20 Mar 20220318 Trade Review DAX T2

Posted at 07:52h

in DAX Trade Review, Developing H4 Break Down, Opportunistic Trade, Trade Reviews

0 Comments

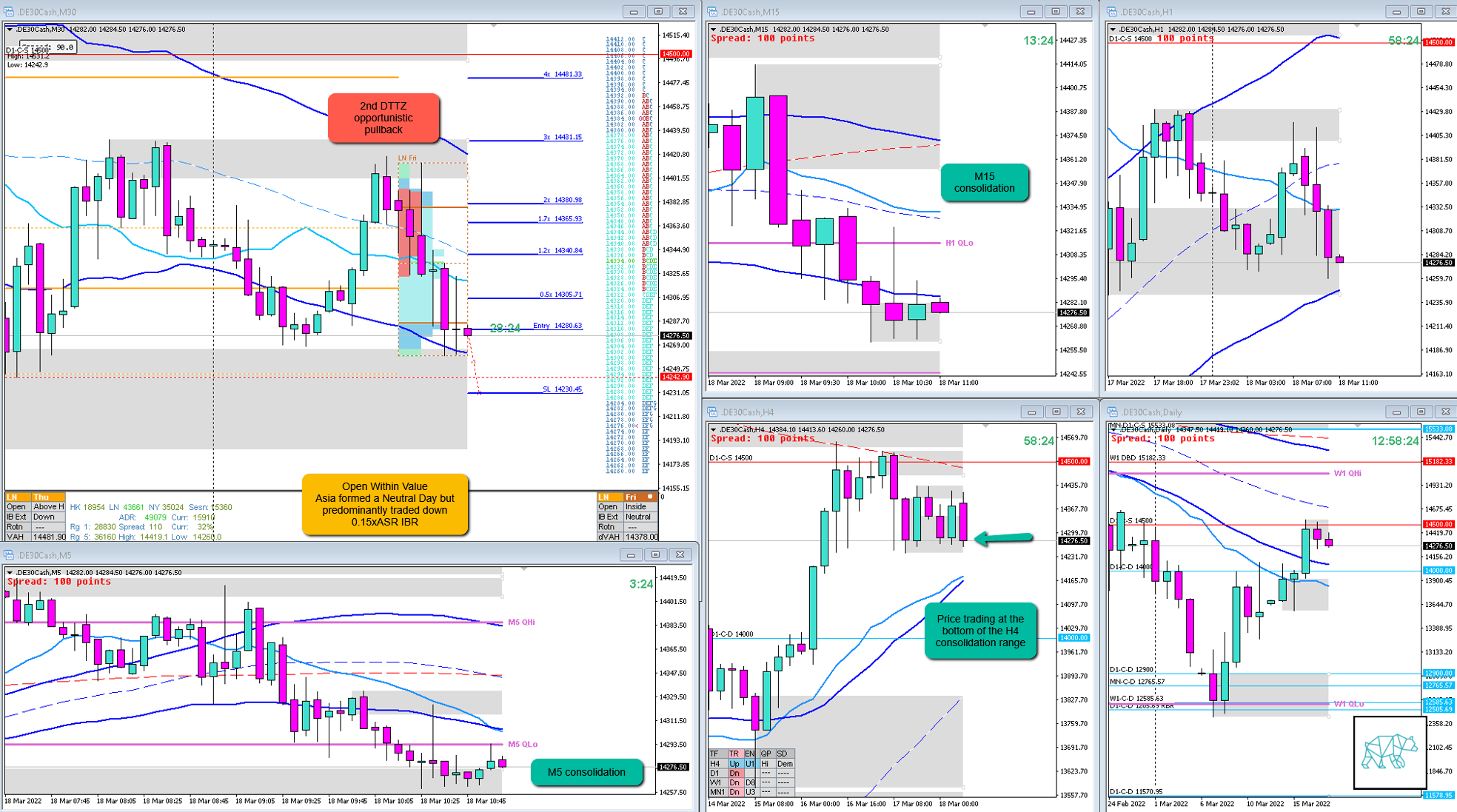

Play: 2nd DTTZ Opportunistic Trade Auction Fade

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

- Result

- 0R

- Open Sentiment

- Open Within Value

- Asia formed a Neutral Day but predominantly traded down

- IBR

- 0.15xASR Tight IBR

- Trend

- Trend is Down 2/3

- H4: Up

- D1: Down

- W1: Down

- Hypo

- Hypo 4

- Long

- Auction Fade

- Attempted Setup

- 2nd DTTZ Countermove Opportunistic Auction Fade

- Entry Technique

- M5 RBR created near IB low after C TPO had extended to the upside

- SL placement

- Adjusted SL at (3000)

- TPO period for Entry

- G TPO

- Trade Duration

- 0h11m

- Long/Short

- Long

- Leading Narrative

- 3‑I Day

- Neutral Day

- LTF consolidation

- 2nd DTTZ

Actual Development

- G TPO got close to Fading the Auction all the way to IB low and hit 1.2R before closing down as a DBD

Good points

- Understanding the narrative

Bad Points

- Not taking the trade — I wanted to see a more confident close on M5/M15. This was too much to ask and the consolidation itself was a good enough entry.

- I’ve done this kind of trades before so not sure why I doubted it. Perhaps because of the previous loss. I was also considering F TPO closing with a long selling wick. I’ll have to keep taps on this if it happens again.

Next Day Analysis

- Target hit?

- No, 1.2R

- Time-based Exit?

- -1R

- Overlap Noise?

- -1R

- End of Day?

- -1R

- Highest R multiple?

- 1.2R

TAGS: Open Within Value, Trend is Down 2/3, 3–1 Day,

Premarket prep on the day:

Daily Report Card:

No Comments