28 Oct Analyzing your Trading Stats Month 5

#tradingforex #forex #tradingjournal #daytrading #tradinglifestyle #daytraderlife #trackyourstats #tradingstats

So you’ve been trading for a while. How do you know what to look for? How do you know what you are doing right and wrong? Which setup works best? What time of day works best? How long do I let winners and losers run? How much is my expectancy? What is my risk to reward ratio? In other words: how much money am I putting on the line to make how much? Just by looking at these stats you will get real insight into your strengths and weaknesses. Do not overlook this. Do not be one of those people that just trade and trade and trade but never review and wonder where they went wrong. You need to know what to improve upon.

Thank you for following my progress

First off. For those of you that have been following my journey I’d like to give a big thank you! I know I haven’t been blogging much. Although almost everyday I upload trading plans and a Daily Report Card. I sincerely hope my journey somehow adds to your own. Furthermore, you should know by now that I’m quite serious about this. I try not to half-ass this although I still make mistakes. Which is perfectly fine. Try. Fail. Review. Try again and repeat till infinity! What works now, might not work later. So it’s this process that will keep you in the running. If continuous learning excites you?! You’ve found the right path in trading.

Out of Drawdown and then some

For those of you that have been following my trading journey know that I was in a drawdown. One month in July (with a little spill over to the first week of August) of seemingly doing everything wrong had taken away all my gains and then some. Now however I can say that I am out of the drawdown and am well on my way. The stats that I am about to share with you help me track what I deem to be important. These mostly focus more on my process than actually making money. Process is king. Money is just a result of performing well on your process. Let’s get to some stats.

DRC Tracking Stats

So here you can find the ‘raw data’ stats that I tracked. The picture is too big for me to post so I have provided you with a download option underneath. Let me know what you think of this. Always looking for like-minded people while staying open to new ideas 🙂 Hit me up if you wish to get my source file as it contains the formulas I use to get all the fancy colors and such.

And here is the ‘raw data’ for my comparison sheet comparing October to September:

If there are any questions pertaining to the reasons of anything I track here just hit me up.

I track hypos as followed: Hypo 1 is what I think is the most likely outcome to the current market narrative. Hypo 2 second and so forth.

Hypo

- 11 times

- 3 times

- 1 times

- 0 times

There were a total of 14 days that I sat down to trade. Of these 14 days I had 11 times where my Hypo 1 would play out. 3 times where my Hypo 2 would play out. Followed by 1 time Hypo 3 and 0 times of Hypo 4. Now if you are counting those up you it ass to more than 14. This is because on certain days 2 hypos would play out during the same session.

When comparing October to September we can see the following:

September:

October (including percentage change compared to September):

From these stats I can conclude that I have gotten better in my accuracy in determining what outcome a particular session could have. I went from being scattered over Hypo 1 and 2 predominantly to now more consolidated in hypo 1.

Right on the outcome

I also track if I was right on the outcome of the hypo. It is one thing to hypothesize a direction or sentiment of the market. It is another thing to hypothesize how the market will react to that direction or sentiment in terms of price action and order flow. So I keep track of this as well. This is NOT about predicting the market. This is about understanding what TYPE of price action and or order flow event is more likely to occur in WHICH setting. By doing this I hope to gather data to draw better conclusions for the future. If a certain price action or order flow event happens more often in a particular setting one could assume that this is valuable information. The next time I encounter this setting or market conditions, I might be able to obtain a better entry based on cold hard data that I have collected for myself.

Here are the stats:

Trading Window Opportunity?

I wanted to know how many opportunities there were and if I would take them or not. My hope was to surmise through this a potential fear of taking trades that were obvious to take. From the 14 days I observed there were 11 days of which presented opportunities. According to this small sample size I can surmise that 79% of the time we saw an opportunity or another. Last month this was 89%.

From the 11 days that presented an opportunity, there were 8 days that I took an opportunity and 4 I didn’t. Here are the reasons for the 3 times I didn’t take the opportunity:

- 10/6: didn’t take the opportunity because I failed to give more weight to the lack of H4 demands. With LTF congestion on the way to a H4 target I could have surmised the possibility for a low/medium initiative activity day.

- 10/9: Due to market was balancing ie within value. I was looking for a value rejection failure ie. return to value. Instead there was an actual rejection of value. There was an orderflow event I could have capitalized on so I have made a rule for myself that (as always) order flow reading trumps whatever narrative is statistically more viable to play out.

- 10/12: on this particular day it was my first time consciously witnessing a ‘deep’ value acceptance play. I failed to act on it but learned a lot for future reference.

Day Type

Learning more about the day types can give you an edge on what to expect throughout the day. In assessing which day type is developing you can alter or set your expectations. From the 14 days I tracked I was right all 14 times.

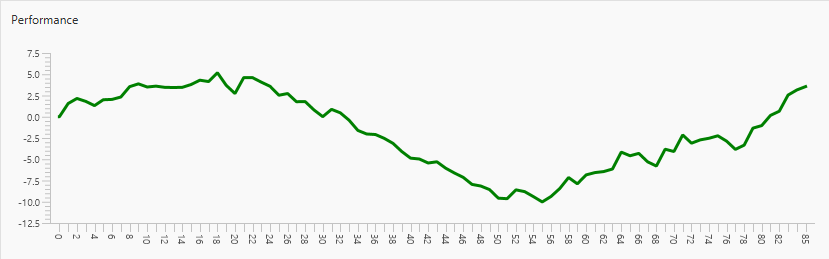

Equity curve

Overall I was down ‑2.44% and currently I sit at +3.32%. My profitable trades this month generated 7.40% and the trades I learned from account for a 1.6% loss.

Trades

I took 10 trades in October of which 8 were winners and 2 losers.

I don’t like focusing on the trades that work because they will take care of themselves. So here I will dive slightly deeper into the 2 losses I had. Especially the ones that hit a full stop loss. The rest I feel are of less importance. From experience I can tell that if the trade goes against me quite quick I should not have been in the trade to begin with.

2 losses

The 2 losses happened on the same day. This was the day I got put on the Bart Simpson exercise. Had to write 50 sentences of: “I will not use weak patterns on low timeframes for trading decisions”. This was because on this particular day (10/7) I grasshoppered out of the first trade based on a very weak M15 three inside up pattern. If I had let the trade develop it would have managed slightly over 1R profit.

The second trade was a value acceptance play to which I failed to account for the Spread in my stop loss. If I had done that price would have missed my SL so I wouldn’t have hit a FULL STOP but due to a time-based exit I would have lost less than that. About ‑0.5R. This is why I had put in a weekly goal of accounting for spreads into my SL. Which I now do almost as second nature.

Analyzing setups

I started tracking certain statistics within Edgewonk and these are some of the conclusions I came up with. I believe trading P&L is a result of how well you apply your edge at any given time. Knowing your edge and its statistical attributes is the only thing as a trader that we can control through our process. To be able to control our process we need to be in the best state of mind. Having said that let’s get started on some stats here. My data sample is only 66 trades so the conclusions should be taken with a grain of salt. Preferably I would need a sample size closer to 200 trades to increase the validity of the conclusions. Also, before starting to nitpick on details I believe it is more of value to look at the outliers then to try and understand each of the factors. Enough said. Let’s go.

Here is a comparison to September:

Overall I have gotten slightly better compared to September. Again, not going to dwell too much on these stats unless there are obvious outliers.

- Mondays, Tuesdays, and Fridays I perform better.

- Worst performing day is Thursday still. Even though it got 9% better compared to September.

Value Open Sentiment

Here I try and gather information on how the Value Open sentiment affects my trading. In other words when do I perform better: in a balancing, moderate imbalance or large imbalance market sentiment.

OaboveVA/IR = Open above value, inside range

OinsideVA = Open inside value

OaboveVA/OR = Open above value, outside range

ObelowVA/OR = Open below value, outside range

ObelowVA/IR = Open below value, inside range

Not much has changed here. Open inside value and open above value, outside range are still my favorites. Probably due to me being a contrarian. Let’s move on to entry TPOs.

Entry TPOs

Overall have gotten slightly better but nothing to write home about. Down 17% on H TPO also nothing significant since it was just 1 trade I did that happened to lose. Again, I am looking for outliers. Don’t want to dwell too much on these details.

Plan

This week my mentorship is ending. My plan forward is to continue honing my skills and then get ready to apply working with a prop firm. I’ll continue what I am doing right now and reassess at a later stage.

Monthly goals (previous)

- Continue tracking hypos

- I enjoy tracking hypos and the potential outcome. It sets me up to be in line with the market narrative. At the same time it allows me to gather data on a particular price action or order flow event and how often (or not) it happens in a certain setting. This hopefully will allow me to find better entries in the future.

- Focus on my own progress and less on others

- I did well here. I also think it’s because I have been doing well this month. I believe that in times when things aren’t going so well that this little demon might creep up on me again. I’ll keep this as a goal though since it has a different connotation as well that I will add to the goals for next month.

- Feeling okay with NOT trading

- I did well here. I am more and more getting out of the urge to have to trade. It also makes me more relaxed and I enjoy the process even more.

- Don’t trade during TPO C, unless there is a momentum trade

- I did well to be cognisant of this TPO but still haven’t traded it too much yet to gather any significant stats on it. 1 time over the whole month I traded in October. It was a winner. I will still keep this goal for next month though.

- Be more selective with trades on Wednesday, Thursday and Friday.

- To be honest I did not take this much into consideration and I will stop tracking this goal. I believe that I should focus more on taking clean setups and the rest will follow. After I reach a data sample of 200 trades I can revisit this.

- Have ‘quieter’ weekends

- I am getting better at this.

Monthly goals (coming)

- Continue tracking hypos

- Focus on my own progress and less on others

- I don’t need any validation from anyone. With all the work I put in I already have a good understanding of the areas where I need work.

- Feeling okay with NOT trading

- Don’t trade during TPO C, unless there is a momentum trade

- Have ‘quieter’ weekends

- Minimum of 3 days of working out, aim for 5.

If you have made it all the way through… Here is a FREE LAMBO!!!

Sorry no Lambo. Nonetheless, I greatly appreciate your interest in my journey. I’m sure it is not an easy read as I tend to get long-winded. If you have any comments or suggestions feel free to let me know. Even though I do like writing I don’t consider myself to be much of a writer. I rather talk or play online games 🙂 Reach out to me. Let’s hang. Talk. Even though I haven’t played in a while I am sure I can still kick your A** in Call of Duty Modern Warfare or some Sim Racing or Sim Flying perhaps? 🙂 Let’s team up.

No Comments