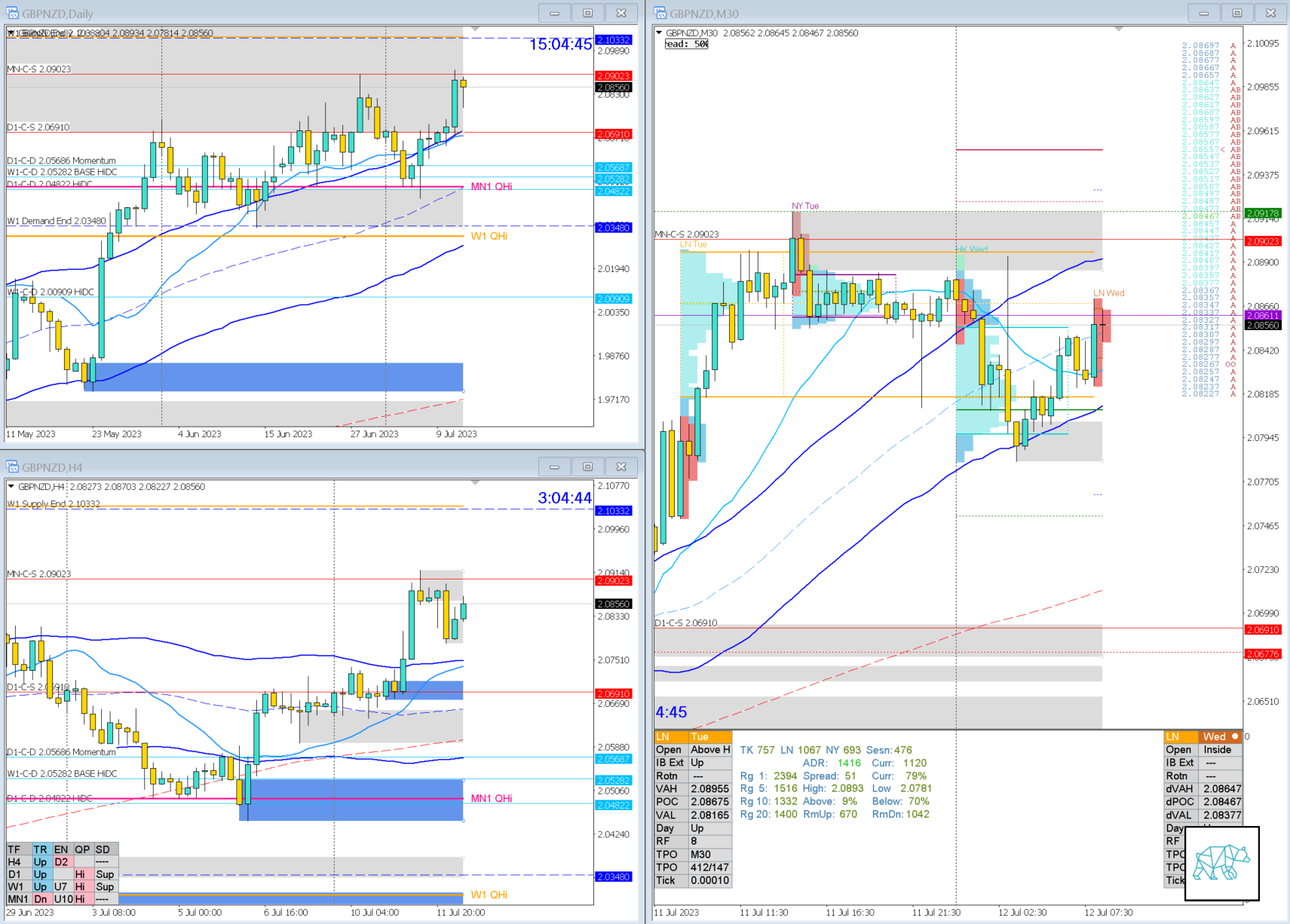

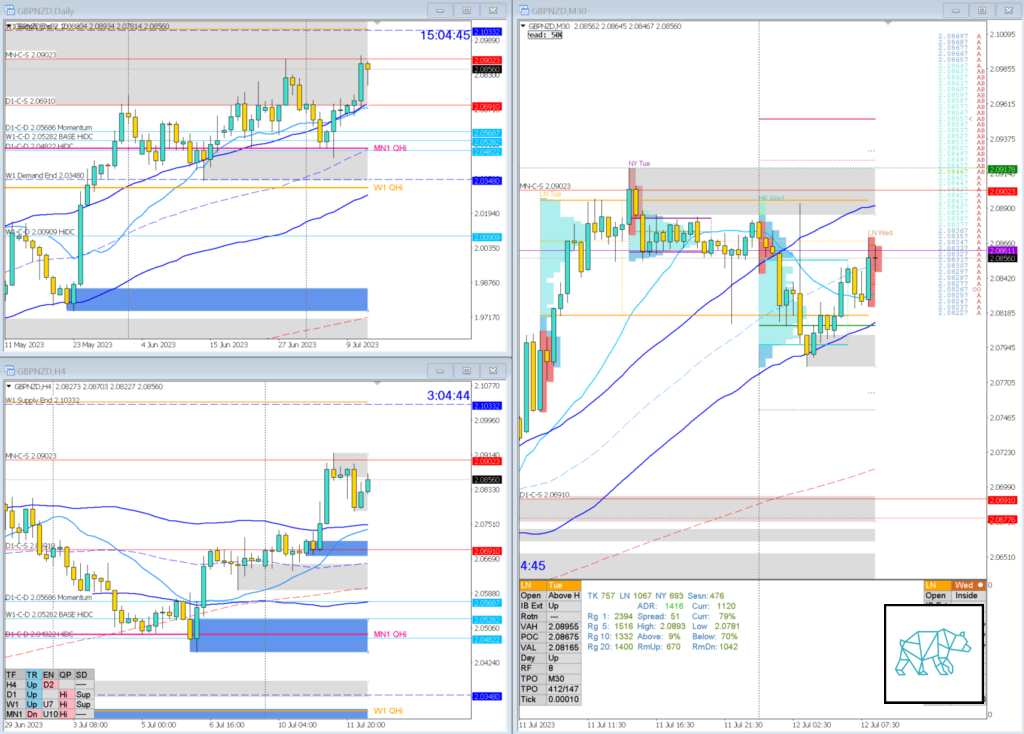

12 Jul 20230712 Premarket Prep GBPNZD

⇧ Detailed plan with HYPOS outlined within link ⇧

#Fintwit #GBPNZD #VWAP #Keltner #Forex #MarketProfile #Orderflow

This is my premarket prep for today’s European session for GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Larger Timeframe

MN price trading:

Last month closed as a Spinning Top with slightly longer buying wick

Above Body — Within Range — Within QHi — Wide Q

Price trading at MN UKC in R

2nd test of MN supply

W1 price trading:

Above Body — Above Range — Within Supply — Within QHi — Wide Q

Long wicks around

Last week closed as a possible base with longer buying wick

Price made a HH trading deeper within W1 Supply nearing W1 Supply End 2.10332

Narrative

D1

Price closed deeper within D1/W1 Supply taking out a newly formed D1 supply and closed above previous structure high (not yet above channel FT)

Price trading within Wide D1/W1 QHi

Price tested 50% mark and is possibly reactive

H4

H4 Bear Engulf at MN Supply

H4 swing taken out

Trend

Trend is UP 3/3

Market Profile

Value created above the previous

LN Open

Within Value

Prev. Day Exceeded ADR by 1.69

Asia traded lower

Premarket formed a H4 Inside Bar

0.45xASR IBR

Additional Notes

N.A.

Hypo 1

Short

Reversal — Possible Failed Auction

Hypo 2

Long

Reversal — Possible Failed Auction

Hypo 3

Long

Late-Sustained Auction

Hypo 4

Short

Late-Sustained Auction

Clarity / Confidence (1 — 5, low to high)

2

Mindful Trading (1–5 Bad to Good)

3

Don’t know what all the abbreviations are? Check out my lexicon:

Check me out on other platforms as well:

No Comments