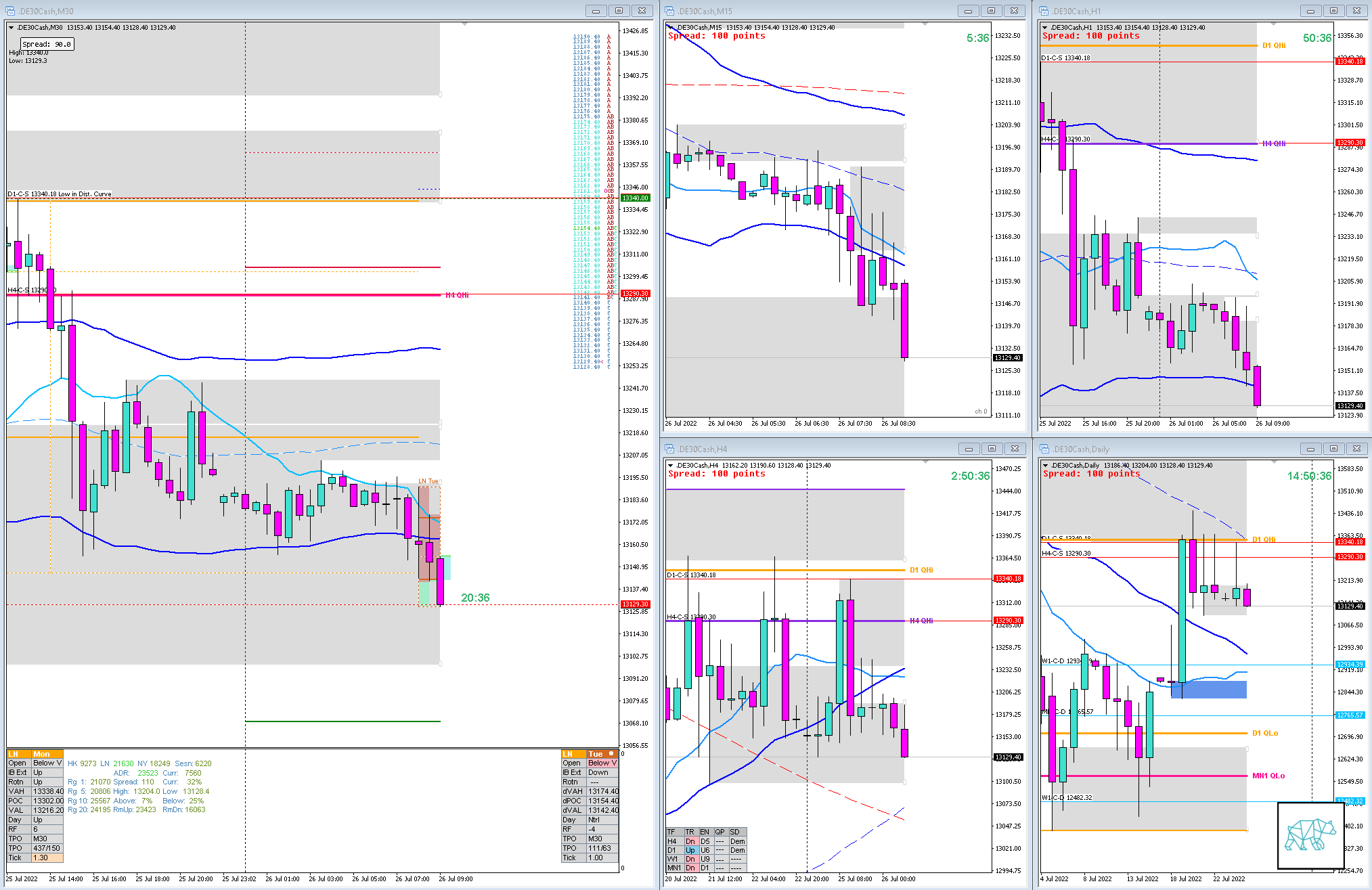

26 Jul 20220726 Premarket Prep DAX

#Fintwit #DAX #DE30Cash #MarketProfile #Orderflow

This is my premarket prep for today’s European session for DAX. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Larger Timeframe

- MN

- Price made a LL and is trading back within Body, above MN demand, QLo

- W1

- W1 Consolidation and break higher, price trading within body

Narrative

- D1

- Consolidation continued through D1 Inverted Hammer with selling wick reacting off D1 Supply, QHi

- H4

- H4 Phase 1 / 3

- Another rejection of H4 QHi

- Trend

- Trend change: Mixed Trend

- Market Profile

- 4‑day overlapping bracketing range

- LN Open

- 0.25xASR Below Value, Within Range

- Moderate Imbalance

- 0.23xASR Tight IBR

- Asia traded sideways forming a Neutral Day

Additional Notes

- Thursday, Jul 28, USD, Fed Interest Rate Decision

Hypos

- Hypo 1

- Short

- Sustained Auction, preferred late-sustained auction

- Hypo 2

- Long

- Failed Auction, might see follow-through to opposing side, monitor for VAA

- Hypo 3

- Long

- Auction Fade

Clarity / Confidence (1 — 5, low to high)

- 2

Mindful Trading (lack of sleep?)

- Extra caution

Focus Points for trading development

- Monthly Goals

- Use SL scaling

No Comments