17 May 20230517 Premarket Prep GBPNZD

#Fintwit #GBPNZD #Forex #MarketProfile #Orderflow

This is my premarket prep for today’s European session for GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

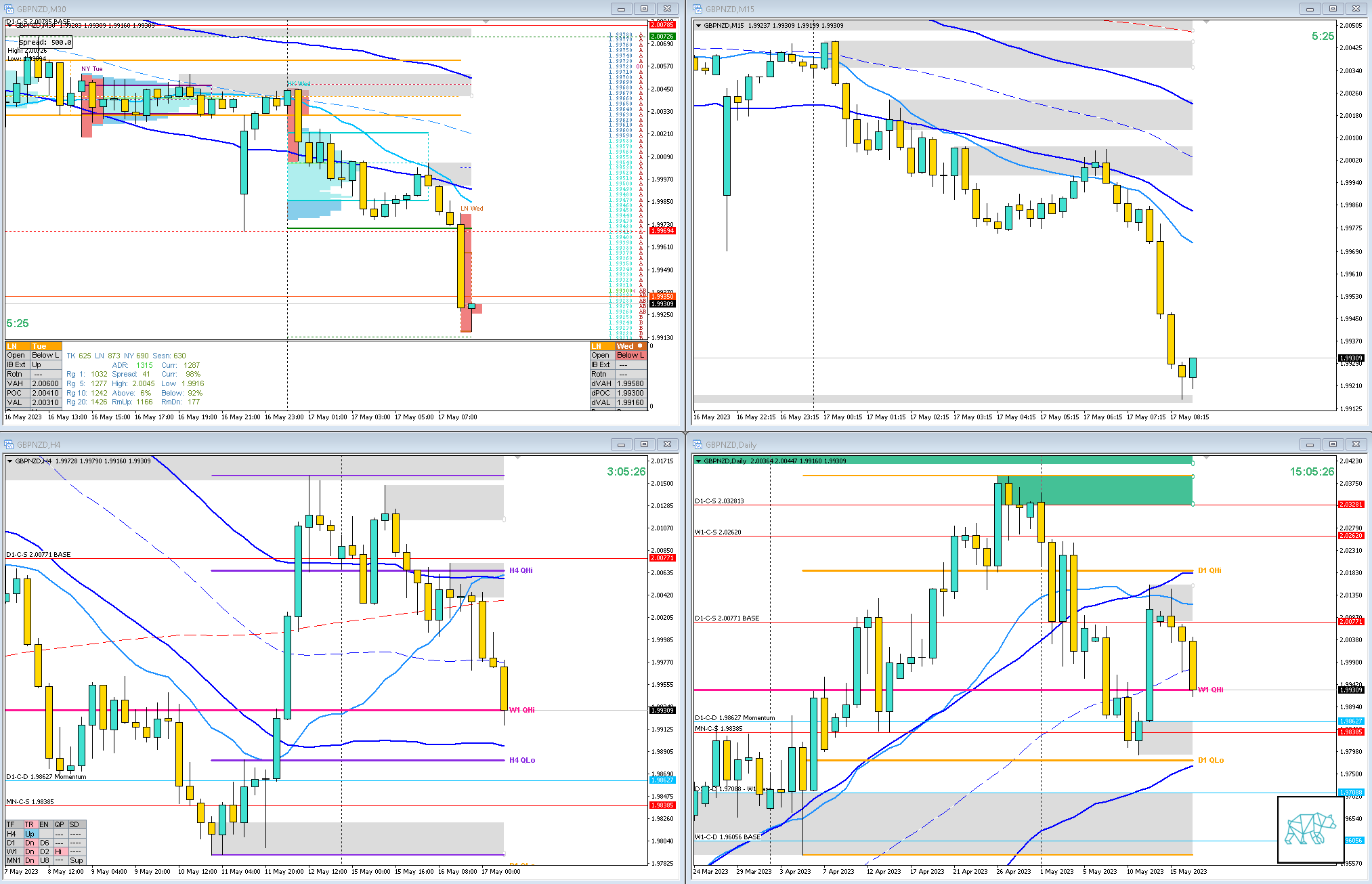

Larger Timeframe

MN price trading:

Within Body — Within Supply — Mid Swing — Wide Q

W1 price trading:

Below Body — Within Range — Within QHi — Wide Q — W1 Hammer, possible Base

Narrative

- D1

- Possible D1 VWAP in UT BD to CAR

- D1 QHi rejected, price trading mid swing

- Price traded lower from D1 Supply Base

- H4

- H4 QHi rejected, price trading mid swing

- H4 VWAP in UT BD

- Trend

- Trend is DOWN 2/3

- Market Profile

- 3 overlapping values

- LN Open

- 0.66 x ASR- Below Value — Outside Range

- Moderate to Large Imbalance

- Asia traded lower

- Frankfurt traded lower

- ADR exhaustion right below IB, possible unidirectional day

- 0.72xASR IBR, possible momentum

Additional Notes

- N.A.

Hypos

- Hypo 1

- Long

- Failed Auction

- Hypo 2

- Short

- Late-Sustained Auction

- Hypo 3

- Short

- Weakness From Within IBR

- Hypo 4

- Long

- Auction Fade

Clarity / Confidence (1 — 5, low to high)

- 1

Mindful Trading (1–5 Bad to Good)

- 1

Focus Points for trading development

- Monthly Goals

- Use SL scaling

T3chAddict

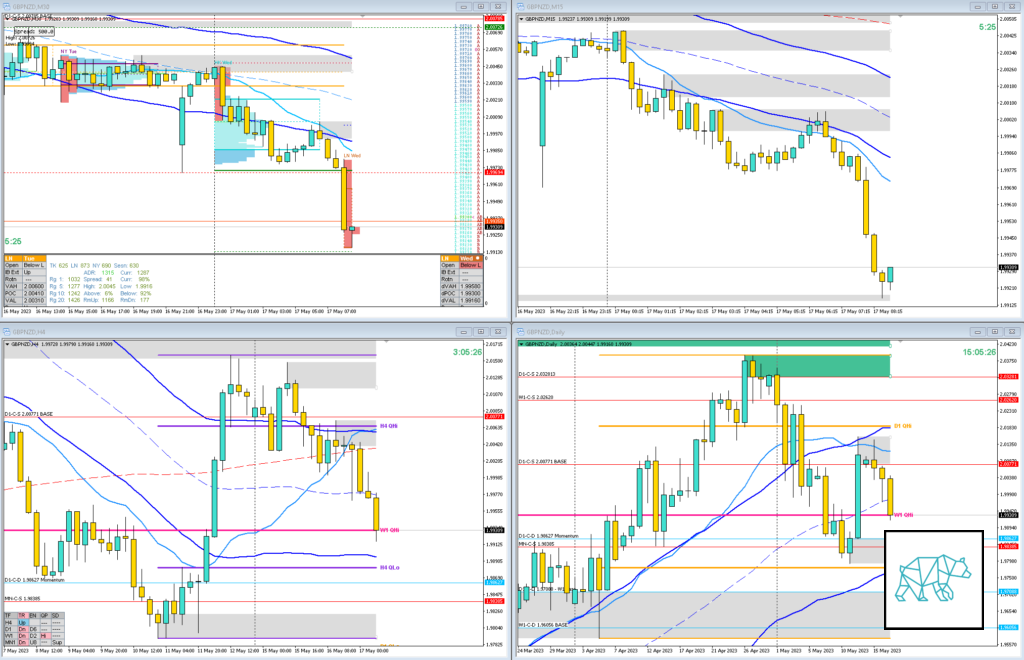

Posted at 09:26h, 17 MayC: formed a DBD but no extension

D: M5 Bear Engulf for early entry short, monitoring for a possible IB extension exhausting ADR. D closed as a possible Base. Not the best sign but sticking with it for awhile longer.

T3chAddict

Posted at 10:43h, 17 MayE: Price reached for 1R then formed a M1 Bull Engulf and I took 0.7R. Price having extended in E TPO as well as ADR gotten exhausted (although in line with a possible unidirectional day due to Asia having traded lower). As well as F TPO having a potential reversal (albeit possibly short term).

E closed as aDBD below IB