16 Dec 20221216 Premarket Prep Gold

#Fintwit #XAUUSD #GOLD #MarketProfile #Orderflow

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

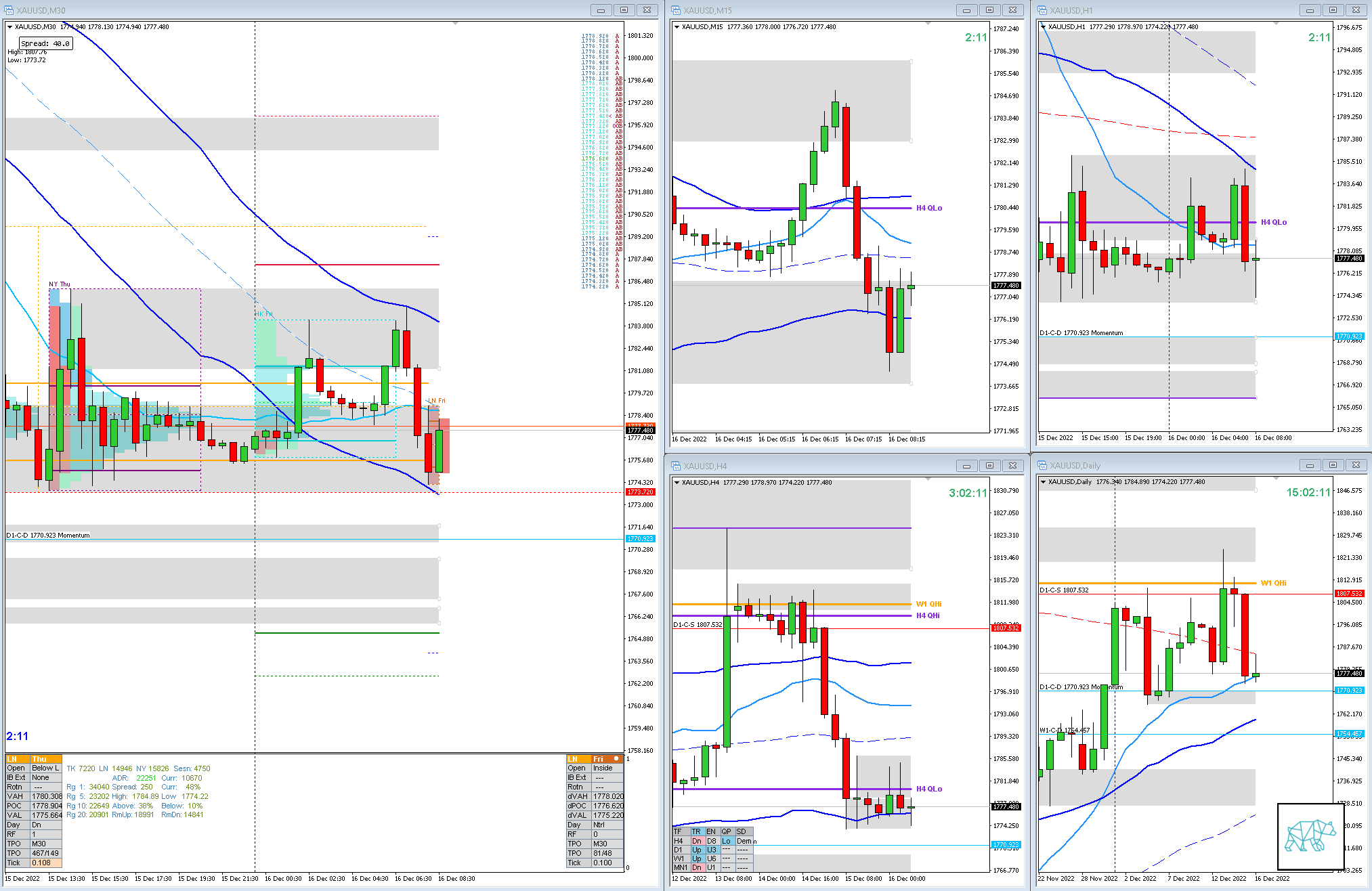

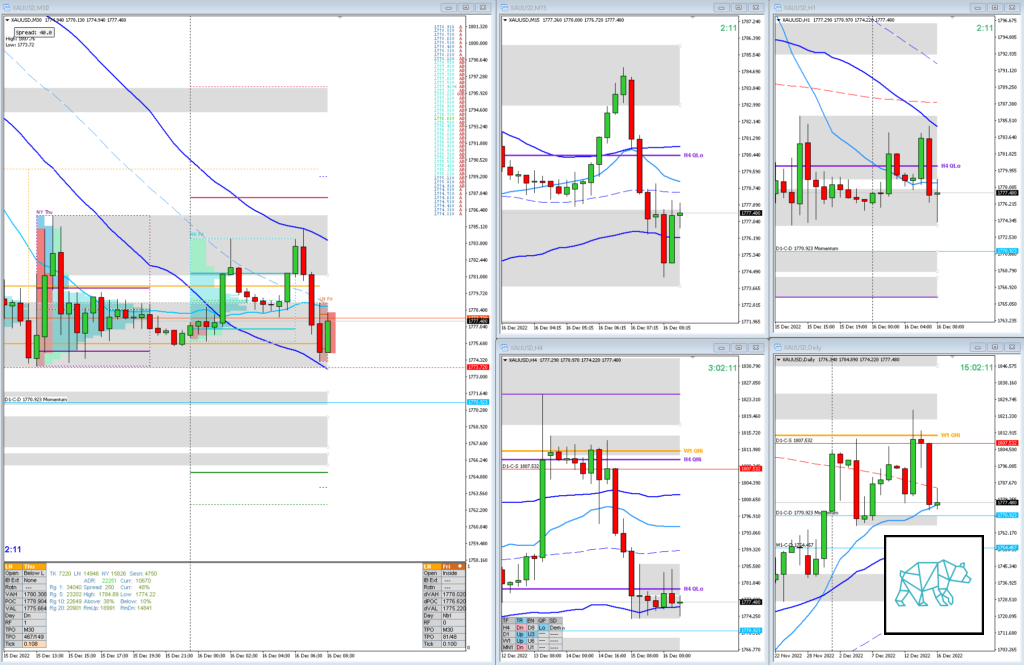

Larger Timeframe

- MN

- Price made a HH but is now trading above body, within range, at MN VWAP

- W1

- Price made a HH but is now trading below body, within range, seeing a reacting off W1 QHi

Narrative

- D1

- Huge D1 Three Inside Down giving D1-C‑S 1807.532 at W1/D1 QHi taking out D1 demand HiDC, currently trading at D1 VWAP in UT coinciding with D1-C‑D 1770.923 HiDC

- H4

- Possible H4 Phase 4, some consolidation at H4 LKC with longer selling wicks, trading within Wide H4 QLo

- Trend

- Trend is UP 2/3

- Market Profile

- Value created below the previous

- LN Open

- Prev. Day Exceeded ADR by 1.53

- Open Within Value

- Asia traded higher

- 0.32xASR IBR

- Possible Friday Profit-Taking

Additional Notes

- N.A.

Hypos

- Hypo 1

- Short

- Failed Auction

- Hypo 2

- Short

- Late-Sustained Auction

- Hypo 3

- Long

- Failed Auction

- Hypo 4

- Long

- Late-Sustained Auction

Clarity / Confidence (1 — 5, low to high)

- 2

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Use SL scaling

juan l.

Posted at 11:03h, 16 DecemberGood evening compadre !

Do you have any children ? I have two 15yr old girl and a 1yr old girl, If the teenager isn’t interrupting me when i’m trading , the baby with the wife will. just another level of difficulty added to the mix. I’m seriously thinking of going to a co-working space. well that’s the end of my rant , now to business.

1. So its Friday and The weekly candle is trading at the bottom of a bearish candle and fridays are take profit days (as you mentioned). That being said, how does that affect your outlook for today?

2. London Session is less active, what do you do to account for that ? Seems like Market stalker methods have less probable outcomes for London, but you’ve been profitable.

3. In addition to the 2nd question, Is alot of your trading range trading ? Is that what you use the VWAP/Moving averages/keltner channels ?

4. A bearish/bullish pattern within the IB with a breakout of the IB and the TPO closing outside along with a second TPO closing outside of the IB, could that be part of a sustained auction setup ?

I must say i am definitely enjoying learning from Dee and i am eternally grateful to you for answering my questions. Trading is a lonely and support one way or another is always needed. I wonder why she doesn’t do a trading room ? Regardless thanks to you both.

Cheers !!

T3chAddict

Posted at 11:37h, 16 DecemberGood morning compadre!

I do not have children no. If it happens it happens but I can see how having one or two in your case can be an “obstacle” in trading. Even with no kids I too am thinking to relocate to a co-working space. Besides trading I also run my business from home. SO it’s a lot of time spent in my office. Having a dedicated place to go too can also elleviate to always “do more”. Burn out is a real thing.

1. So you say price is trading at the bottom of a bearish candle on the weekly but I fail to understand which bearish candle you are referring to. The developing ie. current candle? If so, it hasn’t closed yet as I mentioned before. It is however, trading within the buying range of last week’s candle.

Friday Profit-taking indicates to a possbility for institutional traders to take profits before the weekend as they like to stuff their pockets before going on a bender over the weekend 🙂 And it is them that we try to follow when trading. An easy example would be if Monday through Thursday would have seen an uptrend than it is more likely Friday could see profit-taking and thus a retracement . This short term impact on price is all we need as day traders.

Today it’s somewhat different because price has already seen a big sell off yesterday. exceeding ADR which in and of itself could see a counter move ie. go up in this case. Profit-taking would be in line with that same directional cue. For me, price is also consolidating on H4 at H4 LKC in R coinciding with H4 QLo and could also be reason for an attempt to a lonhg-biased move. Now all of this doesn’t mean anything if your particular setup that you are trying to trade doesn’t fit the narrative. Right now we have E TPO making a HH after C broke IB. Preferably for any sustained auction you would want it early into the session. For LN that is the 1st DTTZ (C/D TPO). However, lately I have observed price making a 2nd DTTZ Sustained Auction under similar circumstances so that is what I am actively forward-testing right now.

2. Yes London is less active for Gold as its main session is the NY one. However, ranges are wide enough to offer enough opportunities to trade. I actually don’t remember if I asked you but do you trade the LN session as well? Would it not make more sense to trade the US session given your location?

MS methods have enough probable outcomes for London. Don’t worry. Sometimes we can even see London trade much wider ranges than NY. So what do I do to account for LN being less active? I try to frame it within the context of the Daily narrative of which the move I expect to happen during NY as that is its main session. So basically often I am looking for LN session to provide with a move to setup the move coming during NY if that makes sense. If you follow the Cat and Mouse method that Dee teaches this too will make more sense. Simply put. Asia goes up, LN goes down, NY goes up or vice versa.

Continued

T3chAddict

Posted at 12:02h, 16 December3. No it is not. I like to align myself with the narrative of the day and trade whatever I see (given I am prepared for it). Having said that it seems redundant to say that as we are all trying to align ourselves with the narrative of the day. I do not have a preference for any particular setup or narrative. Although my stats do show that I am more a contrarian as I like to go against trends ie. mean reversion. Even within these I seem to have a slight favor to the short side as well. Although these preferences don’t have a significant impact on how I view the markets.

I use VWAP/MAs/KCs as a visual aid to reflect what it is that I think might be unfolding. If there is a SD zone that happens to coincide with however I view those indicators it is just that bigger of a confidence ‘booster’ than when it is not. As Dee likes to put it they are supporting factors to what at it’s core is still the MS method. Although I have tweaked certain aspects of the method based on my personal observations. Here is where the discretion comes in. But this is a talk for much much later in your trading journey 🙂

4. Yes that would be a good sustained auction. Although if a second TPO has already closed outside of IB then it also needs to have made a HH/LL plus keeping the open sentiment in mind you could already be too late to join the auction. Certain situations need you to enter on a break of IB. Certain situations need a TPO close outside before you enter ie. late-sustained auction (more preferable on a re-test of IB, but other facors as the length of the TPO closing outside of IB could impact your decision-making on this particular setup). Sometimes you can enter ‘early’ on the bearish/bullish pattern from within IB without break of IB if trade location is right. Then you can monitor the break of IB as part of you OODA loop.

THank you very much. I have to say you are not the first one to ask questions but you sure are asking good questions. So keep up that inquisitive mind.

Trading is indeed very lonely hence my blog. “Luckily” the MS method is not for everyone (a.k.a people that are looking for a quick way to make a buck) and most people are deterred by the amount of information and work you’d have to put in to understand these methods. I set out to be able to trade all market conditions. These strategies help you to do that. So in essence you are “never” lacking for a trade opportunity. No matter ranging/trending.

I think I remember talking to Dee about a trading room and this is what I think I remember. In a trading room there are so many people that have no clue shouting oh buy here sell there which makes for a very convulated space. Apart from that it increases pressure on a trader if others are watching you like a hawk. Added pressure is not what we are looking to have. Although I’ve seen Dee recently put out a live trading video so the next eveolutionary step for her could very well be trading room of some sorts.

Thank you for taking an interest and keep it up. If we don’t speak I wish you a very good weekend. I’m done with my DAX trade and gonna call it a day/week.

Do your work but then also spend time away from the charts. Spend time with the fam. Do something fun 🙂 What do you do for fun?

T3chAddict

Posted at 12:08h, 16 DecemberBy the way I’ll be looking to a better commenting plugin for my website. I think writing half a book here (as I get very long-winded) in the comment section isn’t the most clear and easy to read as I’d like.

juan l.

Posted at 12:36h, 16 DecemberI Made my first trade using MS method. 2:1 R/R !!

juan l.

Posted at 12:37h, 16 DecemberGOLD/USD London session

T3chAddict

Posted at 13:27h, 16 DecemberCongratulations! Now, take me through your thought process. Before trade. During trade. After Exit. It could be as simple or elaborate as you like 🙂

juan l.

Posted at 19:39h, 17 DecemberI used to be a scalper so 15min felt like alot of time to plan my entry/exit here was my thought process:

Daily : drops into 1D demand zone w/ 1D‑C 1784

4H: Consolidation base around 4H Qlo for the past couple days

Asia market drops right before london open

London Open : Outside VAL within range

A&B TPO’s find support on 1D‑C 1784.8 dancing around inside M30 Qlo

C TPO : breaks IB to the upside / candle rejects 1D-D-C1784.8 with large buy wick but still closes inside IB

D TPO : inside IB / candle again rejects 1D-D-C1784 large buy wick closes bullish toward higher end of IB

E TPO : breaks IB to the upside confidently , past C TPO / Candle breaks out of M30 Qlo, nice bullish candle.

I looked left and saw no opposing zones that would impede my trade meeting a decent T/P.

As E TPO was breaking past the C TPO i began calculating stoploss based on ASR/3 an (16.6point S/L)

Take profit would be 33.2 points and that was an acceptable area to do so, It was a recent previous M30 supply and a H4Qlo.

Dropped down to the 5min to look for a good S/L area. decided on below previous bullish candle, below the current VAH.

Due to optimal stop placement ( avoiding the Algos ) I decided on 1788.0 for S/L

When E closed I immediately enter the trade. S/L 1788.0 — T/P 1793.5.

I monitored the trade on the 5min T/F. If a candle closed below the last 5min swing low. i would exit the trade

at a -.6R loss. After the trade closed past the previous 5min swing high, i walked away to avoid grasshopping out of the trade

(a problem had before). Meet my T/P very cleanly.

Please provide any Tips, tricks and especially critiques. I welcome criticism as it only will better my trades. Enjoy your weekend !

T3chAddict

Posted at 06:39h, 18 DecemberIs this Futures or Spot?

juan l.

Posted at 15:26h, 18 DecemberMuppet meter flashing red for me ! 🤣 following Dee on futures and you on spot is mixing me up !

I did the trade on spot, but when you asked me to go back and explain i looked at futures.

but i just looked at the chart. SR lo on spot coincides with 1D-D-C1784 on futures.

there is also a 10$ difference on price

everything else is very similar

T3chAddict

Posted at 10:01h, 19 DecemberThe open sentiment on spot was within value. This inherently changes the dynamic. There was no test of D1 Demand. And I see some congestion even with E TPO closing above IB it still closed within value and did not reject value until F TPO closed above. So I would say this was a bit more of a risky trade. I was forward-testing this particular trade as I mentioned before. I logged it as shown in the picture.

A sustained Auction works out better earlier in the session. Another piece of information that I was testing as the move happened at 2nd DTTZ. I forward-test this as 2nd DTTZ Sustained Auction. Supporting narrative: Prev. Day Exceeded ADR, price trading at D1 VWAP in UT, price consolidating within H4 QLo at H4 LKC in R, trend being up 2/3.

Your trade management seems sound. Good job.