09 Mar 20220307 Trade Review DAX

Play: Strength From Within IBR

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

- Result

- 1.2R

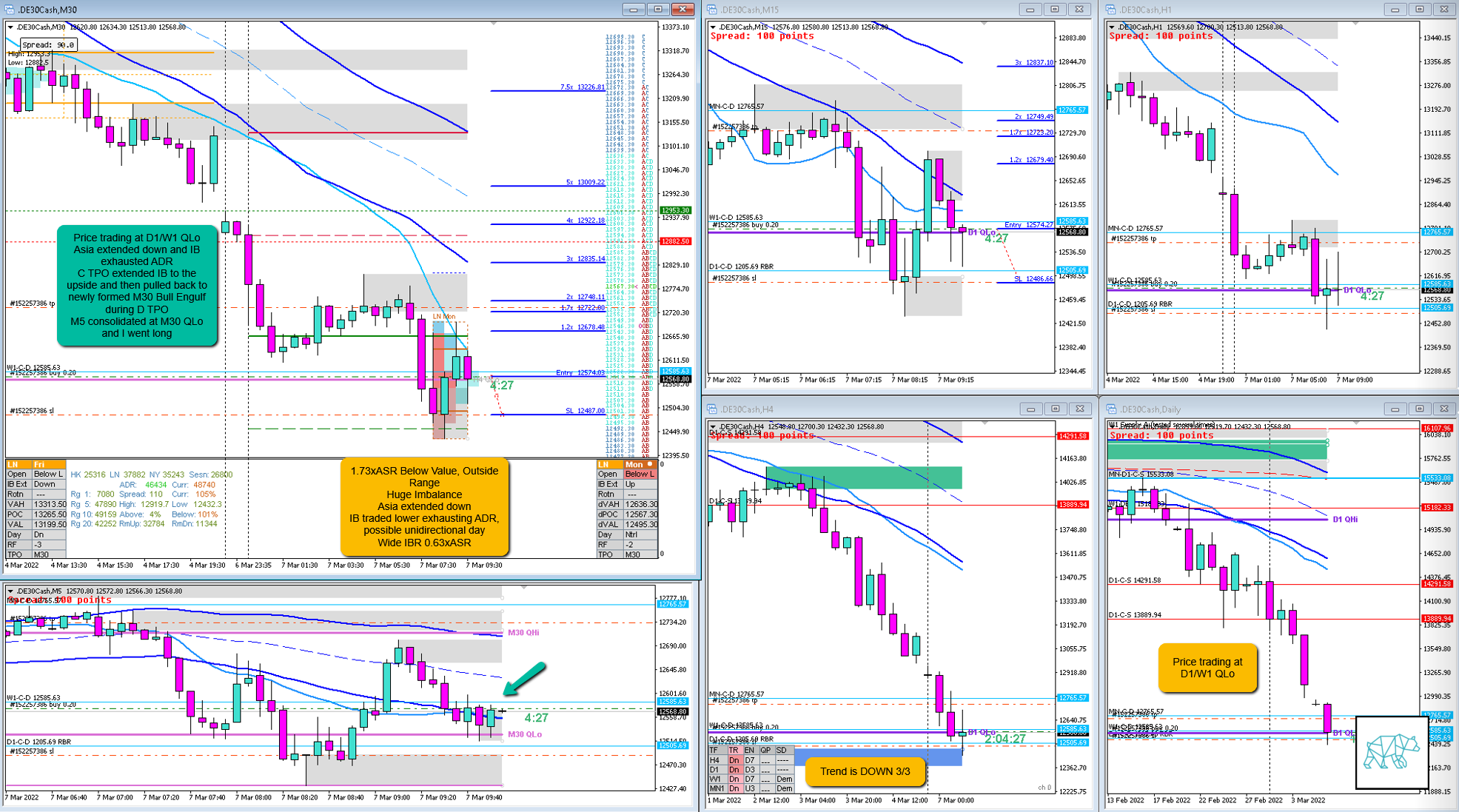

- Open Sentiment

- 1.73xASR Below Value, Outside Range

- Huge Imbalance

- Asia extended down

- IB traded lower exhausting ADR, possible unidirectional day

- IBR

- Wide IBR 0.63xASR

- Trend

- Trend is DOWN 3/3

- H4: DOWN

- D1: DOWN

- W1: DOWN

- Hypo

- Hypo 2

- Long

- Strength From Within IBR

- Attempted Setup

- Strength From Within IBR

- Entry Technique

- M5 consolidation at M30 QLo and newly formed M30 C‑dem (Bull Engulf)

- SL placement

- Average SL (8500)

- TPO period for Entry

- D TPO

- Trade Duration

- 0h15M

- Long/Short

- Long

- Leading Narrative

- Price trading at D1/W1 QLo

- Asia extended down and IB exhausted ADR

- C TPO extended IB to the upside and then pulled back to newly formed M30 Bull Engulf during D TPO

- M5 consolidated at M30 QLo and I went long on 4th candle close closing bullish

Actual Development

- D Closed higher within IBR as a Hammer

- E TPO moved higher hitting 1.2R target

- What followed was a consolidation and then a move higher eventually hitting 7R

Good points

- Understanding the narrative

- Taking the trade even though being tired

- Not taking the Failed Auction as per Hypo 1 due to insufficient profit target because of the newly formed M30 Bull Engulf

Bad Points

- Could’ve let the trade longer based on E TPO hitting profile higher indicating a possible continuation as it had formed a Poor High which usually gets taken out. I didn’t want to risk it with the strong DT.

Next Day Analysis

- Target hit?

- Yes, 1.2R

- Time-based Exit?

- 2.7R

- Overlap Noise?

- 4.2R

- End of Day?

- 0.8R

- Highest R multiple?

- 7R

TAGS: Below Value, Outside Range, Huge Imbalance, Trend is DOWN 3/3, Wide IBR,

Premarket prep on the day:

Daily Report Card

No Comments