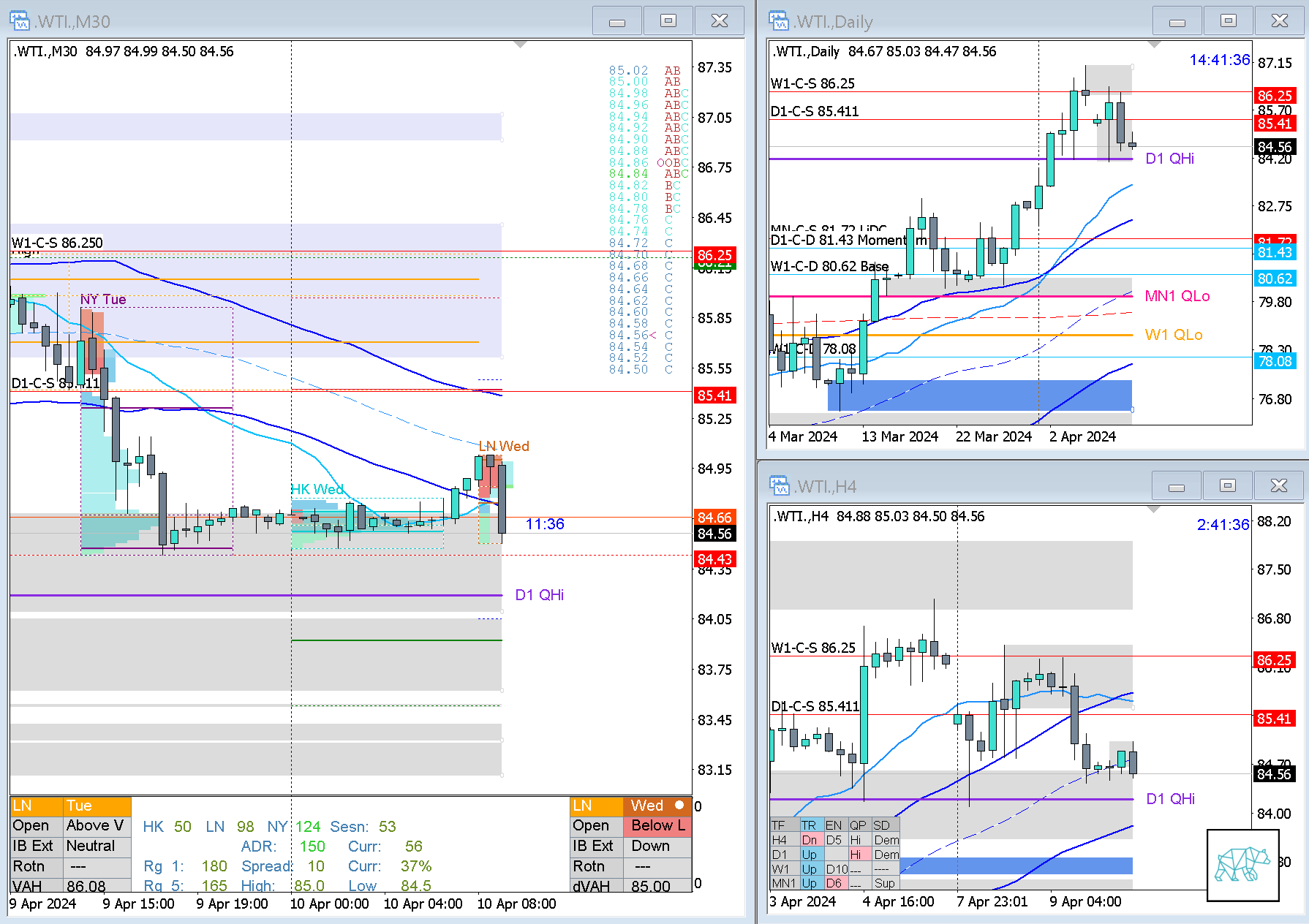

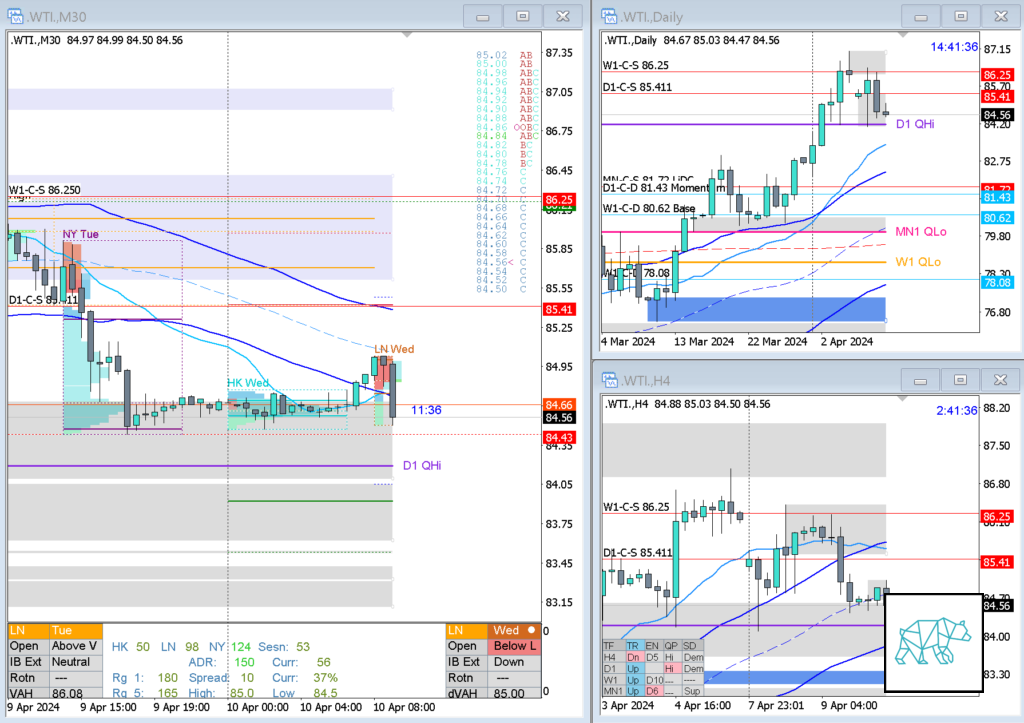

10 Apr 20240410 Premarket Prep WTI Crude

⇧ Detailed Trading Plan for London Session with HYPOS outlined within link ⇧

#Fintwit #WTI #Crude #CrudeOil #WTICrude #VWAP #Keltner #MarketProfile #Orderflow #TradingPlan

This is my premarket prep for today’s European session for WTI Crude. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Narrative

D1

Price trading within QHi

D1 Bear Engulf within Wide QHi at W1 Supply

H4

No Q Swing

Price trading at H4 50MA UT

Trend

Trend is UP 2/3

Market Profile

Value Overlapping the Previous

LN Open

Below Value — Outside Range

Moderate to Large Imbalance

Prev. Day Exceeded ADR — Yes

Asia traded — sideways

IBR — Normal

Additional Notes

Apr 11, ECB Interest Rate Decision

Hypo 1

Short

Late-Sustained Auction

Hypo 2

Long

Reversal — Possible Failed Auction

Hypo 3

Long

Auction Fade

Clarity / Confidence (1 — 5, low to high)

2

Mindful Trading (1–5 Bad to Good)

2

Don’t know what all the abbreviations are? Check out my lexicon:

Check me out on other platforms as well:

No Comments