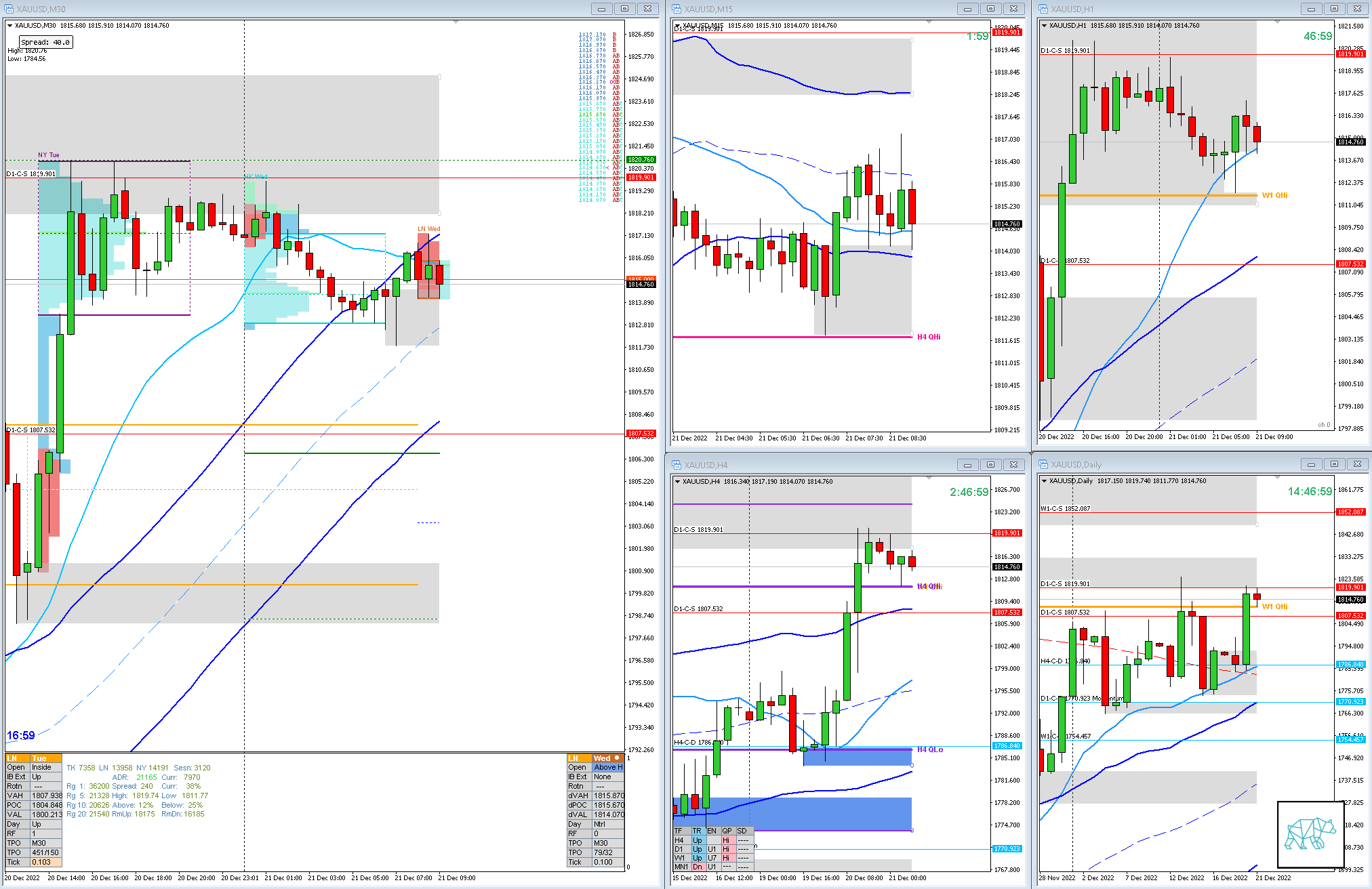

21 Dec 20221221 Premarket Prep Gold

#Fintwit #XAUUSD #GOLD #MarketProfile #Orderflow

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Larger Timeframe

- MN

- Price made a HH, trading above body, outside range, at MN VWAP

- W1

- Price trading above body, within range, within Wide W1 QHi

Narrative

- D1

- Big D1 Bull Engulf closing within Wide W1/D1 QHi, above previous high, below D1-C‑S 1819.901

- H4

- Price faltering within Wide W1/D1/H4 QHi

- Trend

- Trend is UP 3/3

- Market Profile

- Wide value created above the previous

- LN Open

- Prev. Day Exceeded ADR by 1.71

- 0.60xASR Above Value, Outside Range

- Moderate to Large Imbalance

- Asia formed a Neutral Day but mostly traded lower

- 0.23xASR Tight IBR

Additional Notes

- N.A.

Hypos

- Hypo 1

- Short

- Late-Sustained Auction

- Hypo 2

- Long

- Reversal, possible Failed Auction

- Hypo 3

- Short

- Reversal, possible Failed Auction

- Hypo 4

- Long

- Return to Value, Auction Fade

Clarity / Confidence (1 — 5, low to high)

- 2

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Use SL scaling

juan l.

Posted at 20:46h, 21 DecemberNight Night sleepy head !

So my thoughts aligned with your first hypo for the direction of the market. Initially i saw what i thought was a confirmation of my

analysis:

price still over extended

as soon as the london session opens heads lower.

C&D TPO’s continue down and maintain price outside of IB

Previous swing low is broken

Look left, no signs of resistance for a short

Bearish candle pattern on the 5min TF.

Enter short on a pullback

Initially trade goes my way, i see the short momentum is lost, move S/L to B/E. I get stopped out B/E

So obviously there was still some momentum left in the Gas tank. So the question is:

1.What factors should be used to determine if a move still has momentum so as to not jump in early ?

2.What factors should be used to determine that a move has lost all its momentum ?

3. Or am i just not reading the market correctly ?

Thank you Sire for your answers. For la familia, Gracias.

T3chAddict

Posted at 10:08h, 14 MayHey man. I’m back. Installed a new commenting plugin and want to see if you get this message. How have you been?

juan

Posted at 17:41h, 14 Maywhats up homie. still grinding. finished the course, finding my weaknesses. currently in an Apex challenge. up in profit. getting a little better everyday. Need to do my weekly/daily plans. right now doing them in my head ( not the best ). found CL to be my best asset to trade, so for right now i only trade CL NY session 1/2 trades per day.

T3chAddict

Posted at 12:23h, 15 MayI’m slowly getting back into it after nearly 4 months being away.

Doing them in your head is a slippery slope bro. If CL works best for you stick with it. Wish you the best on the challenge.

T3chAddict

Posted at 06:01h, 22 DecemberWhat do you mean price over extended? Break of IB?

1. Single prints, M15/M30 close outside of IB, you keep using the M5 but I would suggest basing your decisions off the M15/M30

2. TPO structure build, M15/M30 close within IB (strong price action)

3. I was in on this short as well. I was more patient than you (as price did not fail the auction and thus was sustained) and let the trade develop a bit longer and ended up taking only a minor 0.7R.

To moving stop to break even I will say this:

https://www.youtube.com/watch?v=svJRF_dEkHY

juan l.

Posted at 12:21h, 22 DecemberHi.

Over extended, meaing price is in Qpoint extremes and zones extremes.

Break of IB or trading outside IBR.

1. Thank you for helping me realize that decisions are not based on 5min TF. Oopsie

Thank you for that video, She pointed out the problem perfectly. My Entry/strategy is wrong.