03 Oct Gold 2021 Week 40 Trading Plan

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #Gold #XAUUSD

This is my weekly outlook on GOLD. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

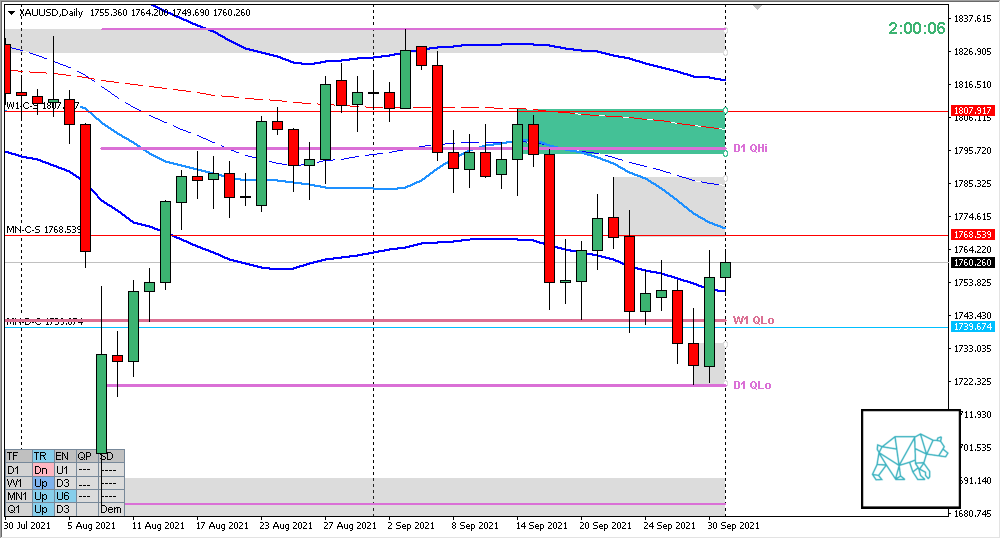

Monthly — Bearish

- MN QHI rejected, currently mid swing

- Price closed below MN Supply forming an Evening Star but with a slight reaction off MN-C‑D 1739.674

Weekly — Bullish

- Price reacted off and closed above MN demand and W1 QLo closing as a Bull Engulf with long buying wick

Daily — Bullish

- Big D1 Bull Engulf on first test of D1 QLo and slight continuation higher closing below D1 supply coinciding with newly formed MN Supply.

Sentiment summary — Bearish

- MN closed bearish increasing the expectation for more downside. ALthough with the nature of an Evening Star there could be a pullback 30–50% of last month’s bar before continuing down.

- W1 Closed somewhat bullish reacting off demand but let’s see what follow-through it gets. There could be some continuation higher first.

- D1 Bull Engulf could see a test of newly formed demand. Price still below D1 VWAP in DT with no close within D1 Supply. Price is coming from a D1 QLo rejection but will need to clear that supply first for the sentiment to change to bullish.

Additional notes

- Oct 08, 20:30, USD, Non Farm Payrolls (Sep)

ZOIs for Possible Shorts

- W1-C‑S 1807.917

- MN-C‑S 1769.539

ZOIs for Possible Long

- MN-C‑D 1739.674

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 20 trades by the end of the month, preferably 2 a day (not in the same product at the same time)

- Weekly Goal

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- No early exits, either hit SL or 2R target, latest cut-off 1:30 London time

- Risk Management

- 2 consecutive days of lack of sleep = NO TRADING

No Comments