14 Apr 20220413 Trade Review Gold

Posted at 05:01h

in Developing H4 RBR, Gold Trade Review, Late-Sustained Auction Entry, Sustained Auction, Trade Reviews

0 Comments

Play: Late-Sustained Auction (Averaged into Position)

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #Gold #XAUUSD

Cut position in half and re-entered for better average entry long

- Result

- 1.2R

- Open Sentiment

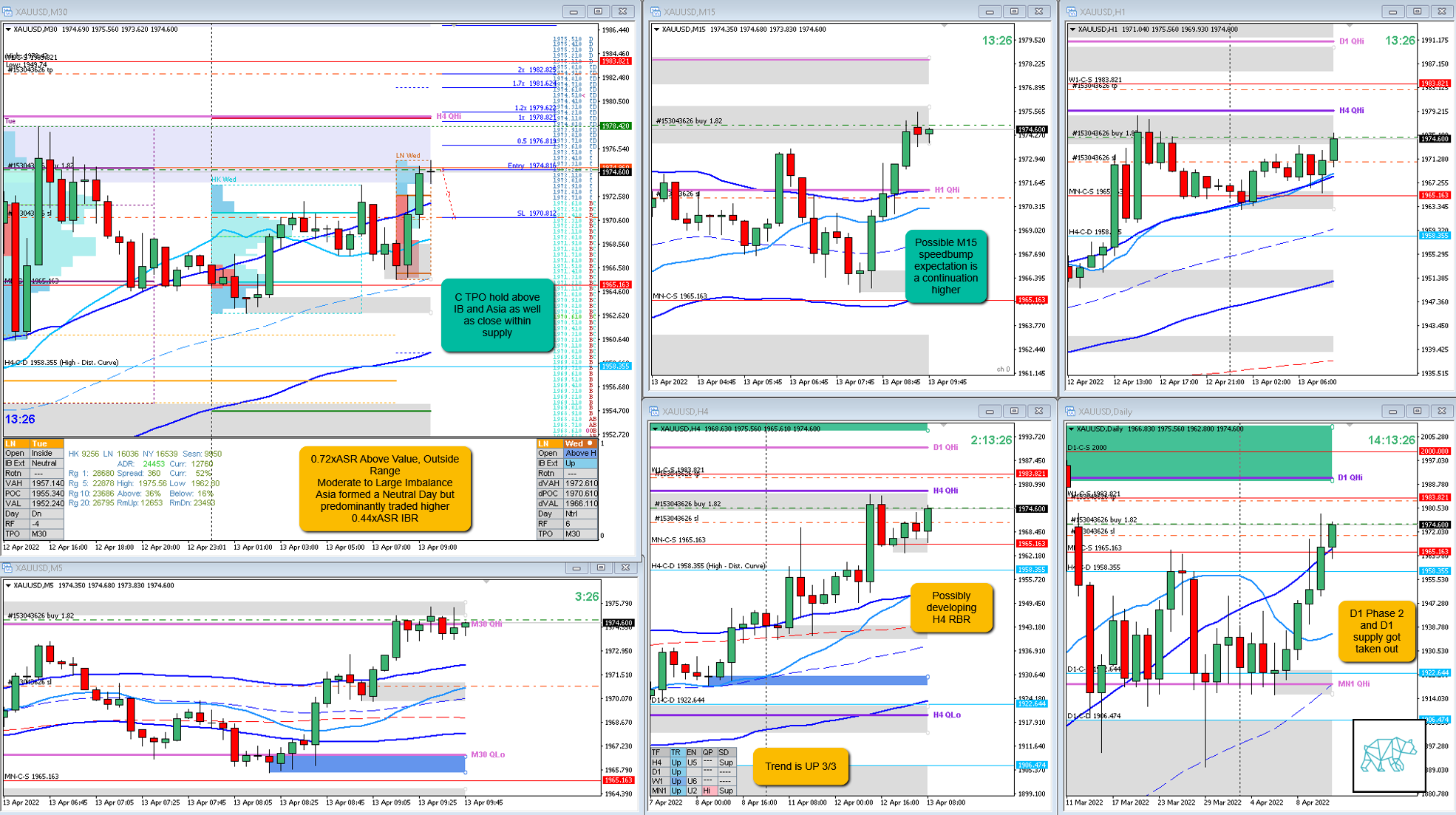

- 0.72xASR Above Value, Outside Range

- Moderate to Large Imbalance

- Asia formed a Neutral Day but predominantly traded higher

- IBR

- 0.44xASR IBR

- Trend

- Strong UT

- H4: Up

- D1: Up

- W1: Up

- Hypo

- 1

- Long

- Late-Sustained Auction, preferably hold above Asia

- Attempted Setup

- Late-Sustained Auction

- Entry Technique

- C TPO hold above IB and Asia as well as close within supply

- Waited for a pullback to IB high, got put off by a potential M5 reversal, but considered the possibility for a low initiative activity sustained auction as D TPO had made a HH and went long anyway

- When price eventually did pull back I cut my position in half and added another half closer to IB High

- SL placement

- Standard SL (400)

- TPO period for Entry

- D TPO

- Trade Duration

- 1h0m

- Long/Short

- Long

- Leading Narrative

- Strong UT

- Possible D1 Phase 2

- Possible Developing H4 RBR

- C TPO closing above IB and Asia as well as closing within old H4 supply

- Hypo 1 at 1st DTTZ

Actual Development

- D TPO closed as an Inside Bar above IB sustaining the auction

- Expectation is for a continuation which came in E closing higher although not confidently F took price higher hitting target

Good points

- Great that I traded even though not being the sharpest I could still focus on the narrative unfolding through reading of price action and profile. Although did struggle.

- Great that I went long anyway even though price close further away from IB, price could have seen a faster continuation and I would’ve missed the trade completely

- Then great that I averaged in by cutting position in half and then re-entering at a better price when price pulled back.

Bad Points

- Trade went to 1.7R

Next Day Analysis

- Target hit?

- Yes, 1.2R

- Time-based Exit?

- 0.5R

- Overlap Noise?

- 0.9R

- End of Day?

- 0.7R

- Highest R multiple?

- 1.7R

TAGS: Above Value, Outside Range, Moderate to Large Imbalance, Trend is UP 3/3, Averaged into Position, Hypo 1 at 1st DTTZ,

Premarket prep on the day:

Daily Report Card:

No Comments