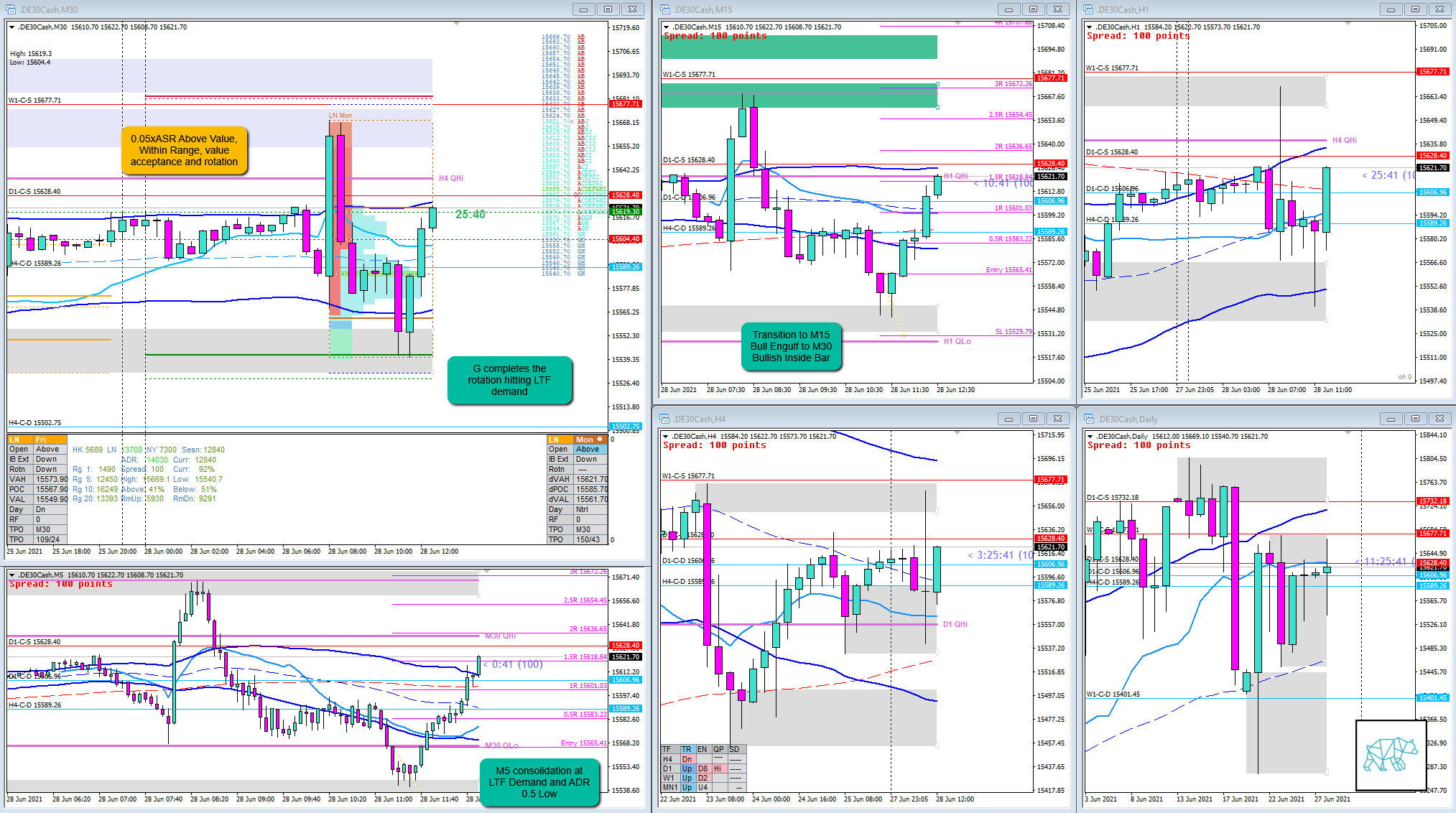

29 Jun 20210628 Trade Review DAX

Play: Reversal at Value Edge (fail)

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GBPNZD

Market Narrative

There was an open 0.05xASR above value, within range. Moderate Imbalance with close proximity to value edge. FF traded lower, after which IB made a big swing up and down and accepted value in C. I did not see this as I had changed my TPO sizing. I thought price was consolidating at value edge and with the open sentiment being above I expected a move higher. Had I seen the acceptance of value I would not have taken this trade.

How was the Entry?

Along the lines of my thinking without knowing the acceptance of value I thought the entry was good. It was based off a M15 Bull Engulf at value edge with nearby demand. Also, I waited for 2 hours in line with the FF move to potentially get in on the reversal.

How was the SL placement and sizing?

SL placement was a standard size and well below the formation.

How was the profit target?

How was the Exit?

M15 failed to close higher and even though it was a weak bear engulf it coincided with M5 failing to break above M5 VWAP in DT. Scratched the trade for ‑0.2R.

What would a price action-based exit have done for the trade?

I took a PA-bsed exit at ‑0.2R

What would a time-based exit have done for the trade?

-1R stop being hit as quickly after price moved down rotating through value.

What did I do well?

I did well to take the trade. If there was no earlier acceptance this would have been a perfectly fine trading idea.

What could I have done better?

I could have paid more attention to the TPO sizing. I now have a rule to base my analysis on scale 1 of TPO sizing for both DAX as well as Gold as these tend to make huge profiles.

Observations

Dax seems to like accepting value then failing the auction and move higher.

Missed Opportunity

TAGS: Above Value, Within Range, Moderate Imbalance, Extended Frankie Fakeout,

Premarket prep on the day

Daily Report Card on the day

No Comments