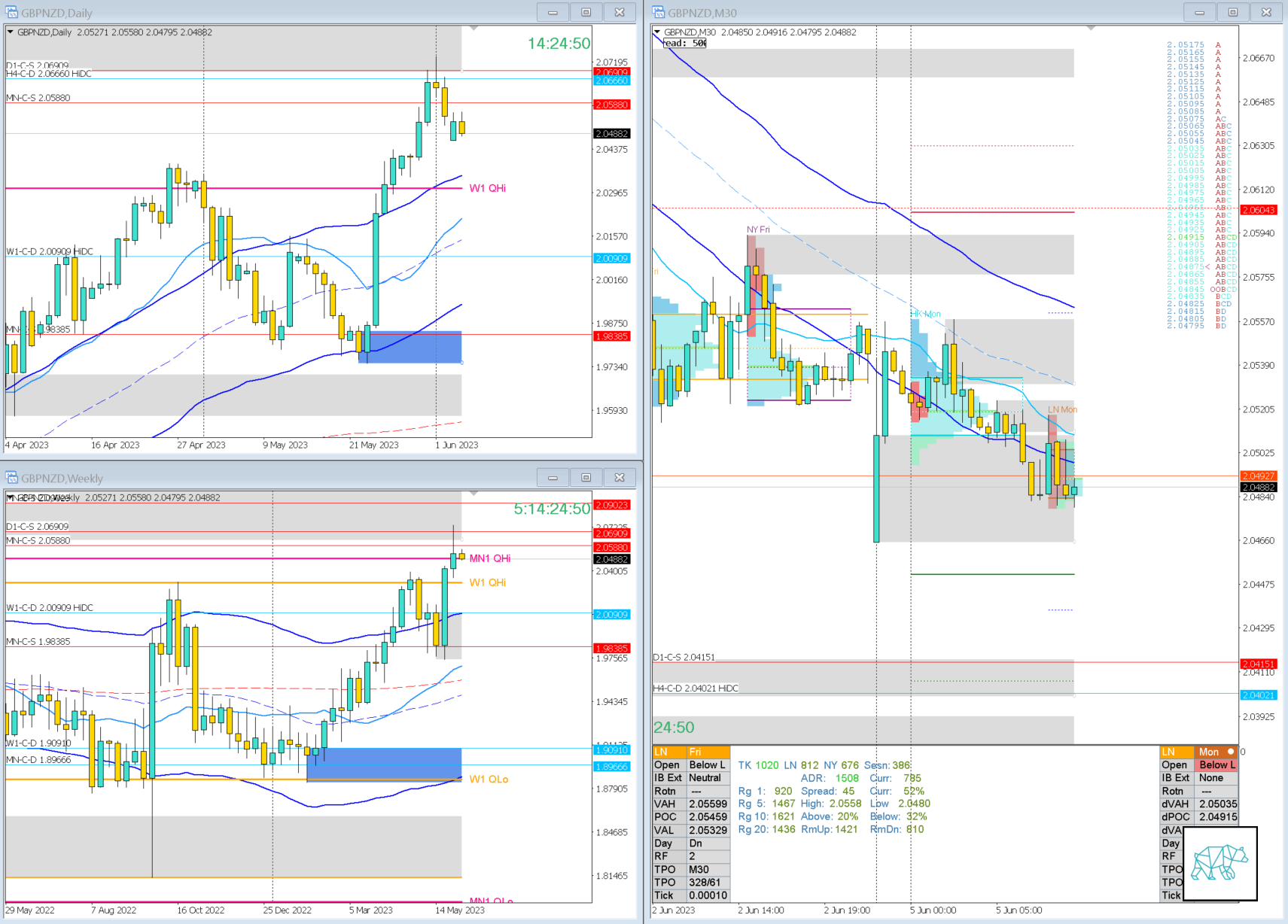

05 Jun GBPNZD 2023 Week 23 Trading Plan

#Fintwit #XAUUSD #GBPNZD #MarketProfile #Orderflow #TradingPlan

This is my weekly outlook on GBPNZD. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, get in touch with me.

Monthly — Bullish

- Price closed above previous structure high within Wide MN QHi as a Hammer and closed within MN-C‑S 2.05880

- Conjecture: a Hammer indicates a possible continuation. Which would be in line with trading into a Wide QHi. However, price is also trading at MN UKC in R coinciding with the MN QHi and could see sellers come in. Potentially further higher up at MN-CS 2.09023.

Weekly — Bullish

- Price closed as an Inverted Hammer above previous structure high, within Wide W1 QHi

- Conjecture: Inverted hammer indicates a possible continuation however price could see sellers come in around these levels

Daily — Bearish

- D1 Evening Star with some continuation

- Price trading within Wide D1/W1 QHi

- Conjecture: Price has seen some reversing at D1 Supply, within larger timeframe supply. D1 Evening Star is a momentum move so in absence of that price could push higher.

Sentiment summary — Bullish

Additional notes

- N.A.

Focus Points for trading development

- Monthly Goals

- Use SL scaling

No Comments