20 May 20220519 Next Day Analysis Gold

Posted at 04:52h

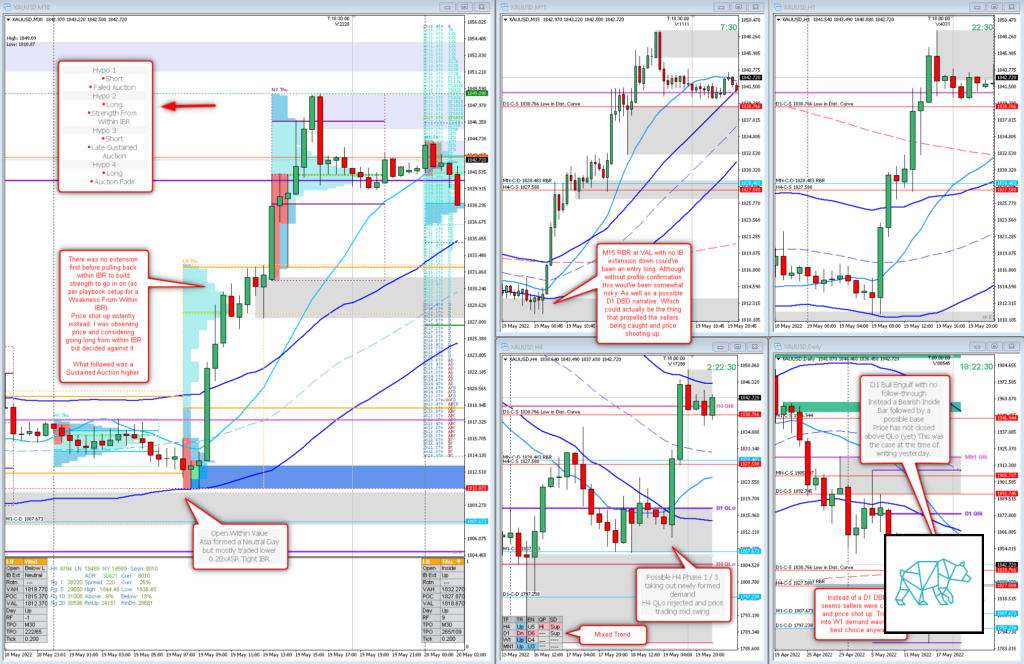

in Early Entry, Gold Trade Review, Next Day Analysis, Reversal Within IBR, Strength From Within IBR, Sustained Auction

2 Comments

#fintwit #XAUUSD #GOLD #NextDayAnalysis

⇧ More info within link ⇧

Premarket Prep:

Alfie

Posted at 11:24h, 08 JuneBrilliant analysis. What’s the difference between strength within the IB and weakness within the IB as a setup? Is it just one is short from Supply within the IB and the other is long from Demand?

T3chAddict

Posted at 12:13h, 08 JuneThanks. Great question.

That is correct. Although this is not the best example as my notes indicate and hence I did not take a trade based on it. I struggled finding the right supportive price action, profile reading to support the developing narrative. And when in doubt…

Usually a Strength/Weakness From Within IBR happens when there is a Wide IBR (wider than 3/4 ASR) indicating possible responsive activity. In this case it was the open within value indicating possible responsive activity.

Price extends IB and then pulls back within IBR, then finds strength (long) /weakness (short) at a SD level before continuing the direction of the extension.

In this case there was no extension of IB first and one could argue this was a reversal trade taking D1 QLo as a directional cue ie. long. Further ambiguous circumstances include the open within Value and reversing at VAL. Suffice to say this is not a textbook example of the Strength From Within IBR setup.

Have a look at some other examples and let me know if you have more questions on it.