30 Sep Analyzing your Trading Stats Month 4

#tradingforex #forex #tradingjournal #daytrading #tradinglifestyle #daytraderlife #trackyourstats #tradingstats

So you’ve been trading for a while. How do you know what to look for? How do you know what you are doing right and wrong? Which setup works best? What time of day works best? How long do I let winners and losers run? How much is my expectancy? What is my risk to reward ratio? In other words: how much money am I putting on the line to make how much? Just by looking at these stats you will get real insight into your strengths and weaknesses. Do not overlook this. Do not be one of those people that just trade and trade and trade but never review and wonder where they went wrong. You need to know what to improve upon.

Thank you for following my progress

First off. For those of you that have been following my journey I’d like to give a big thank you! I know I haven’t been blogging much. Although almost everyday I upload trading plans and a Daily Report Card. I sincerely hope my journey somehow adds to your own. Furthermore, you should know by now that I’m quite serious about this. I try not to half-ass this although I still make many mistakes. Which is perfectly fine. Try. Fail. Review. Try again and repeat till infinity! What works now, might not work later. So it’s this process that will keep you in the running. If continuous learning excites you?! You’ve found the right path in trading.

Making my way out of a Drawdown

Another month has passed so another review is upon us. Well.. Me. Long story short. I am in the process of actively experimenting with all that I have learned. Trying to make sense of it all. Untangling that spaghetti that is currently taking occupancy of where my brain used to be. In my pursuit of doing this I have started incorporating hypos (hypotheticals) into my premarket preps (which you can find here). So even though I can’t be trading every day due to limitations of only trading the London session and being limited in 1 tradable asset. Dee suggested me to keep track of how often I am right on the direction of the session. So that I have yet another metric to gauge my progress with than just the trades I do. I thought this was not enough and started incorporating hypos again. I used to do this before and I love the exercise. I keep track of how I think a session will play out based on likelihood of the event and then track which hypo actually did and to what extent. Then also if there was a trading opportunity and if I actually traded it. Hypo 1 is always the one I deem more likely than 2 and so forth. Then I grade the hypo in percentages to the degree I feel the hypo played out based on the observations I made. So let’s get to my stats.

DRC Tracking Stats

Hypos

| Hypo 1 | 9 times | ||||

| Hypo 2 | 11 times | ||||

| Hypo 3 | 2 times | ||||

| Hypo 4 | 2 times |

There were a total of 18 days that I sat down to trade. Of these 18 days I had 9 times where my Hypo 1 would play out. 11 times where my Hypo 2 would play out. Followed by 2 times Hypo 3 and 2 times of Hypo 4. Now if you are counting those up you see that there are more than the 18 days I sat down to trade. This is because on certain days 2 hypos would play out during the same session.

Right on the outcome

Later on in the month Dee suggested for me to track the outcome of my hypos as well. Not just if they played out but did they play out the way I hypothesized they would play out. From the 13 days that I tracked 11 times I was right on the outcome and 2 times something completely different happened. On the first occasion I was expecting a momentum trade but instead we got responsive activity within IB and a IB extension later on in the session. The extension was extensive but on medium initiative activity shown through double TPO prints. The second occasion was yet again a momentum trade that I hypothesized. And yet again I was wrong. Instead there was a slow and sluggish move in line with profit-taking.

Trading Window Opportunity?

I wanted to know how many opportunities there were and if I would take them or not. I hoped to surmise through this a potential fear of taking trades that were obvious to take. From the 18 days I observed there were 16 days of which presented opportunities. I include here the ones that were and were not under my current trading rules for which I took paper trades. According to this small sample size I can surmise that 89% of the time we can see one opportunity or another.

From the 18 days there were 10 days that I took an opportunity.

- 2 of which I did not trade due to a lack of sleep or motivation and I was practising feeling okay with NOT trading. This is an issue for me that I feel I have to tackle. I usually feel a sense of FOMO but not in chasing trades. I feel the FOMO of missing a day of being able to trade thinking I could have learned so much in this particular day. See how I didn’t say a particular trade I could have made money off. Although that is true on a certain level. What is also true is that a trader NEEDS time away from the screens. And that when I feel I HAVE to trade then there is something wrong. Because I love trading. And as such I shouldn’t feel forced to trade for whatever reason.

- 1 day I had PC troubles. DAMN YOU MICROSOFT!

- 1 day the move happened later in the session and I did not want to risk due to my trading window closing and not having enough time for a good profit target.

- 2 days I didn’t trade because there were simply no opportunities.

- 1 day I took what I thought was the right opportunity but instead I missed the real opportunity after taking a small loss. But due to me being in the one trade I missed the real trade. Still count it for my tracking sheet.

- 1 day I had put in a buy stop order, that would have netted a 2.5R, but cancelled the order because of different deliberations I was making at the time. I now know that certain factors that day took precedent over the ones I was considering and I should have let the trade on. Live and learn, my friend.

Day Type

Learning more about the day types can give you an edge on what to expect throughout the day. In assessing which day type is developing you can alter or set your expectations. From the 14 days I tracked I was right 12 times. From the 2 times I was wrong, 1 I was actually right but wrote it wrong in my tracking sheet under the incorrect name.

Trades

I took 17 trades in September of which 11 were winners and 6 losers. Of these there were 4 paper trades.

I don’t like focusing on the trades that work because they will take care of themselves. So here I will dive slightly deeper into the 6 losses I had. Especially the ones that hit a full stop loss. The rest I feel are of less importance. From experience I can tell that if the trade goes against me quite quick I should not have been in the trade to begin with.

From the 6, I had 2 full stops. The first one on the 18th was a mean reversion trade. I had put in a buy stop order above IB in case of a momentum trade. But when this didn’t happen I should have changed my strategy and canceled the order. I did not and the order was triggered during E. Not a good sign for a momentum trade. Hence I bought at the top of the (micro) swing and quickly got stopped out within the consolidation.

The second full stop was a single print fade I took on the 23rd. This wasn’t a single print fade setup to begin with due to the sustained auction and lack of a strong selling tail plus single prints being too wide. Live and learn, my friend.

The rest of the losses I won’t get into because like I said. Usually when I take a good setup it either goes well pretty quickly OR I lose a little due to a time-based stop or change in sentiment. Either way I take the trade off at a lower loss.

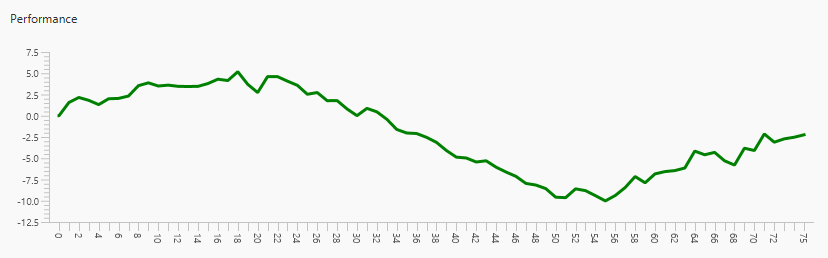

Overall I was down ‑7.04% last month (and 10+ % before) to currently sitting at ‑2.44%.

Here you can see my Overall Evaluation and for this month:

Analyzing statistics

I started tracking certain statistics within Edgewonk and these are some of the conclusions I came up with. I believe trading P&L is a result of how well you apply your edge at any given time. Knowing your edge and its statistical attributes is the only thing as a trader that we can control through the medium of our process. To be able to control our process we need to be in the best state of mind. Having said that let’s get started on some stats here. My data sample is only 57 trades so the conclusions should be taken with a grain of salt. Preferably I would need a sample size closer to 200 trades to increase the validity of the conclusions. Also, before starting to nitpick on details I believe it is more of value to look at the outliers then to try and understand each of the factors. Enough said. Let’s go.

| Total | Win | Loss | % | ||

| Monday | 8 | 4 | 4 | 50% | |

| Tuesday | 6 | 2 | 4 | 33% | |

| Wednesday | 22 | 9 | 13 | 41% | |

| Thursday | 15 | 3 | 12 | 20% | |

| Friday | 24 | 14 | 10 | 58% |

- My best days are Fridays and Mondays, with Friday taking the cake because of a bigger sample size and win rate.

- I didn’t think Mondays would have been as good but I have been doing okay. Nothing too fancy here also not a lot of trades taken. Based on my own reasoning I do feel as if I am doing better on Mondays. It might be perhaps an aftermath to Friday’s trading. Not sure yet but will continue collecting data. This combined with being more careful due to perhaps having less energy ‘might’ make me more selective. That is a big might though so will need to track this longer for a more accurate assessment.

- I like trading more towards the end of the week then the beginning which doesn’t always translates into better stats. This is conjecture but I think this could be due to me ‘feeling better’ as the week goes on due to having slept better and more consistently. Due to my social life on the weekends (even though I tapered down considerably already) is still impacting my mood and energy levels in the beginning of the week. One could also perhaps say that due to better mood/energy I might be getting too cocky and end up looking for more trades than there are opportunities. Time will tell as I build up my sample size.

- Thursdays I perform the worst with only 20%

Value Open Sentiment

In order for me to get a better understanding on how well I perform in a certain open value sentiment. I had to go back through all of my trades and set the right open value sentiment for that trade. A bit of work but if you want to get a good understanding than it might just be worth it.

| Total | Win | Loss | % | ||

| OaboveVA/OR | 20 | 9 | 11 | 45% | |

| OaboveVA/IR | 8 | 3 | 5 | 38% | |

| OinsideVA | 13 | 7 | 6 | 54% | |

| ObelowVA/IR | 10 | 3 | 7 | 30% | |

| ObelowVA/OR | 24 | 10 | 14 | 42% |

Surprisingly, I’ve been doing well on Inside Value days. I will need to keep monitoring this for a bigger sample size as stated earlier. Also Below and Above Value, Outside of Range I seem to like more. The latter I would assume because of my tendency to like shorting more than going long. All in all in line with being more of a contrarian. Let’s move on to entry TPOs.

Entry TPOs

| Total | Win | Loss | % | ||

| B | 4 | 1 | 3 | 25% | |

| C | 14 | 1 | 13 | 7% | |

| D | 21 | 14 | 7 | 67% | |

| E | 11 | 5 | 6 | 45% | |

| F | 9 | 4 | 5 | 44% | |

| G | 7 | 2 | 5 | 29% | |

| H | 3 | 2 | 1 | 67% | |

| I | 2 | 2 | 0 | 100% | |

| J | 1 | 0 | 1 | 0% |

Not doing too well on early entries but the biggest outlier is entries during C. only 7% make it. This was an issue that we had identified earlier and is due to misuse of momentum trades. Now that I have a better understanding I hope to do better. For now, I will refrain from trading during C unless there are valid grounds for a momentum trade. D has always been my best entry TPO and I believe TPO I is when I spot a failed auction but will definitely need more trades than just 2 🙂

Setups

This is the part that needs more work in terms of tracking. I find that certain setups that I have defined the narrative or market conditions for can also be determined as a type of trade. I don’t think that makes a lot of sense to most people. Here’s an example. A mean reversion trade could be a momentum trade as well. So do I classify it as a mean reversion or momentum trade? Still figuring that out. The way I have it now is that whatever the reason is for me to take the trade is what I define it to be as a setup. So if the mean reversion trade developed as a momentum trade I am more likely to call it a momentum trade. In the end it doesn’t really matter as much as the Open Value sentiment part does. Since this kind of dictates the conditions for a possible setup.

Again, just looking at the outliers here. In this case I am apparently doing better at mean reversion trades which the Open Value Sentiment can confirm. For some reason it says that I am up on Value Rejection plays but I have 3 winners and 7 losers. The 3 winners might make up for more profits than the losers I am guessing. The rest doesn’t tell that much. Again, need more trades.

Conclusion

My stats confirm what I already thought. I like being a contrarian. I do okay on open inside value days. Mean Reversion are more my thing. I like trading on Fridays which also yield me better results.

Monthly Goals

- Continue tracking hypos

- I did well here as outlined above. For the most part it has been either my first or second Hypo that played out. I am happy with that and will continue tracking my hypos. What it also does it sets me up pointing to the right direction but also have contingencies for when the sentiment changes.

- Focus on my own progress and less on others

- I did well here I think. I didn’t look too often at others in the portal and when I did I didn’t feel much. I think that when you ‘feel’ a certain way on someone else’s progress it inherently shows your own weakness. I like to think that when something makes you feel bad you should go towards it and find out what it is that is bothering you. In my case it was quite obvious. I was on the right track, and then I was not. But others were still… at least so it seemed. So this made me feel even worse. I took a step back and focused on the things I could control. My way. When I showed myself that I can actually do this and it can actually be done. I felt less and less ‘influenced’ by others. In the end it is my own path and I am only competing with my myself and the many demons I have. Gotta slay those demons or find a way to not let them impact your trading.

- Feeling okay with NOT trading

- As previously outlined this was one of my goals and I think I did well here. On the rare occasions I did not feel like trading I simply did not trade. Even though there was still a voice nagging I feel I made progress in this department.

My goals for coming month

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- I have outlined for myself how to go about tracking this. You know where you might be lacking or need work so judge for yourself if this is a point you need to work on.

If you have made it all the way through… Here is a FREE LAMBO!!!

Sorry no Lambo. Nonetheless, I greatly appreciate your interest in my journey. I’m sure it is not an easy read as I tend to get long-winded. If you have any comments or suggestions feel free to let me know. Even though I do like writing I don’t consider myself to be much of a writer. I rather talk or play online games 🙂 Reach out to me. Let’s hang. Talk.

No Comments