19 Oct Gold 2021 Week 42 Trading Plan

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #Gold #XAUUSD

This is my weekly outlook on GOLD. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

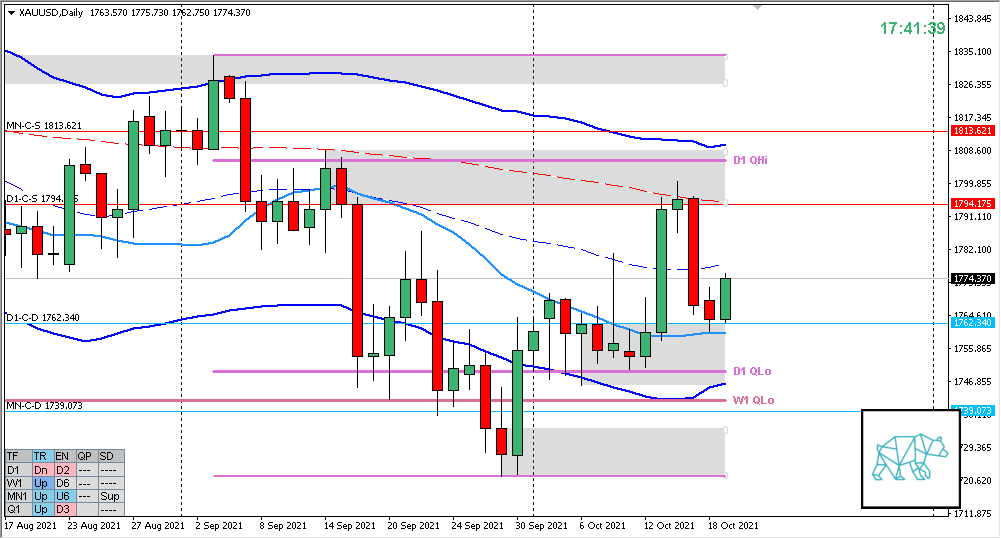

Monthly — Bearish

- MN QHI rejected, currently mid swing

- Price closed below MN Supply forming an Evening Star but with a reaction off MN-C‑D 1739.073 retracing to newly formed MN C‑sup

Weekly — Neutral

- Flimsy W1 RBR with long selling wick after a 2nd test of W1 QLo

Daily — Bullish

- Big Bear Engulf at first test of D1-C‑S 1794.175 (coinciding with D1 200MA) returning to D1-C‑D 1762.340

- Price coming from a D1 QLo rejection

- Possible D1 Phase 1

Sentiment summary — Neutral

- MN retracement to newly formed C‑sup isn’t the strongest bearish signal as it’s formed through an Evening Star. Although still about 2 weeks left in the month and price is following a MN QHi rejection.

- W1 is closing higher although with long selling wicks plus coming from W1 QLo

- D1 possibility for a Phase 1 expectation is for phase 2 although price would need to clear supply that has only been tested once and seen a big reaction. Thus a possible Phase 3 is still in the cards as well following the larger timeframe sentiment. D1 demand still in the way at D1 QLo though so there might be some sideways market first.

Additional notes

- N.A.

ZOIs for Possible Shorts

- MN-C‑S 1813.621

- D1-C‑S 1794.175

ZOIs for Possible Long

- D1-C‑D 1762.340

- MN-C‑D 1739.073

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 20 trades by the end of the month, preferably 2 a day (not in the same product at the same time)

- Weekly Goal

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- No early exits, either hit SL or 2R target, latest cut-off 1:30 London time

- Risk Management

- 2 consecutive days of lack of sleep = NO TRADING

No Comments