13 Dec 20221213 Premarket Prep Gold

#Fintwit #XAUUSD #GOLD #MarketProfile #Orderflow

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

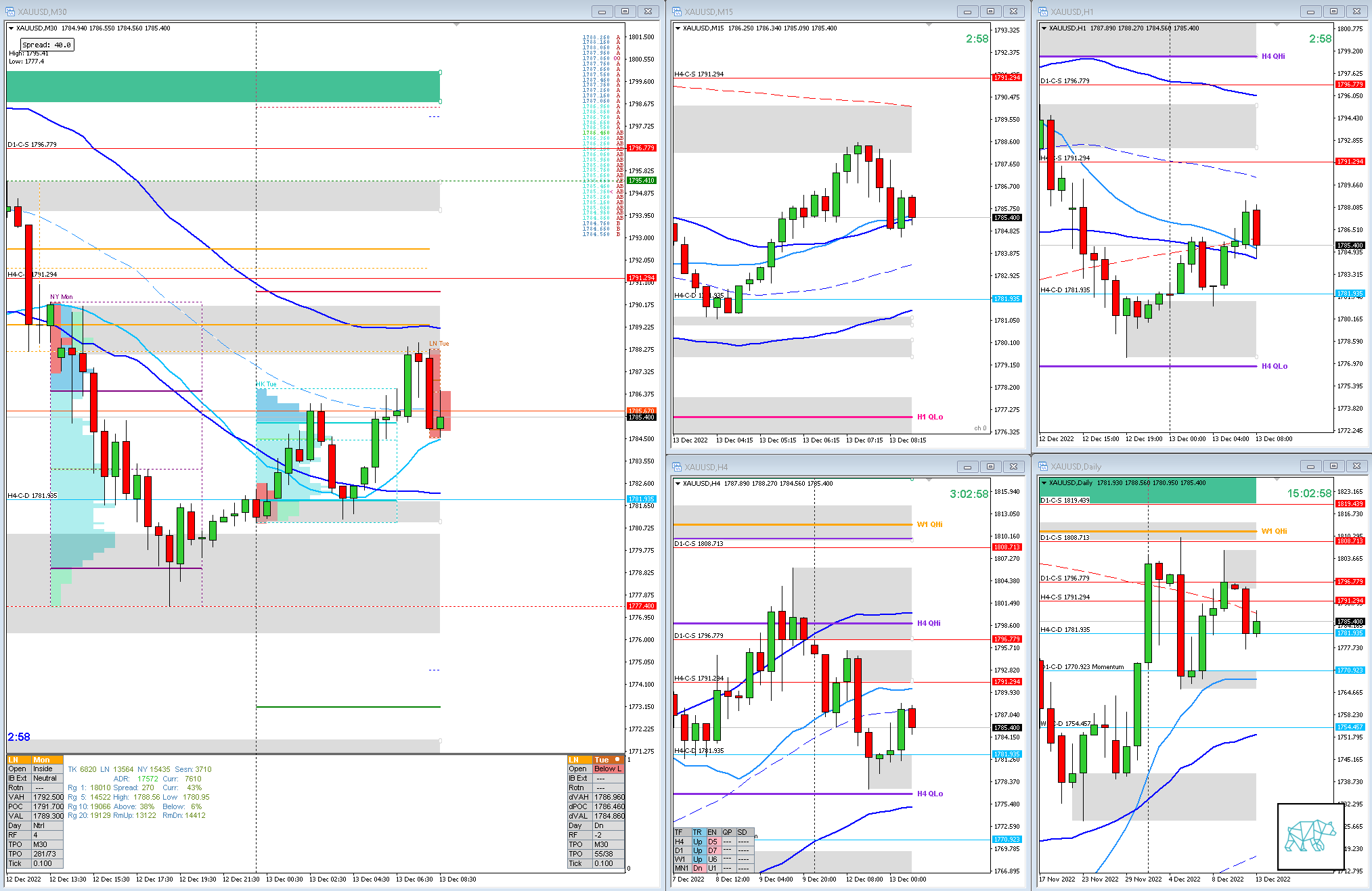

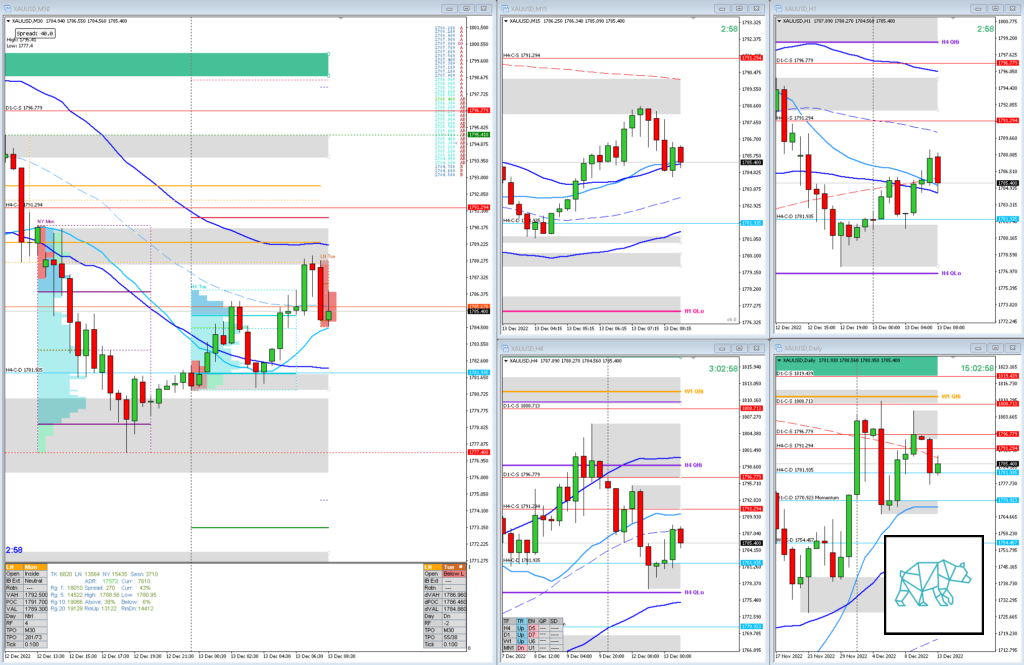

Larger Timeframe

- MN

- Price trading above body, back within range after having made a HH

- W1

- Price trading below body, within range, below W1 QHi, at W1 50MA in R

Narrative

- D1

- Price traded lower forming a D1 Three Inside Down (base formed over the weekend)

- Price trading at D1 200MA, above D1 VWAP in UT

- H4

- Price continued lower giving H4-C‑S 1791.294 (within value, at PPOC)

- Premarket formed some demand above H4 QLo (no touch) giving H4-C‑D 1781.935

- Trend

- Trend is UP 3/3

- Market Profile

- 2 overlapping values

- LN Open

- Prev. Day Exceeded ADR by 1.02

- 0.10xASR below Value, Outside Range

- Moderate to Large Imbalance

- Asia traded higher

- 0.28xASR IBR

Additional Notes

- Thursday, Dec 15, Interest Rate Decisions

Hypos

- Hypo 1

- Short

- Return to Value, Reversal, Possible Failed Auction

- Hypo 2

- Short

- Late-Sustained Auction

- Hypo 3

- Long

- Failed Auction

- Hypo 4

- Long

- Auction Fade

Clarity / Confidence (1 — 5, low to high)

- 1

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Use SL scaling

juan l.

Posted at 10:43h, 13 DecemberGood evening !! did you put your pajamas on yet and drink your hot milk ?

1. Larger/ Med TF were are in the middle of Qpoints, Would you rely on Market profile and TPO’s alone to trade today ? or is there something else you would incorporate.

2. How does CPI today affect how you trading ? I feel that usually the trading range narrows for equities, how does it affect Gold ?

3. apart from the trading plan and journal. Do you have a checklist you look at immediately before entering a trade ? or is it more discretionary ?

I feeling like having sautéed brains today please

T3chAddict

Posted at 13:52h, 13 DecemberHa not quite yet. Couldn’t find a good trade so decided to stay out today. Went to cook dinner to surprise my gf instead.

1. Price action trumps everything. Today on Gold I was ready for a move higher due to a possible move higher on H4, combined with a retracement of D1 move down due to Prev. Day having exceeded ADR as well as Trend still being up 3/3. There was a M15 Bull Engulf that closed right at IB low, combined with a possible base on M30 so decided to stay out even though eventually price did move higher Failing the Auction. It did so by first making a LL. Not the clearest play. But yeah normally when price is in the middle I take extra care but heavily rely on price action and market profile reading (which I actually always do). But this all has to fit the trading setups we have. If it doesn’t fit I back off. Not always. Sometimes I have experienced a certain scenario before and trade off of that ie. discretionary.

2. CPI affects swing traders more than it does for us. I have not noticed specifically that ranges get tighter because of CPI. There are also interest rate decisions coming up so. As long as it is wide enough for our strategies ie. preferably more than 60 pip ASR or even better 80 pips we are still good to go. When ranges get tighter I find that M15/M30 combos don’t work as well so I rely more on M15/H1. But that is if you really “need” to find a trade. Luckily Gold keeps good ranges throughout the year.

3. So the MS method is a systematic trading strategy. I believe we all use discretion to a certain extent. There are certain scenarios that I know of that the MS method cannot account for. But this comes with experience. Having said that before I enter a trade I act on my trading plan. I know what Price Action / Market profile combinations I wish to see. Which I do not include in my plans because you’d lose rigidy as well as put too much work in. I know, as you will after completing the courses, what confirmation I am looking for to act on any hypo. Then I execute. Then I monitor through OODA loops (which you will learn as well) if the trade is working out. However, more often than not I am correct on the directional bias of the session and monitoring too much can actually hurt my bottomline. So I try to give the trade time to do what it is supposed to do and am okay if I get stopped out. Yesterday I was in a trade that almost got stopped out and I just let it. Went away. Saw to my surprise that it was nearing my TP and I took it. You do not know which kind of trader you are until after you gain some experience with the strategies. For me it is more time-based. If it doesn’t work out in about an hour, hour and half I am looking for reasons to either stay with the trade or exit.

Please make sure your brains are still good to go through the courses 🙂