this. Do not be one of those people that just trade and trade and trade but never review and wonder where they went wrong. You need to know what to improve upon.

Thank you for following my progress

First off. For those of you that have been following my journey I’d like to give a big thank you! Almost everyday I upload trading plans and a Daily Report Card. I sincerely hope my journey somehow adds to your own.

Upsloping curve continued

The stats that I am about to share with you help me track what I deem to be important. These mostly focus more on my process than actually making money. Process is king. Money is just a result of performing well on your process. Let’s get to some stats.

DRC Tracking Stats

Here you can find the details of my DRC tracking sheet. DRC stands for Daily Report Cards. If you would like to take a look at some examples you can do so here. Every trading day I recap my notes, trades, and performance. I grade myself on how well I executed my plan as this is the most important. Living in a probabilistic world of trading making money is a side-effect of trading your plan. No one real trader in the world has a 100% win rate (if they are please run away quickly).

DRC Overall Evaluation

Here you can see that Mondays, Tuesdays and Fridays are days I perform better. Open Above (as well as below) Value Outside Range as well as opens within value are my best trades. Entries taking during C are still a concern but I have been getting better and I believe with time this number will go up. Still the best Entry TPO is D.

Here you can find the raw data of my DRC tracking sheet. As always since the file is too big I have provided you within a download link below it.

Trades

I took 2 trades in December and both were winners. Woohooo 100% WIN RATE!! Lambos for everyone! Why are you still here? Thought I told you to run away! 🙂 Okay get down to some stats. Yes I took 2 trades and yes both of them made a profit. But as you can see further down my win rate overall to date is 55%. So please stay. I am not a FURU. Or guru for that matter. Just a guy trading and sharing his progress.

Opportunities Presented

This time around I would like to focus on the opportunities that presented themselves but I didn’t capitalize on. Through doing this exercise I am trying to pinpoint if the opportunities were within my trading plan and rules. If they were, why did I not take the opportunity. What made me hesitate. Is there a pattern there? Or… on the other side. How did the opportunity not fit my plan and rules and is there a way for me to capitalize on this next time around? I have seen a few things happen over and over again. For example trading directly into a medium/higher time frame supply/demand zone. Observing this time after time gives me more confidence to perhaps take the opportunity next time.

Side note: Now that I have a better framework of how I view the market, I believe there are more opportunities the market provides. So I started to count those even though they don’t fit my current trading rules whereas before I wouldn’t count them.

I observed (ie. sat down in front of the screens) 14 days this month. Of these I found 13 days that gave an opportunity. Of these 13 days I only took a trade on 2 separate days. So what happened on the remaining 11 days? That’s what I am going to dissect here:

- 12/1

- Not according to rules. Range was too tight. My edge needs a minimum average range session to work out.

- 12/3

- First day of adding Gold back into the mix so when an early entry presented itself in GBPNZD, I was busy writing the Weekly trading plan for Gold.

- 12/4

- Not according to rules. There was a News Event Driven ‘burst’ that came into the market. Even though I was aligned with the direction I had not taken a position and missed out on the move. Did well to stay out afterwards as this would have been FOMO. I am still learning how to trade NED plays so the more I observe the better I can capitalize another time.

- 12/8

- Not according to rules. This day I saw an opportunity on the M5 but there was no clear signal (or incomplete potential price pattern) on the M15/M30. With letting M30 guide my trades I couldn’t justify going in with a M5 signal. I am getting better at spotting M5 opportunities though.

- 12/9

- Not according to rules. This day there was a momentum trade right into a H4 demand. I usually stay away from these trades as the opposing supply or demand can be reactive. Although I have observed on plenty occasions how price reacts when it is ready to ‘penetrate’ the medium/high time frame supply or demand. Price usually is more likely to create counter-directional price action even on profile but the medium/timeframe developing candle can lead you into staying with the direction. This way you can see how lower timeframe patterns are created within a medium/higher timeframe framework.

- 12/10

- Not according to rules. Same as 12/9 trading into demand. Did take a paper trade being in the process to learn trading these setups. The paper trade made a hypothetical 4R profit. I don’t count these though.

- 12/11

- Not according to rules. Price traded into medium time frame demand.

- 12/16

- Not according to rules. Same as 12/9 and 12/10 trading into demand. Furthermore, this month being December I wanted to protect profits but also I only had 1R buffer at the time of this potential opportunity.

- 12/17

- Not according to rules. The entry was based on M5 and no clear pattern on M15 or M30. When there was one the move had moved too far already and SL placement would have been terrible.

- 12/21

- Not according to rules. The move was based off a retest of newly formed M15 demand. This entry would have given a good SL placement. Anything afterwards was not.

- 12/23

- The opportunity was right at the open so didn’t take it as I was also writing my premarket prep. I did take note of it and next time perhaps I can take it. I call this the ‘Influx of players at open’. Probably ‘opening drive’ is a better name for it.

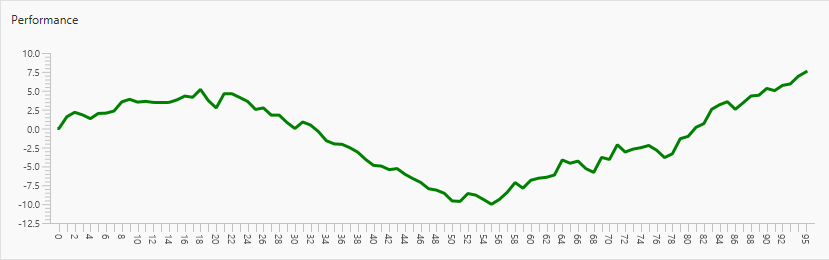

Equity curve

Started the month with +5.77% and currently I am at +7.46%. My profitable trades this month generated +1.69%. ‘Winning Streak’ since September up by 17.18%.

November:

December:

Overall Evaluation

Woohoo!!! 100% WIN RATE for December! I am Da BomB!!! 🙂 Only two trades though 🙂

For some reason this month my Profit Factor wasn’t calculated. Perhaps due to only having 2 trades? Not sure. Last month my profit factor was 2.82 check out my previous month here.

Plan

I had hoped to get more trades in during December but the market giveth whenever it giveth 🙂 Or something like that. Nonetheless. I will take the plunge and try out for a prop firm in January. I made a basic comparison of The 5ers and TopstepFX but decided to devote an entire post to that. So hang tight for that post as I am still working on it. The reason why I am not considering FTMO is the time limit they oppose on you. I do not want to feel any pressure of having to take a trade. If the market simply isn’t providing me with the right opportunity I simply do not trade.

Previous Monthly Goals

- Continue tracking hypos

- Did well here. Will continue the exercise.

- Focus on my own progress and less on others

- Did well here. Will continue the exercise.

- Feeling okay with NOT trading

- Did very well here as you can see I only took 2 trades this month.

- Don’t trade during TPO C, unless there is a momentum trade

- I am doing well with this and even took a trade during A!

- Have ‘quieter’ weekends

- Doing well with this

- Minimum of 3 days of working out, aim for 5.

- Did really well with this until the holidays as new cases emerged and as a precaution I stayed away from the gym. I did add jogging to make up for some of it.

If you have made it all the way through… Here is a FREE LAMBO!!!

Sorry no Lambo. Nonetheless, I greatly appreciate your interest in my journey. I’m sure it is not an easy read as I tend to get long-winded. If you have any comments or suggestions feel free to let me know. Even though I do like writing I don’t consider myself to be much of a writer. I rather talk or play online games 🙂 Reach out to me. Games I play when I have time:

- Online Chess

- Call of Duty

- Flight Simulator 2020

- F1 2018

- Dirt Rally 1 and 2