14 Dec 20221214 Premarket Prep Gold

#Fintwit #XAUUSD #GOLD #MarketProfile #Orderflow

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

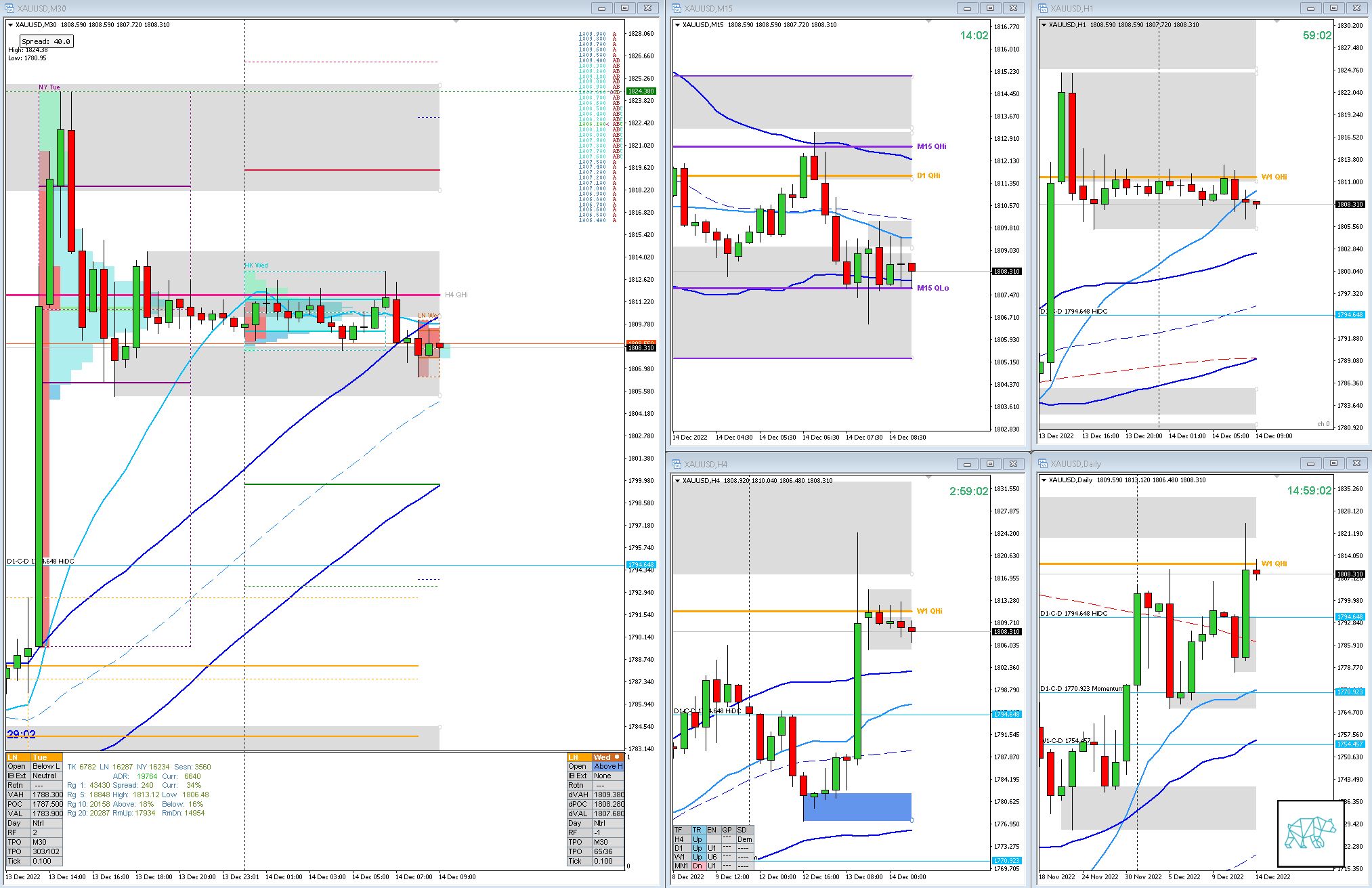

Larger Timeframe

- MN

- Price made a HH, trading at MN VWAP

- W1

- Price made a HH testing Wide W1 QHi

Narrative

- D1

- Big D1 Bull Engulf giving D1-C‑D 1794.648 HiDC at D1 200MA failing to close within Wide W1/D1 QHi leaving a selling wick

- H4

- Big H4 RBR closing slightly above previous swing high although closing with a selling wick

- Price slowing down below W1/D1 QHi

- Trend

- Trend is UP 3/3

- Market Profile

- Value created below the previous

- LN Open

- Prev. Day Exceeded ADR by 2.20

- 1.27xASR Above Value, Outside Range

- Large to Huge Imbalance

- Asia formed a Neutral Day trading sideways

- 0.22xASR Tight IBR

Additional Notes

- Interest rate decisions tomorrow

Hypos

- Hypo 1

- Short

- Late-Sustained Auction

- Hypo 2

- Long

- Auction Fade

- Hypo 3

- Long

- Failed Auction, possible continuation

- Hypo 4

- Short

- Reversal, Possible Failed Auction

Clarity / Confidence (1 — 5, low to high)

- 1

Mindful Trading (lack of sleep?)

- Feeling okay but will take it easy

Focus Points for trading development

- Monthly Goals

- Use SL scaling

juan l.

Posted at 12:08h, 14 DecemberGood evening Lad,

New dynamic this week triggered by big events. In light of that

1. How is your analysis affected when price movements are triggered by big events ?

2. Is that bullish engulfing with a large selling wick indicative of a possible short term pullback ?

The consolidation below Q points on different time frames leads me to believe so as long as the price action confirms it. What are your thoughts ?

3. You said you use Keltner channels and i think i see them on your chart, how come you rarely mention them in your analysis ?

4. Is it worth trading on Days with big impact news ?

Thank you for your answers in advance, Cheers mate.

T3chAddict

Posted at 12:55h, 14 DecemberGood morning(?!)

1. It is not directly, because I stay out when they come out. Everything else I am of the opinion I can see it factored within the price. If not. I stay out. This doesn’t mean I do not believe in fundamentals in anyway. I do. However, we all trade our believes in the end and I am more inclined to look at price patterns (unless there is a black swan event). When they are aligned with the market we trade. If not, we stay out. No matter however you came to your assumption. This assumption of course needs to be a valid strategy thus have edge. Luckily you are in the process of learning such strategies 🙂

2. Not just that. Also the fact that the whole candle traversed 2.20xADR. Whenever price exceeds ADR there is usually a rubberband retracement before continuing (if any). Another factor were price not closing wtihin W1/D1 QHi.

3. I use Keltner channels as a supporting factor if they happen to coincide with other levels that I am observing.

4. It depends. Usually around days where there is an interest rate decision price can be “wonky” in expectation of it. When for example NFP comes around every 1st Friday of the month there can also be a difference in behaviour even the day before. For example, I am less likely to go with a sustained auction as I have found that on multiple occasions price just dies down after a break of IB. So on those days if I do go with a SA I might wait for a Late-SA or watch price like a hawk. The moment price starts faltering I am out.

Just keep em coming. Surprised your brain hasn’t melted yet so that’s a good sign 🙂

juan l.

Posted at 17:25h, 14 DecemberMy trading journey is do or die ( hence Do or die Marketstalker ) . I feel to that to make it in this type of career you need an extreme high level of persistence, grit and curiosity.I have made life-changing decisions the past year and i have given myself no other option but to learn how to trade consistently and profitably.

T3chAddict

Posted at 05:39h, 15 DecemberGreat to hear of your commitment. I have something similar on my desk staring at me to remind myself: