26 Jun Gold 2021 Week 26 Trading Plan

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #Gold #XAUUSD

This is my weekly outlook on GOLD. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

Monthly — Slightly Bullish

- Price traded higher (and closed on its high) from the Bull Engulf in April arriving at MN QHi

- Currently retraced all off last month’s bar but no close yet nearing MN-C‑D 1741.655

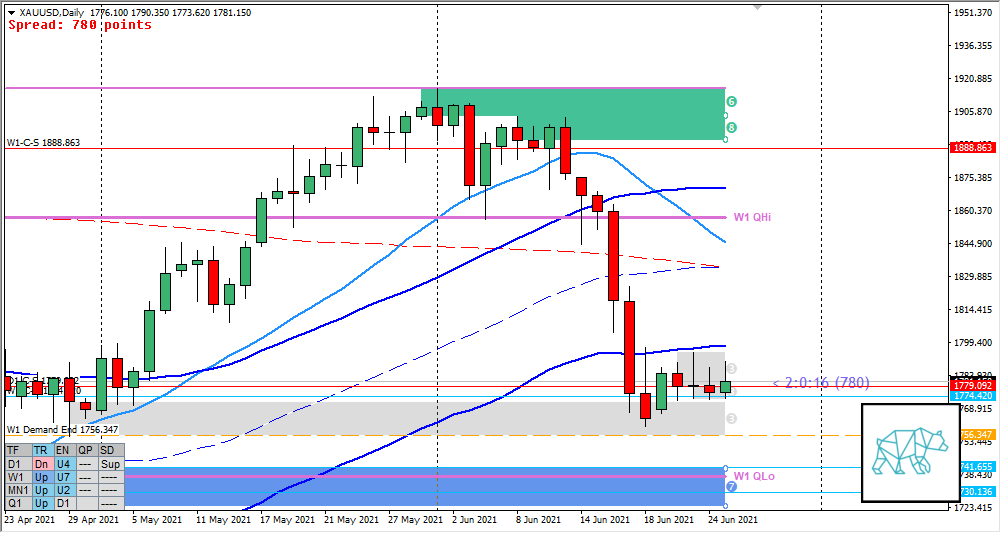

Weekly — Bearish

- Last week closed as an Inside Bar with slightly longer selling wick trading slightly above W1-C‑D 1774.420

- W1 QHi rejected with no arrival at W1 QLo (yet)

Daily — Neutral

- Possible D1 Phase 1 / 3 with Friday having formed a Bull Engulf with longer selling wick (longer selling wicks in entrie consolidation.

- D1 Supply and Demand created above W1 demand

- D1 QHi rejected with no arrival at D1 QLo (yet)

Sentiment summary — Slightly Bearish

- Price is nearing, but has not yet arrived at, MN-C‑D 1741.655

- W1 had a big move down rejecting W1 QHi with no arrival at QLo and last week only pulled back slightly.

- D1 showing a possible phase 1 / 3, with 3 being in line with a possible continuation to W1 narrative. Price would need to break from D1 consolidation (and take out S or D) to confirm a direction.

Additional notes

- Jun 28, 21:00 USD Fed’s Williams speech

- Jun 29, 01:10 USD Fed’s Quarles speech

- Jun 29, 20:00 EUR Consumer Price Index (YoY)

- Jun 30, 15:55 EUR Unemployment Change

- Jun 30, 17:00 EUR Consumer Price Index (YoY)

- Jun 30, 19:00 GBP BoE’s Haldane speech

- Jun 30, 22:30 USD EIA Crude Oil Stocks Change

- Jul 01, 16:00 EUR Markit Manufacturing PMI

- Jul 01, 17:00 EUR Unemployment Rate

- Jul 01, 20:30 USD Initial Jobless Claims

- Jul 01, 21:45 USD Markit Manufacturing PMI

- Jul 02, 03:00 GBP BoE’s Governor Bailey speech

- Jul 02, 20:30 USD Nonfarm Payrolls

ZOIs for Possible Shorts

- D1-C‑S 1779.092

ZOIs for Possible Long

- W1-C‑D 1774.420

- MN-C‑D 1741.655

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 13 trades by the end of the month

- Weekly Goal

- Weekly Focus Points

- Min. 3 times working out at home + mandatory cardio

- Trading rules

- Focus on taking ONE trade a day. If I missed the first DTTZ then a trade needs to be taken on the 2nd DTTZ unless there is a high/medium initiative activity day.

- Only price-action based exit rules (or if hit time stop comes earlier)

- M15/M30 entries and exits at 1st DTTZ, M5 entries and exits at 2nd DTTZ

- Buffer trades (profit target >1R) are allowed and encouraged

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- No social media / messenger apps / phone calls allowed during the trading window

- Weekly Focus Points

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments