15 Oct 20211014 Trade Review DAX

Posted at 06:32h

in DAX Trade Review, Return to Value, Reversal, Sustained Auction, Trade Reviews

0 Comments

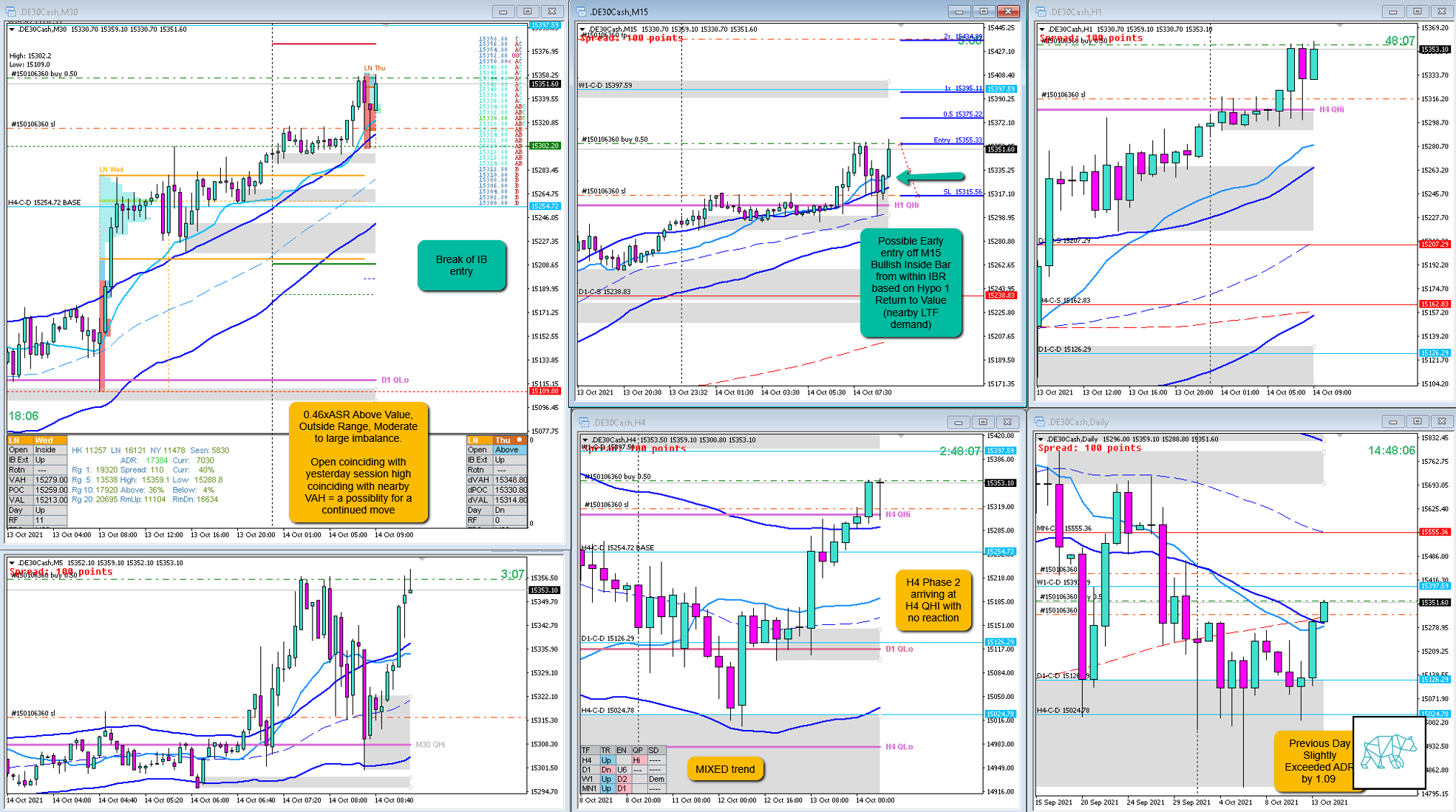

Play: Sustained Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

- Result

- 2R

- Product

- DAX

- Open Sentiment

- 0.46xASR Above Value, Outside Range

- IBR

- 0.46xASR

- Hypo

- 2

- Attempted Setup

- Sustained Auction

- Entry Technique

- Break of IB

- SL placement

- Standard SL size

- TPO period for Entry

- C TPO

- Trade Duration

- 4h30m

- Long/Short

- Long

- Leading Narrative

- Prev. day slightly exceeded ADR indicating possible strength. Open was at yesterday’s high which coincided with nearby VAH. Thus a Return to Value or Sustained Auction was in the cards.

Actual Development

Price formed a base in D TPO then followed a RBR in E before consolidating later in the session to continue in the overlap noise hitting the target.

Good points

- Taking the trade

- Understanding and remembering the significance of the open at yesterday’s high with nearby VAH

- Letting go of prev. Day having exceeded ADR and a possible pullback might be in play

- Following the price and profile showing a sustained auction even during the consolidation period

Bad Points

- Not really a bad point but I could have had an earlier entry due to the same narrative. A possible early entry would’ve been from within IBR at LTF demand above VAH. Price likes to use nearby LTF SD zones as a potential bouncing board for continuation moves.

Next Day Analysis

- Target hit?

- Yes, 2R

- Time-based Exit?

- 0.7R

- Overlap Noise?

- 0.6R

- End of Day?

- 3.5R

- Highest R multiple?

- 3.5R

TAGS: Prev. Day Exceeded ADR, Above Value, Outside Range, Moderate to Large Imbalance,

Premarket prep on the day:

No Comments