06 Dec 20221206 Premarket Prep Gold

#Fintwit #XAUUSD #GOLD #MarketProfile #Orderflow

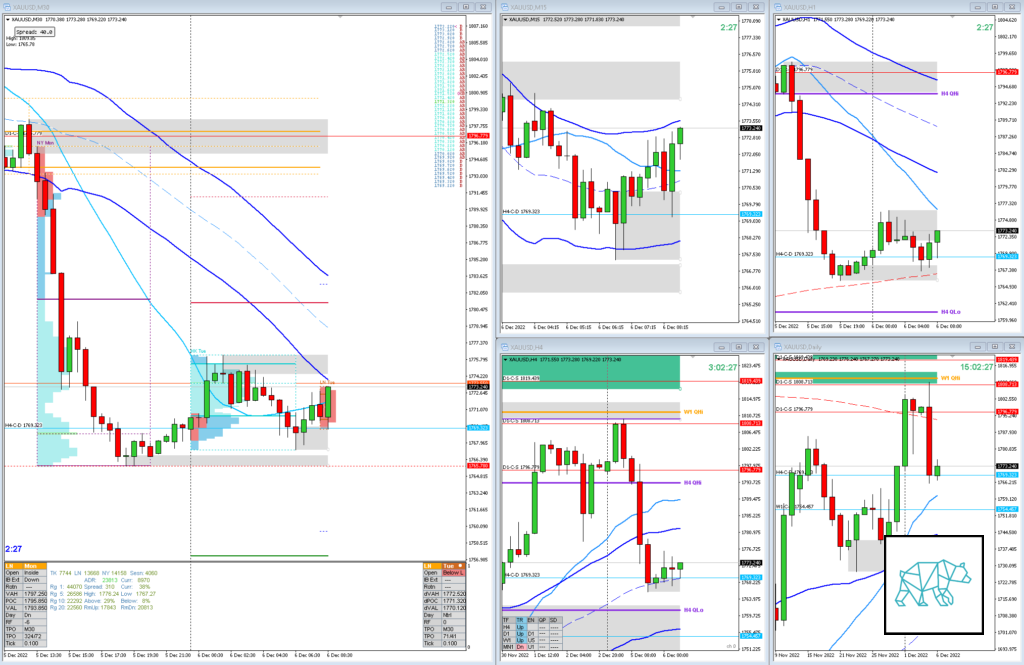

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Larger Timeframe

- MN

- Price made a HH trading at MN VWAP and is currently trading within Body

- W1

- W1 retraced to previous week’s 50% mark after having made a HH with near-touch of W1 QHi (coinciding with W1 50MA in R)

Narrative

- D1

- D1 consolidation with break down at D1-C‑S 1808.713, W1/D1 QHi giving D1-C‑S 1796.779 (near Round No.)

- Price trading near D1 VWAP in UT

- H4

- H4 QHi rejected, price trading mid swing although not far above H4 QLo

- Some demand created at H4 50MA in UT giving H4-C‑D 1769.323

- Trend

- Trend is UP 3/3

- Market Profile

- Value created slightly below the previous

- LN Open

- Prev. Day Exceeded ADR by 1.85

- 1.63xASR Below Value, Outside Range

- Huge Imbalance

- Asia formed a Neutral Day

- 0.26xASR Tight IBR

Additional Notes

- N.A.

Hypos

- Hypo 1

- Short

- Late-Sustained Auction, possible Failed Auction with continuation

- Hypo 2

- Long

- Late-Sustained Auction

- Hypo 3

- Long

- Auction Fade

- Hypo 4

- Short

- Auction Fade

Clarity / Confidence (1 — 5, low to high)

- 2

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Use SL scaling

juan l.

Posted at 14:00h, 06 Decemberwhat has more weight the Q hi’s and weekly demand zone above the price ? or the different time frame supply zones below ?

T3chAddict

Posted at 14:46h, 06 DecemberHa that is not co clear-cut. I think you mean supply zones above and demand zones below 🙂

When you ask what has more weight it depends on how often those supplies/demands have been tested. When an area gets tested too many times it is more indicative of that area being weak. Same with QHis and QLo. Although there you should also take note of how wide the Swing High/Low is. If the swing high/low is wide there is a higher probability for a continuation then a reversal. I hope that is somewhat clear although as you have started the course newly I think it will make more sense when you get through those lectures more.