06 Feb Gold Week 6 Trading Plan

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #Gold #XAUUSD

This is my weekly outlook on GOLD. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow through market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

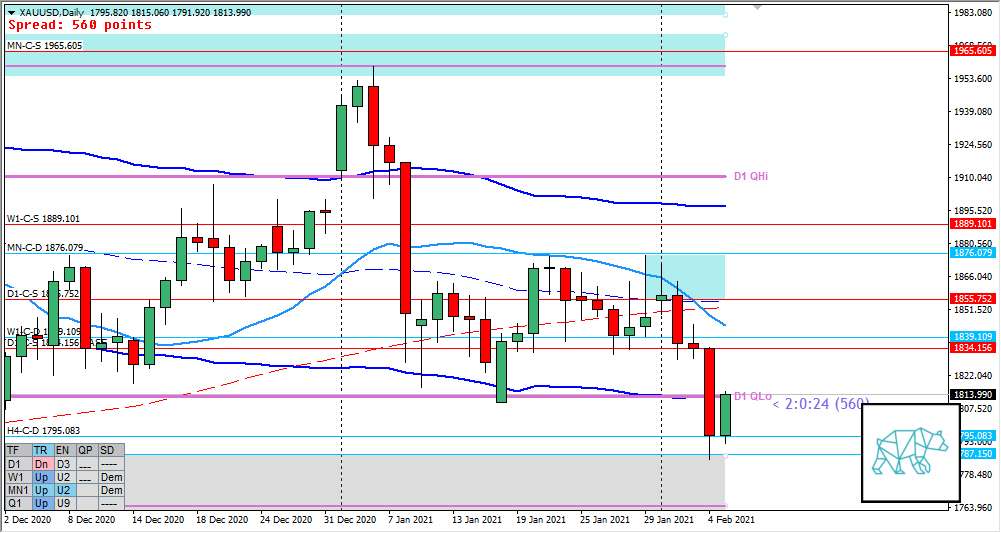

Monthly — Slightly Bearish

- MN-C‑D 1876.079 formed through Bull Engulf in December with no follow-through. Instead a test and reaction off MN-C‑S 1965.605 (2nd test, first in November). Month of January closing down within MN demand although not retracing more than 50% with price currently trading lower although still 3 weeks to go into the candle close.

- Possible Phase 3

Weekly — Slightly Bearish

- W1 Three Inside Down formed closing within W1-C‑D 1839.109 at W1 VWAP CAR forming a squeeze with W1 50MA in UT (didn’t close below).

- Possible W1 Phase 1 / 3

Daily — Slightly Bullish

- D1 DBD (D1-C‑S 1834.156 BASE) created arriving clean at D1-C‑D 1787.150 with consequent reaction closing slightly below 50% retracement closing just above D1/W1 QLo.

H4 — Slightly Bullish

- H4 demand giving H4-C‑D 1795.083 with consolidation and Break higher testing said demand once before continuing higher.

- H4 VWAP in DT just above.

Market Profile — Imbalance

- Values in DT with last value area created just below the previous one

Sentiment summary — Slightly Bullish

- Due to the big drop with a clean arrival we can see shorts covering and perhaps getting ready to change the sentiment if we can follow up on the medium time frame push higher rejecting D1/W1 QLo. A deep close below taking out W1 Demand End 1764.063 would usher in a longer term bearish sentiment.

Additional notes

- N.A.

ZOIs for Possible Shorts

- W1-C‑S 1889.101

- D1-C‑S 1855.752

- D1-C‑S 1834.156 BASE

ZOIs for Possible Long

- MN-C‑D 1876.079

- W1-C‑D 1839.109

- D1-C‑D 1784.150

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym + mandatory cardio

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments