03 Sep Premarket Prep DE30 DAX 09032020

#daytrade #daytrading #forex #FX #INDEX #INDICES #DAX #DE30 #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #tradingforex #daytrading

This is my premarket prep for today’s European session for DE30 DAX. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

Non-conjecture observations of the market

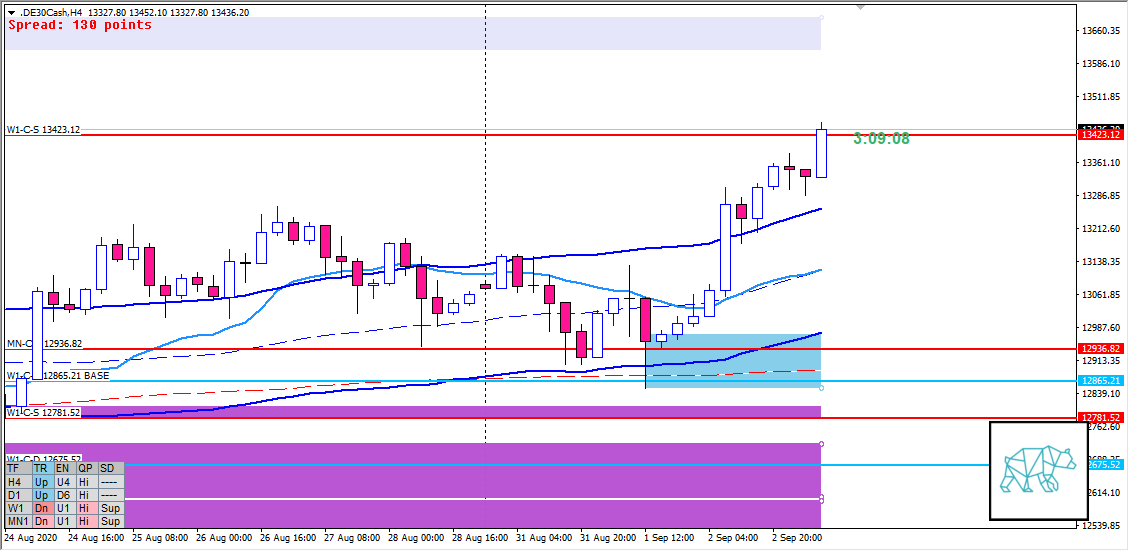

- D1 Bullish Marubozu taking out W1/D1 supply, nearing next supply at W1-C‑S 13423.12 and D1-C‑S 13729.96

- Market Profile

- Yesterday opened above bracketing range

- ADR: 22085

- ASR: 18851

- Day

- Day High 13304.66

- Day Low 13004.35

- Price within above day range

- Locations

- Day High at VAH

Compared against Weekly Trading Plan

- MN closed as RBR

- Trading within MN QHi, currently above last month’s range within MN-C‑S 12936.82

- Trading above last week’s body

Sentiment

- Sentiment

- LN open

- Above value, outside range, right on top of VAH and yesterday’s high

- Open distance to value: 0x ASR

- Sentiment

- Due to the placement of the open I have a more bullish sentiment

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Long

- Return to VAH at Yesterday’s High

- Missed LTF early entry. Might have another opportunity for an OBR play.

Additional notes

- N.A.

ZOIs for Possible Shorts (very risky)

- D1-C‑S 13729.96

- W1-C‑S 13423.12

ZOIs for Possible Long

- D1-C‑D 13098.56 BASE

- D1-C‑D 12997.12

Mindful Trading

- Slept okay

Focus Points for trading development

- Weekly Goal

- Formulate hypos in order of likelihood and track with actual development on the day

- Incorporate profile day type

- Trading Rules

- If Open outside of value consider the placement in relation to ADR

- Don’t take into consideration medium time frame c‑lines past 24 hours

- FX within value > DAX

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- OK to take 1R when in DD

- 2 consecutive days of lack of sleep = NO TRADING

No Comments