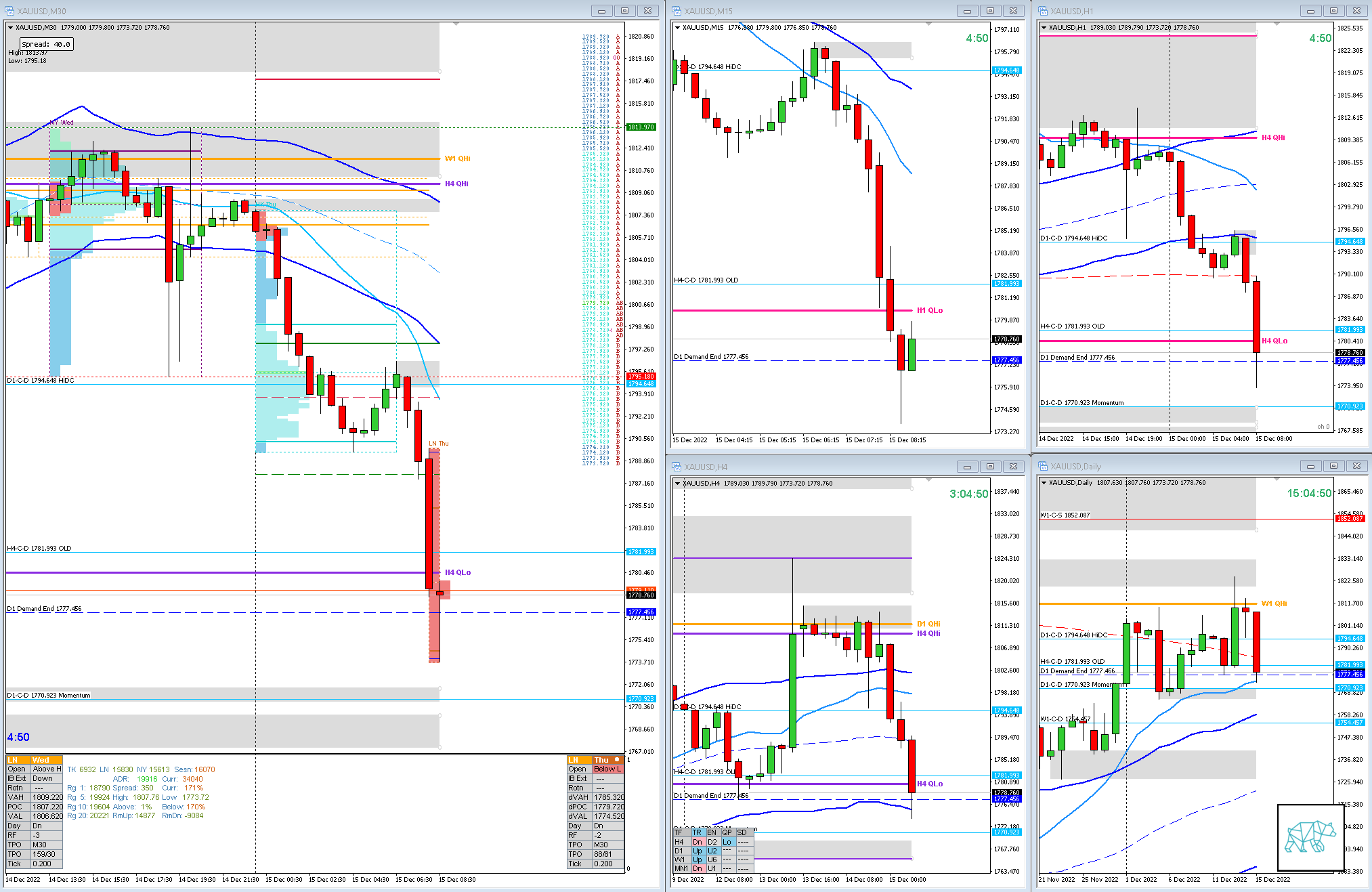

15 Dec 20221215 Premarket Prep Gold

#Fintwit #XAUUSD #GOLD #MarketProfile #Orderflow

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Larger Timeframe

- MN

- Price made a HH and is trading above body, outside range, at MN VWAP

- W1

- Price made a HH testing W1 QHi and is trading below body within range

Narrative

- D1

- D1 Hammer formed below W1/D1 QHi, price currently probing D1 Demand HiDC

- D1 Demand End 1777.456 just above D1 VWAP in UT

- Price trading at D1 200MA

- H4

- H4 consolidation below W1/D1/H4 QHi and break lower closing within D1 demand HiDC, currently testing Wide H4 QLo

- Trend

- Trend is UP 3/3

- Market Profile

- Value created above the previous

- LN Open

- Prev. Day traded 0.94xADR

- 1.12xASR Below Value, Outside Range

- Large to Huge Imbalance

- Asia traded lower

- ADR got exhausted in premarket

- 1.01xASR Wide IBR taking out D1 Demand End

Additional Notes

- Interest Rate Decisions today

Hypos

- Hypo 1

- Long

- Failed Auction

- Hypo 2

- Short

- Weakness From Within IBR (forward-test reversal within IBR)

- Hypo 3

- Short

- Late-Sustained Auction

- Hypo 4

- Long

- Auction Fade

Clarity / Confidence (1 — 5, low to high)

- 2

Mindful Trading (lack of sleep?)

- Feeling okay, but taking it easy

Focus Points for trading development

- Monthly Goals

- Use SL scaling

juan l.

Posted at 12:30h, 15 DecemberGood evening Lad,

So I am finally at the market profile section and things are starting to make alot more sense now.

Based on what i learned ( so far ). This is how i would frame my bias.

1. Weekly : Qhi rejected twice + bearish candle pattern

2.Daily: Q hi rejected previous two days

3. 4Hr ; consolidation with several sell wicks rejecting W/D Qhi and yesterday rejecting H4 Qhi finishing last night with a bearish engulfing.

4. London opens lower outside of Range/ Value ( large imbalance ? , i haven’t used ADR/ASR but im guessing )

5. London session IB breaks down on C period. D period continues down.

6. Normal / Normal variation day , Enter Short Sustained auction at end of D period , Stop loss D period candle open

7. Take profit target: H4 Qlo area ( looking left no opposing demand.)

8. possible TP outcomes:

A. 3:1 R/R

B. TPO prints 4 letters in a row

C. TPO closes back into IB shortly after meaning idea is invalidated and trade is closed ( possible failed auction play ? )

D. time based exit ( London lunch time) if price just wanders.

everything in hindsight is easy, but i want my thought process to align with the method.

Is this thought process acceptable ? let me know. Thanks !

T3chAddict

Posted at 13:32h, 15 December1. Technically W1 QHi has not been rejected athough it seems to be reactive. The move in August came close though. But this is in hindsight as at that time this move actually technically rejected W1 QLo. WHich you can’t see right now unless you use the backtest option by pressing “B” on your keyboard. Then press and hold “control” to go back to the time. Furthermore there is no CONFIRMED bearish candle pattern as last week could be a base and this week has not yet closed no matter how bearish the development might be at the moment. So stay sharp on that.

2. Same as point one as today has not yet closed. Previous move did not touch it. Currently we have a developing candle that seems to be reacting and that took out D1 demand HiDC which is not a good bullish sign of course. But still. Price has not closed yet.

3. Correct

4. Correct

5. I don’t know what chart you are looking at but today IB did not get broken. We are now in the I TPO and still no break of IB. If you mean that IB traversed down then yes that’s correct.

6. Since number 5 is incorrect I have no comment to this one.

7. I think you are making the mistake to trade the IB which is a BIG NO NO. The first hour of trading ie. A and B TPO are the initial balance a.ka. the first hour of trading a.k.a stay the F out. You should not be trading within the first hour. I repeat. No trades within the first hour. Let me say that once again. NO TRADES in the first hour 🙂

What we have right now is a wide Initial Balance Range (IBR aka IB) and price has not even attempted to break IBR at the moment I write this. The implications of a Wide IBR is that any sustained auction is less likely hence a Failed Auction is more probable. Usually a Failed Auction has a target to the opposing side of IB but due to this being a Wide IBR this is not feasible (if in case this actually occurred, which today it did not). On days like this it is best to stay out unless you have break of IB to guide your decisions. Sometimes you can find a LTF SD zone of which you can trade off. I’d say this is more advanced so stick to learning the basics first.

I do have a setup that allows for trading during the IB in certain cases but again this is an advanced play that requires experience. You should first learn the systematic approach before you go wandering off the reservation 🙂

juan l.

Posted at 16:11h, 15 DecemberXAU/USD on MT5 Metaquotes Demo has the timing wrong. That why I had trouble looking at the MP !!!

same insturment on different platforms is causing issues for me. What platform do you trade gold on ?

T3chAddict

Posted at 16:26h, 15 DecemberIt could be that your indicator does not start at the right time and that’s why you are seeing it wrong. Check your indicator to see if it is set correctly. Otherwise you might have to use the offset button. Try changing it to 3600 to account for 1 hour time difference.

juan l.

Posted at 17:06h, 15 DecemberThank you. much better