01 Apr Analyzing your Trading stats Month 10

Analyzing your Trading stats — Month 10

#fintwit #orderflow #daytrading #tradingforex #forex #tradingjournal #daytrading #tradinglifestyle #daytraderlife #trackyourstats #tradingstats

So you’ve been trading for a while. How do you know what to look for? How do you know what you are doing right and wrong? Which setup works best? What time of day works best? How long do I let winners and losers run? How much is my expectancy? What is my risk to reward ratio? In other words: how much money am I putting on the line to make how much? Just by looking at these stats you will get real insight into your strengths and weaknesses. Do not overlook this. Do not be one of those people that just trade and trade and trade but never review and wonder where they went wrong. You need to know what to improve upon.

Thank you for following my progress

First off. For those of you that have been following my journey I’d like to give a big thank you! Almost everyday I upload trading plans and a Daily Report Card. I sincerely hope my journey somehow adds to your own. Keep in mind that this is my journey and might not fit yours. It is up to you to decide what you’d like to take away from this and what to ignore. This is not advice whatsoever. Having said that… Let’s get it on!

Process

The stats that I am about to share with you help me track what I deem to be important. These mostly focus more on my process than actually making money. Process is king. Money is just a result of performing well on your process. Let’s get to some stats.

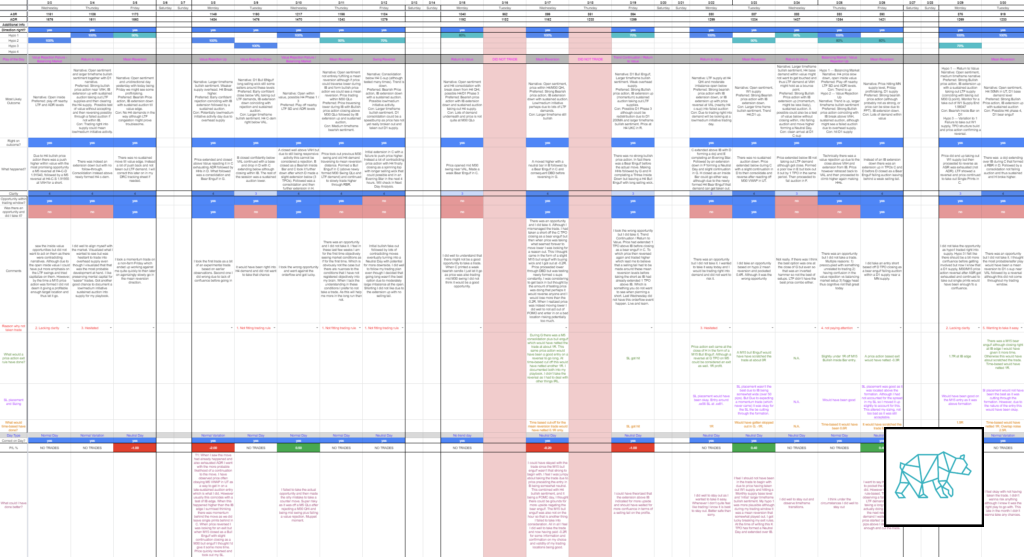

DRC Tracking Stats

Here you can find the details of my DRC tracking sheet. DRC stands for Daily Report Cards. If you would like to take a look at some examples you can do so here. Every trading day I recap my notes, trades, and performance. I grade myself on how well I executed my plan as this is the most important. Living in a probabilistic world of trading making money is a side-effect of trading your plan. No one real trader in the world has a 100% win rate (if they do please run away quickly). If you like to know more on how I track my stats just hit me up. I freely share this information.

STATS GALORE

First of all I gotta say… I love going through my stats. It’s a huge part of the process that tells me how well or not I am performing. Ultimately my process is the only thing I can control. My stats give me the insights I need to understand my edge better. Then tweak or let it be. Rinse and repeat.

March could have definitely been better for me as I will show you later on. A mistake in taking an experimental trade early in the month, to a few losses later on. I like to think that in my first month trading a bigger account did not have any impact on me but I would be lying. Even though I believe it was not as much of a factor. I feel I finally was consciously making decisions to take trades or not. ‘To trade OR not to trade is the question’ for every day trader 🙂

Trading a ‘smaller’ account I think made me a little complacent which if you look at my stats it worked out I guess. Gotten a bit lucky is more like it.

I’ll explain more when we go through the details of the trades taken and opportunities missed. Let’s get to some numbers.

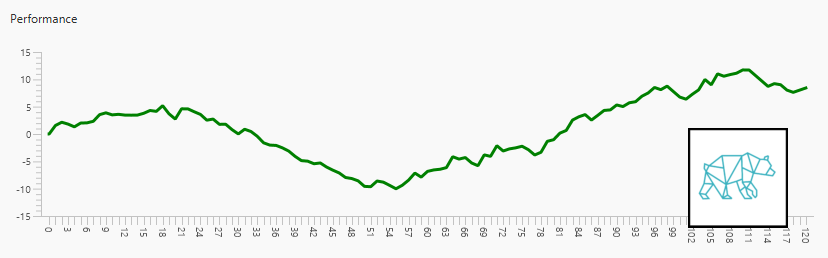

Equity curve

Started the month with +11.33% and currently I am at +8.34%. Down by ‑2.99%.

March

Overall Evaluation

Monthly DRC Tracking Stats

Last time I dove deeper into some other stats. I don’t want to focus too much on these every month as I need a larger data sample for these stats to have more value. These stats I simply look at outliers. Stats that stick out rather than look at its entirety because they don’t matter as much. The outliers give me more insight in where I still need improvement or to tell me where my edge is slightly better.

Day of the week

Open Value Sentiment

Entry TPO

Opportunities Presented

Please understand that a lot of these metrics have a level of subjectivity about them. In terms of what I determine to be an opportunity for example. Although I use a systematic approach and thus have hard rules to trade. I am also improving my entries and thus my rules are ever slightly changing a bit. So one time I’ll take an opportunity where the next I might not based on these ‘new’ rules as I am gaining confidence on trading the lower timeframes. You have to figure out the framework of which you yourself will grade yourself on a job well done or not. These are mine… They might not fit yours. However, you’ll get a good insight into my thought-process and in the end that is all you should be learning from other traders. With that out of the way.

I first have to make the separation between GBPNZD and Gold. I primarily focus on GBPNZD but when ranges are too tight (thus statistically obliterating my edge) I focus on Gold. Although I have been experimenting a little with trying to trade both assets at the same time. Trading one asset is already hard so the focus on this hasn’t been the greatest at this stage of my trading progress.

GBPNZD

For the whole month I sat down to observe the market (not trade, we don’t trade for trading sake. We observe, take notes, if an opportunity comes to us we execute): Not going to talk about the days that the range was too tight or I couldn’t, did not want to, whatever reason, not trade that day.

From the 20 days I observed there were 17 days that presented with an opportunity. On 7 of them I actually took the opportunity.

- 4 winners

- 0.6R

- 0.5R

- 0.4R

- 0.4R

- 4 losers

- -1R

- -2R

- -0.2R

- -1R

- Win rate 50%

Although, I am overall still in profit here we can see that my losses not only exceed my wins but they also exceed in amount (very low profit factor). Meaning on average I lose more on a trade than I make. This is why my profit factor dropped to 0.41. Which is not a good number. This should preferably be more than 1.5.

Let’s dive deeper. To do that I added a new format to my process where I go back and review my trades. These reviews you can find by clicking here: Trade Reviews. They include pictures of entries and exits as well as commentary on both. Therefore I am not going to discuss these here in detail as I have already done so. I review on the trading day itself. Then again on the weekend reviewing my screen recordings and notes.

Hypos and Missed Opportunities

Every trading day I formulate 1 to 3, sometimes 4, hypotheses. These give me a framework to what I expect to see in the market on that day. Then during the session I wait for price action to confirm or negate a hypothesis. If price action confirms I execute a trade. If the trade is based on a hypo it is more likely to be a good trade (no guarantees of course, we are simply looking for higher probability outcomes). So win or loss it was a good trade. This is not always the case as I of course make mistakes and execute a trade on the wrong hypo. But by tracking these stats I get better insights into 1) did I formulate the right hypo 2) did I execute based on the hypo and if not I gain insights into why I did not. Using these metrics I keep myself in check but also gather data on if I am hesitating more than not or if I am not aligned with market conditions.

Here you can see that most of the times I am more correct in my first hypothesis (hypo 1) of what the market is more likely to do. Then I also started tracking to what extend that hypo played out. If you look at my hypotheses here you can see that I also hypothesize what price action or orderflow event I prefer to see. Then I grade myself on the correctness of said assumption. So 1) was the hypothesis a valid one 2) to what extent was it valid? No real outliers here hence the stronger need to focus on outliers as it is in the extremes that we can potentially find valuable information.

Based on getting a lot of hypos right you’d think I’d be taking more trades. However, it doesn’t always fit my criteria giving enough profit target. Or I simply don’t feel like it. All of these metrics are a part of my edge and it is up to me to figure out how to improve.

On the missed opportunities I will be focusing more on GBPNZD than on Gold as that is my main focus. From the 20 days I observed there were 17 days that presented an opportunity. Of which I only traded on 8 days. What happened to those other days? Let’s find out.

I classified the missed trades under the following 4 categories:

- Not fitting trading rule

- 4 times

- Lacking clarity

- 2 times

- Hesitated

- 2 times

- Not paying attention

- Once

- Wanting to take it easy

- Once

Conclusion: According to how well I formulate my hypos and taking into consideration the missed opportunties. I could have taken more trades. When looking at my missed opportunities I can say I lacked clarity in certain trades that only confirmed a hypo after the move had happened. Thus I lacked the clarity beforehand to take advantage of them. The ones not fitting my currectn trading rules are ones that I am still building confidence in. They days I hesitated I wasn’t feeling too confident and just let the trade go. Which is not necessarily a bad thing. I will keep taps on these metrics to find outliers as I go along.

Trades taken

I went back and looked if I grasshoppered out of a trade what that trade would have done. With that I mean if I had actually taken my price action-based exit rule. On top of that I wanted to know what a time-based exit would have done. To get better insight into what I could potentially do better this coming month. Or at least set a goal. To do this I looked what a price action and time-based exit rule would have done.

March 2nd:

Quick recap: Obviously here if I had chosen to wait for a price action exit rule I would have netted more.

- Trade netted: 0.6R

- Price action-based exit rule: 2R

- Time-based exit rule: 1R

March 5th:

Quick recap: On a normal day I believe the thesis would have held up. Since it wasn’t: I could have 1) not traded this day due to price being messy due to Non-Farm Friday 2) I could have potentially opted for a 2nd chance entry on the newly formed M30 C‑sup due to the lack of momentum on this particular day. I will need more statistics on this particular even to back up this thesis though which will be one of my goals for NFF from this day on. Having said that this particular day would have been quite agonizing so there is a point to be made that mental capital preservation could be chosen over a potentially high risk trade. Will gather more stats to deny or confirm this.

- Trade netted: ‑1R — SL got hit

- Price action-based exit rule: About 1–1.5R if I had obtained a better entry the trade would have netted

- Time-based exit rule: About 1R

March 8th:

Quick recap: I should not have taken the late-sustained auction entry as there was less confluence + M30/M15 already printing a reversal (even though this got taken out again later in the session but hindsight is 20/20. We trade what we see in the moment and I ‘missed’ or did not give enough weight to this price action). Same for the single print fade as ADR had been exhausted and M30 consolidation had a weak bear engulf attempt of a break down. As well as structure that was created was very wide in value.

- Trade netted: ‑1R — SL got hit, ‑1R — SL got hit

- Price action-based exit rule: I should not have been in either of these trades

- Time-based exit rule: N.A.

March 10th:

Quick recap: Not take this trade even though I netted minor profits. Even though there was a close well outside of value there was no IB extension to confirm the rejection. Thus a balancing market / value rejection failure was the more probable play. A play off the M30 Inside bar coupled with LTF price action would have been the best entry.

- Trade netted: 0.5R

- Price action-based exit rule: 0.5R

- Time-based exit rule: Would have been stopped out ‑1R

March 17th:

Quick recap: I could have not grasshoppered out of the trade and stuck with it. If the trade was worth taking it was worth following my exit rules.

- Trade netted: ‑0.2R

- Price action-based exit rule: 0.5R

- Time-based exit rule: 0.1R

March 19th:

Quick recap: I could have theorized that the extension above IB indicated for more upside and should have waited for more confluence in terms of a selling tail on the profile. Although with the information presented I was thinking it wasn’t the worst of opportunities. Certainly not the best either.

With the initial extension above IB, and no selling tail, I could have waited for more upside before warranting a short at the next DTTZ.

- Trade netted: ‑1R

- Price action-based exit rule: SL got hit

- Time-based exit rule: SL got hit

March 23rd:

Quick recap: I could have given more weight to the trend as H4 and D1 were up. W1 supply had been taken out, hitting MN boase level indicating more continuation, as well as ADR got exhausted premarket with a huge imbalance indicating a possible strength behind the move. Thus a play off M30 VWAP in UT leaving a buying tail in F could have been a better play.

- Trade netted: 0.4R

- Price action-based exit rule: ‑0.2R

- Time-based exit rule: ‑1R — SL would have been hit

March 26th:

Quick recap: I want to say that I did well to pocket the 0.4R when I did. However this was not rule-based. This was me observing a failure to break LTF demand and price taking a long time before actually doing so. Thus on the next retest of LTF demand I waited and when price started ‘popping’ a few pips above I decided it was enough and cut the trade.

- Trade netted: 0.4R

- Price action-based exit rule: ‑0.3R

- Time-based exit rule: Scratched for 0R

Gold

With Gold I also sat down 20 days to observe. Of these days 18 presented opportunities of which I capitalized on 2 times.

- 0 winners

- 1 scratch

- 1 loser

- -0.5R

- Win rate 50%

As I am still very much focused on GBPNZD I don’t push myself too much on taking trades on Gold. Unless there is a tight range on GBPNZD and thus I can’t trade it. I have taken two trades of which the first was a scratch as I was in a trade on GBPNZD simultaneously. The FX pair was moving in my favor at the same time Gold was at entry level. I decided to take both off at the same time pocketing a profit on the FX pair and scratching on Gold. Then I have one loss.

March 2nd:

Quick recap: I could have let the trade on also due to the inverted correlation with GBPNZD (which doesn’t always work — 72%) and C closing neutral and hammers being prone to see a continuation instead of a reversal.

- Trade netted: 0R

- Price action-based exit rule: 2R

- Time-based exit rule: 0.7R

March 19th:

Quick recap: I believe it was premature to have taken this trade. I should have waited for a stronger buy signal before entering. In hindsight this strong buy signal did not really come to be honest. Although a consolidation on M15 at H4 demand with the right time of day could have warranted an entry. This time the move happened outside of my trading window but it was good to have observed.

- Trade netted: ‑0.5R

- Price action-based exit rule: ‑0.5R

- Time-based exit rule: ‑0.2R

Totals and Conclusion

Trades netted: ‑2.8R

Price action-based exit rule: 2.5R

Time-based exit rule: ‑2.4R

What can I say or conclude about these metrics? Clear price-action based rule is the winner as it would have netted the best outcome for this month. This is not accounting for all of the missed opportunities there were. At least it gives a little insight into my exit rules. I still have to count in the fact that certain trades I should not have taken at all as they were against the overall market directions. If I had aligned myself well in those cases I could have netted even more of course but that is not the issue right now. Trading a bigger account has made me go back to my grasshoppering days. And even though I tried to correct myself mid-month it wasn’t enough to help me end in the green. It did however gave me valuable information to build off better habits for the coming month. I will make the price action-based rule a hard goal for next month.

Objectives

My main objectives for the month of March were:

- Only trade the main account

- Focus on time-based exits

- Don’t look at M5 chart unless within the last half hour of trading window

I believe I did well on the first one as I have only traded the main account. This was somewhat of a bottleneck for me and skewed my stats by trading a smaller and bigger account. Hence I decided to ONLY trade the bigger account which I dubbed my main account. All the paper trades from now on will no longer be done on the smaller account. This was too easy for me to take a trade on the smaller account. I wanted my trades to reflect my ‘conscious trading’ if that makes sense. I did well here though as I had no problem taking trades on the bigger account. I also had no problems taking a loss. Several losses even. I was/am focused on the process and if there is anything to take away from this exercise it is this: I can trade without caring about the money. Says the little grasshopper. Alright, my grasshoppering had other some valid reasons as well okay.

Focusing on time-based exits I did not do too well. Although, what it did do is force me to focus on Day Trading Time Zones (DTTZ) and price action surrounding them. This one I will rephrase into being mindful of DTTZs for next month.

Not looking at M5 chart I kind of failed as I was still peeking at times. Although I must say that as the month went along I did not base much of my decisions off it. For the next month I will focus on the 1st DTTZ for a potential M5 entry to get a better entry off of a M30 formation. Otherwise only allowed at the 2nd DTTZ for entries/exits.

- Only trade the main account

- Be mindful of DTTZs

- Only price-action based exit rules (or hit time stop)

- M15/M30 combination at 1st DTTZ, M5 entries and exits at 2nd DTTZ

Previous Monthly Goals

- Continue tracking hypos

- Love this and it is such an integral part of my process so will keep doing this and not mention under my goals.

- Focus on my own progress and less on others

- I have been doing well here. Discontinue exercise.

- Feeling okay with NOT trading

- I have been doing well here. Discontinue exercise.

- Don’t trade during TPO C, unless there is a momentum trade

- I have been doing well here. Discontinue exercise.

- Have ‘quieter’ weekends

- I have been doing well here. Discontinue exercise.

- Minimum of 3 days of working out, aim for 5.

- This one I will keep as I have been trying to increase my gym time but it still fluctuates too much.

If you have made it all the way through… Here is a FREE LAMBO!!!

Sorry no Lambo. Nonetheless, I greatly appreciate your interest in my journey. I’m sure it is not an easy read as I tend to get long-winded. This and I love me some stats 🙂 If you have any comments or suggestions feel free to let me know. Even though I do like writing I don’t consider myself to be much of a writer. Get in touch if you have any comments or questions or just come say Hi!

No Comments