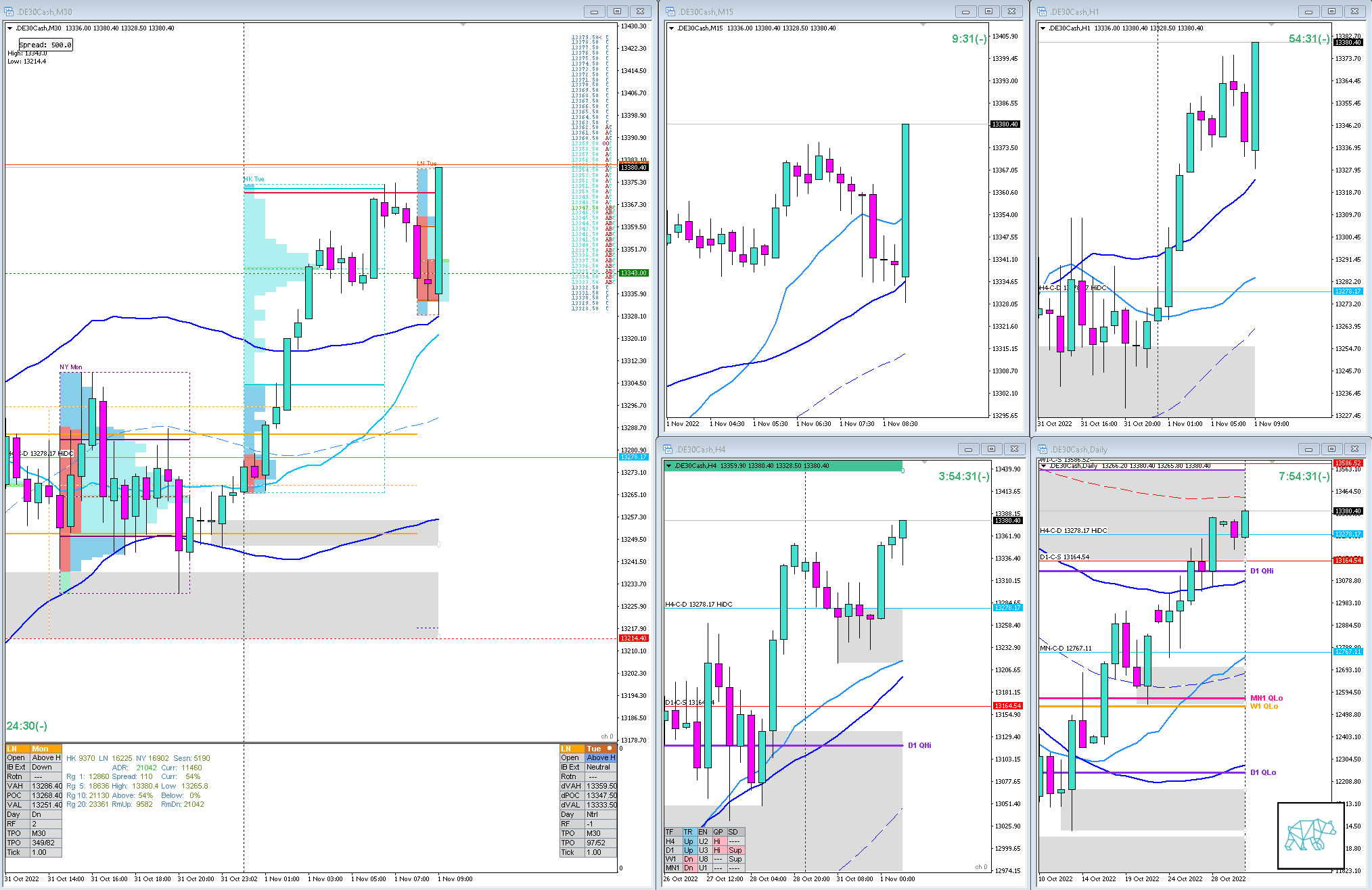

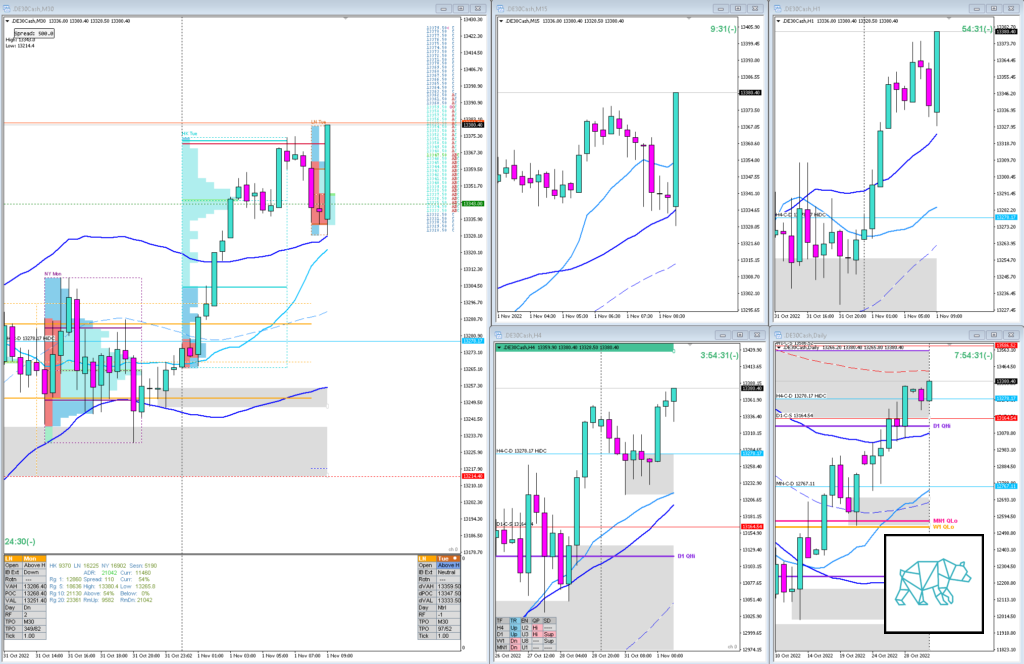

01 Nov 20221101 Premarket Prep DAX

#Fintwit #DAX #DE30Cash #MarketProfile #Orderflow

This is my premarket prep for today’s European session for DAX. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Larger Timeframe

- MN

- Price made a LL but then closed higher as a MN Bull Engulf giving MN-C‑D 12767.11 rejecting MN QLo closing within MN Supply base

- W1

- MN/W1 QLo rejected and price closed higher at W1 200MA within W1 Supply LiDC

Narrative

- D1

- Price closed within D1-C‑S 13164.54 and is nearing D1 200MA

- Price trading above D1 UKC

- H4

- H4-C‑D 13278.17 HiDC (within value below VAH) created above H4 VWAP in UT

- Trend

- Trend is Up 2/3

- Market Profile

- Value created above the previous range

- LN Open

- NY wider than LN

- 0.61xASR Above Value, Outside Range

- Moderate to Large Imbalance

- Asia traded higher

- 0.18xASR Tight IBR

- C TPO extended below but then shot up and already formed a Neutral Day

Additional Notes

- N.A.

Hypos

- Hypo 1

- Long

- Failed Auction, possibility for continuation due to Tight IBR

- Hypo 2

- Short

- Reversal

- Hypo 3

- Short

- Auction Fade

Clarity / Confidence (1 — 5, low to high)

- 1

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Use SL scaling

No Comments