20 Oct 20211020 Premarket Prep Gold

#fintwit #orderflow #daytrading #premarketprep #XAUUSD #GOLD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Compared against Weekly Trading Plan

- Price trading above last week’s body but within long selling wick’s range

Non-conjecture observations of the market

- Price action

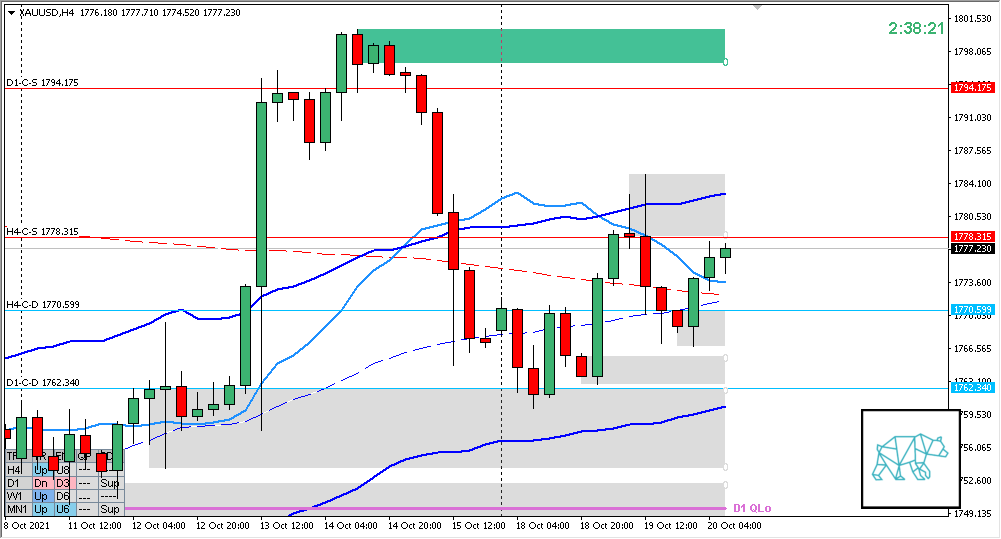

- Weak D1 Bull Engulf with long selling wick giving D1-C‑D 1768.495

- H4 Bull Engulf above previous demand coming from H4 QLo rejection

- Trend: H4 Up, D1 Down, W1 Up

- Prevailing trend: MIXED Trend

- Market Profile

- Value created above the previous with price currenlty trading below

- Daily Range

- ADR: 22379

- ASR: 15140

- 379

- ASR Short: 7825 (too tight)

- 196

- Day

- Yesterday’s High 1785.030

- Yesterday’s Low 1762.750

Sentiment

- LN open

- Below Value, Within Range

- Open distance to value

- 0.07xASR

- Narrative

- Moderate balance. IBR very tight at 0.16xASR. Proximity to value edge could see an acceptance of value although not a great opportunity due to larger timeframe sentiment as well as H4 supply within a somewhat tight value. In premarket price has traded and closed higher. Price is trading mid H4 swing in a mixed trend market. Will need to rely on price action and profile for opps.

- Clarity (1–5, 5 being best)

- 3

- Hypo 1

- Return to Value, Failed Auction Short (IBR too tight), Value Edge Reversal

- Hypo 2

- Value Acceptance

- Hypo 3

- Sustained Auction Up, variation to Hypo 2

- Hypo 4

- Auction Fade Short, Variation to Hypo 3

Additional notes

- N.A.

ZOIs for Possible Shorts

- H4-C‑S 1778.315

ZOIs for Possible Long

- H4-C‑D 1770.599

- D1-C‑D 1762.340

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 20 trades by the end of the month, preferably 2 a day (not in the same product at the same time)

- Weekly Goal

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- No early exits, either hit SL or 2R target, latest cut-off 1:30 London time

- Risk Management

- 2 consecutive days of lack of sleep = NO TRADING

No Comments