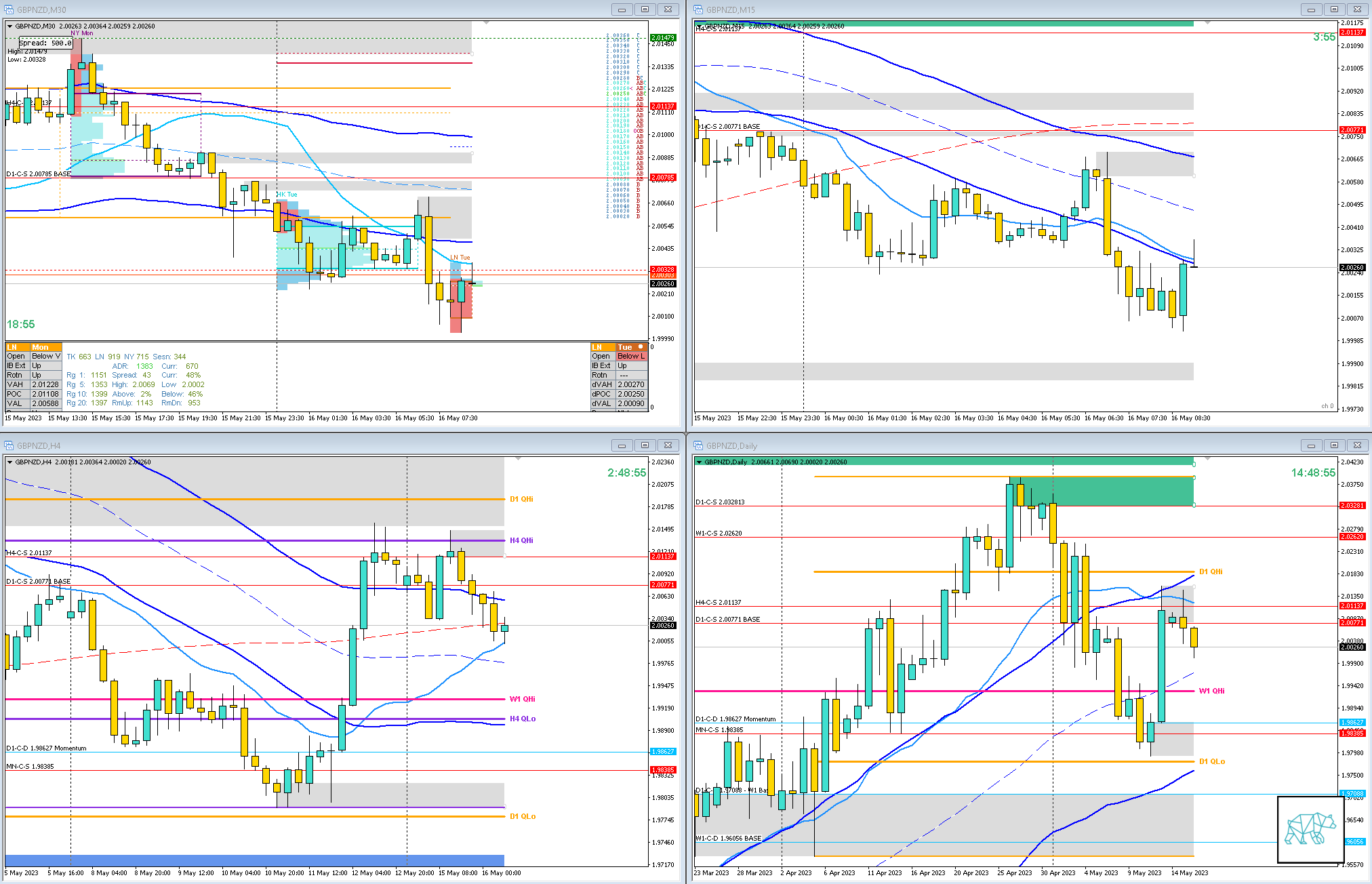

16 May 20230516 Premarket Prep GBPNZD

#Fintwit #GBPNZD #Forex #MarketProfile #Orderflow

This is my premarket prep for today’s European session for GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Larger Timeframe

MN price trading:

Within Body — Within Supply — Mid Swing — Wide Q

W1 price trading:

Below Body — Within Range — Within QHi — Wide Q — W1 Bear Engulf to W1 Hammer

Narrative

- D1

- Possible D1 VWAP in UT BD to CAR

- D1 QHi rejected, price trading mid swing

- H4

- 2 rejections of H4 QHi

- Price closed lower through H4 Bear Engulf giving H4-C‑S 2.01137 taking out H4 Demand HiDC through Bull Engulf and closing below

- Trend

- Trend is DOWN 2/3

- Market Profile

- 2 overlapping values both wider than usual

- LN Open

- 0.44 x ASR- Below Value — Outside Range

- Moderate to Large Imbalance

- Asia traded lower

- Frankfurt traded lower

- 0.29xASR Tight IBR

Additional Notes

- N.A.

Hypos

- Hypo 1

- Short

- Reversal — Possible Failed Auction — possible continuation

- Hypo 2

- Long

- Late-Sustained Auction — possible VAA — Very risky with supplies at VAL and within. No clear target.

Clarity / Confidence (1 — 5, low to high)

- 1

Mindful Trading (1–5 Bad to Good)

- 3

Focus Points for trading development

- Monthly Goals

- Use SL scaling

T3chAddict

Posted at 10:00h, 16 MayAB: Formed a Morning Star

C: Extended above but closed within as an Inverted Hammer / M15 Bear Engulf, due to the Inverted Hammer I paused to go for a FA as price could continue higher first to try and reach for value edge. Which would be the saver play.

D: Ducked above IB again as expected and made a HH. Closed as RBR above IB.

T3chAddict

Posted at 10:33h, 16 MayE closed making a HH testing VAL within M30 supply formed in premarket

T3chAddict

Posted at 11:02h, 16 MayF: M5 consolidation and BD / M15 Inside Bar as per Hypo 1. Closed as M30 Bearish Inside Bar. Not much of a profit target to IB high and congestion on the way.