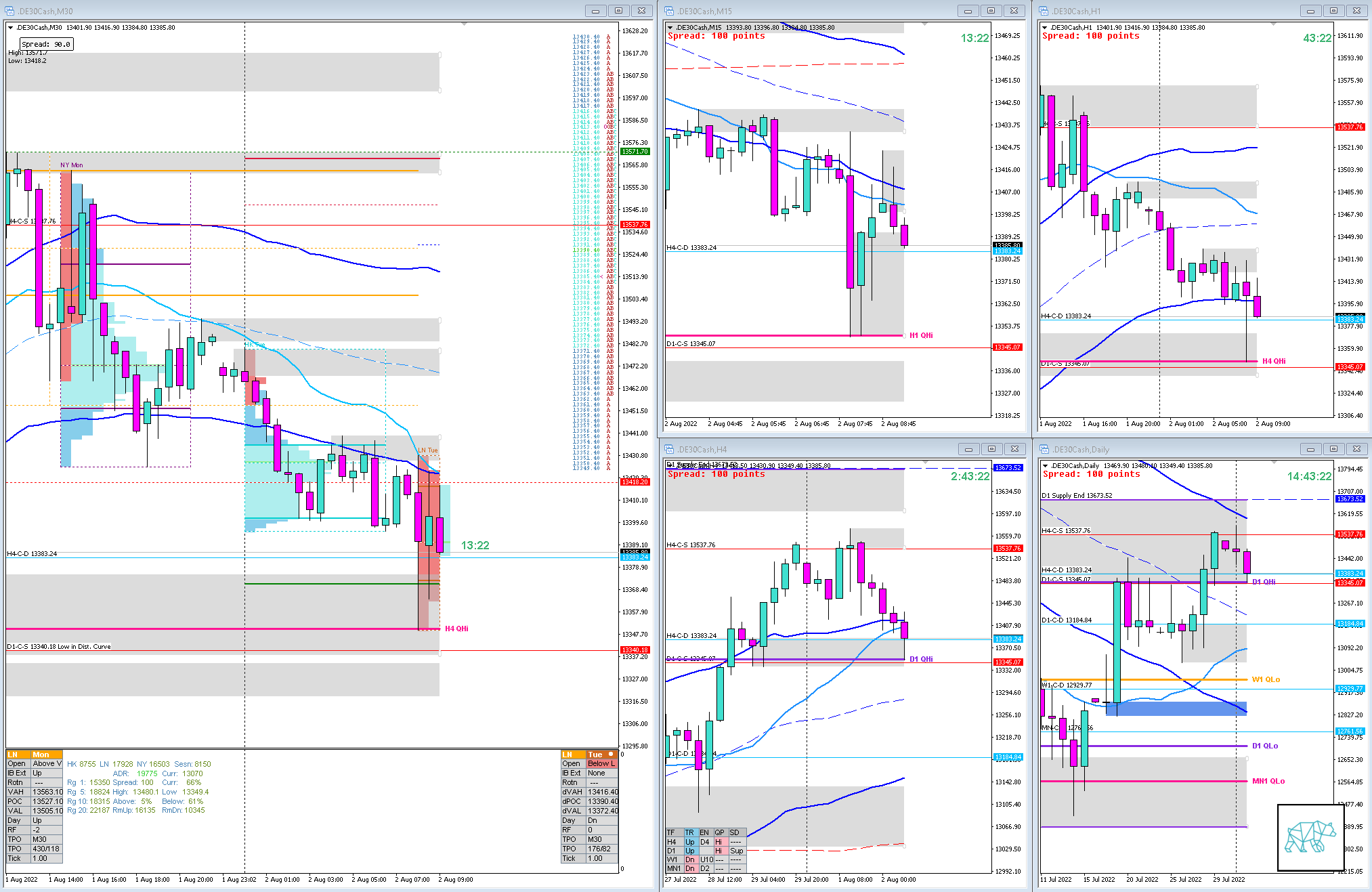

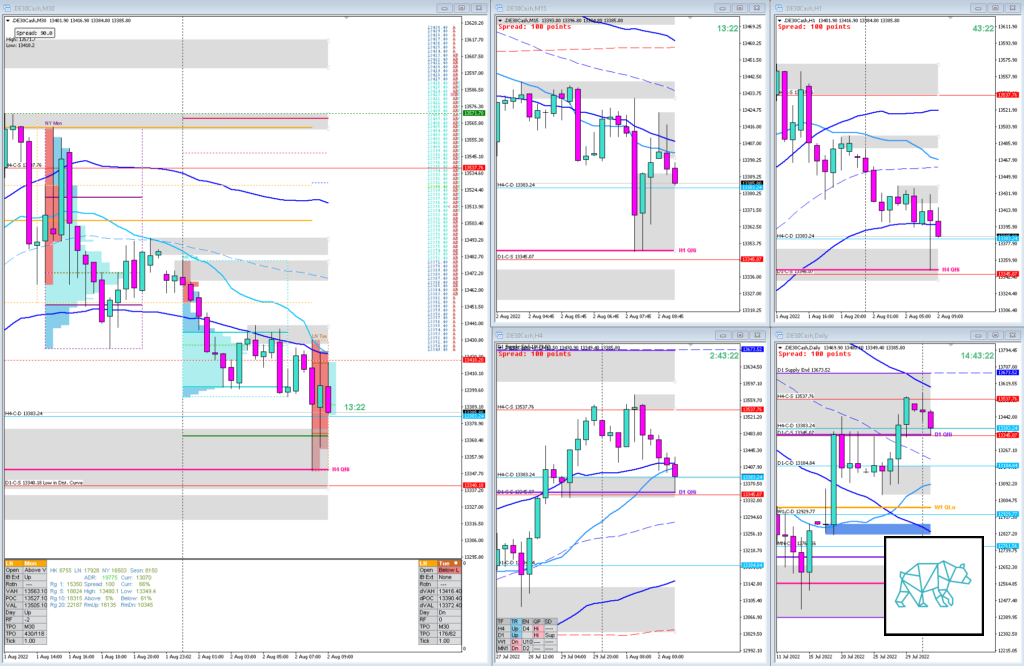

02 Aug 20220802 Premarket Prep DAX

#Fintwit #DAX #DE30Cash #MarketProfile #Orderflow

This is my premarket prep for today’s European session for DAX. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Larger Timeframe

- MN

- MN Inside Bar failing to close above 50% mark although still big reacting off mN demand, MN QHi

- W1

- W1 Consolidation and break higher rejecting W1 QLo

- Price trading within body after having made a HH

Narrative

- D1

- Price trading within D1-C‑S 13345.07, coinciding with D1 UKC in DT

- Possible developing DBD

- H4

- H4-C‑S 13537.76 within Value

- H4-C‑D 13383.24 at H4 VWAP in UT, Inside H4 QHi

- Price trading within Wide H4 QHi (sharing levels with D1 QHi)

- Trend

- Trend is Up 2/3

- Market Profile

- Value in UT

- LN Open

- 0.62xASR Below Value, Outside Range,

- Moderate to Large Imbalance

- Asia extended and traded lower

- 0.57xASR IBR

Additional Notes

- Friday, Aug 05, USD, Nonfarm Payrolls Private (Jul)

Hypos

- Hypo 1

- Short

- Return to Value, Reversal, Possible Failed Auction

- Hypo 2

- Long

- Late-Sustained Auction

- Hypo 3

- Short

- Late-Sustained Auction

- Hypo 4

- Long

- Auction Fade

Clarity / Confidence (1 — 5, low to high)

- 2

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Use SL scaling

No Comments