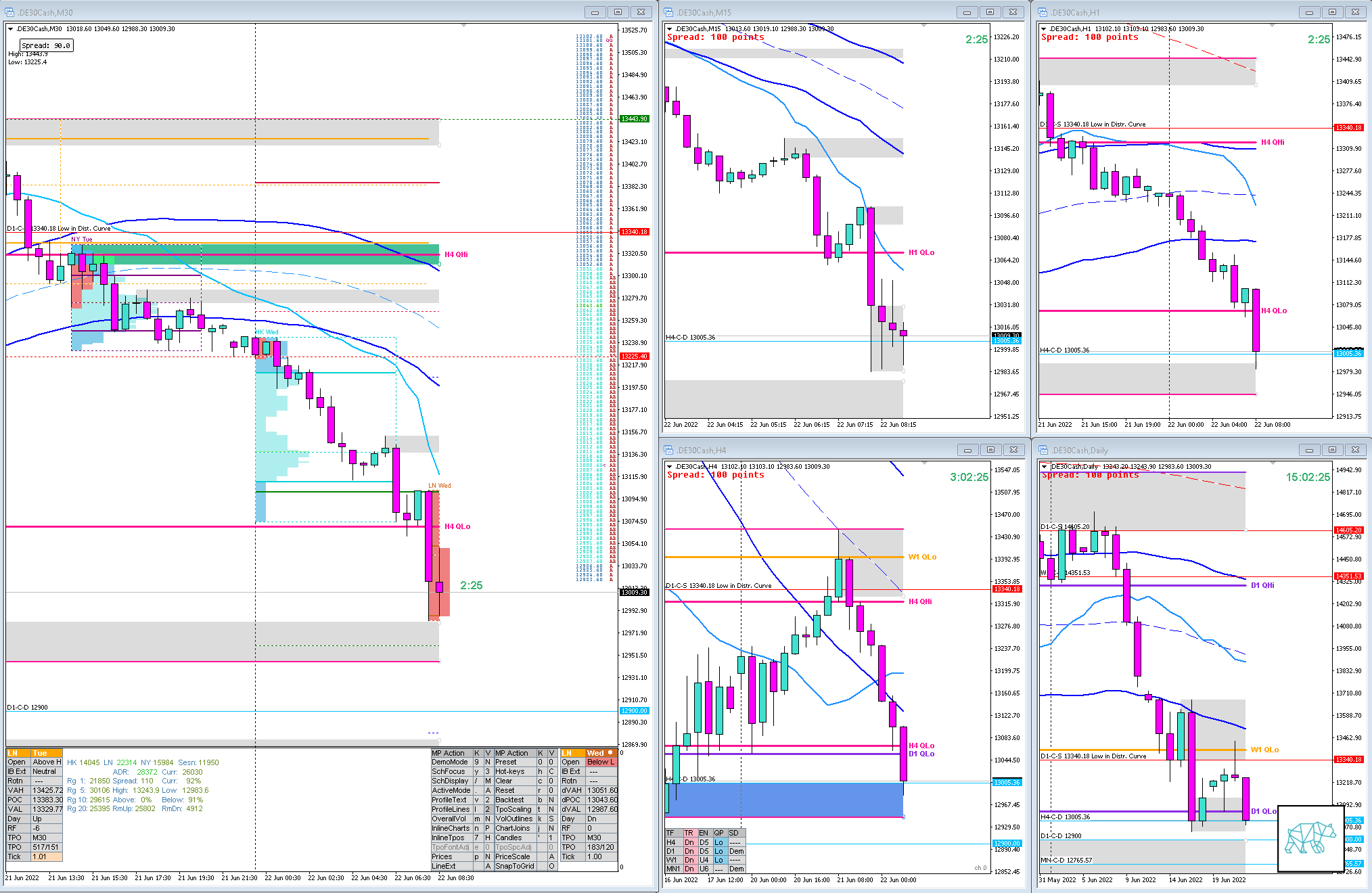

22 Jun 20220622 Premarket Prep DAX

#Fintwit #DAX #DE30Cash #MarketProfile #Orderflow

This is my premarket prep for today’s European session for DAX. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Larger Timeframe

- MN

- Price made a LL and is trading below body and range

- W1

- W1 Closed within W1 QLo, pulled back to test W1 QLo from the inside and is currently trading below body

- Price trading within W1 demand

Narrative

- D1

- D1 Inside Bar at D1 QLo with not much continuation, instead some consolidation

- Price is currently testing D1 QLo again

- H4

- H4 Bear Engulf at D1 Supply Low in Dist. Curve, coinciding with H4 50MA in DT, followed by a Phase 4 currently testing OLD H4 demand / H4 QLo

- Trend

- Strong DT 3/3

- Market Profile

- Value created above the previous 3‑day range

- LN Open

- 1.02xASR Below Value, Outside Range

- Large Imbalance

- Asia opened and directly extended and traded lower

- ADR Exhaustion not far below LN open, possible Unidirectional Day

- LN wider than NY

- 0.54xASR IBR

- Price trading at round number 13000

Additional Notes

- N.A.

Hypos

- Hypo 1

- Long

- Sustained Auction

- Hypo 2

- Short

- Late-Sustained Auction, risky trading into D1 QLo

- Hypo 3

- Long

- Failed Auction

- Hypo 4

- Short

- Auction Fade

Clarity

- 3

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Either hit SL or target, reassess after Trading Window Close

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- Risk Management

- 2 consecutive days of lack of sleep = NO TRADING

T3chAddict

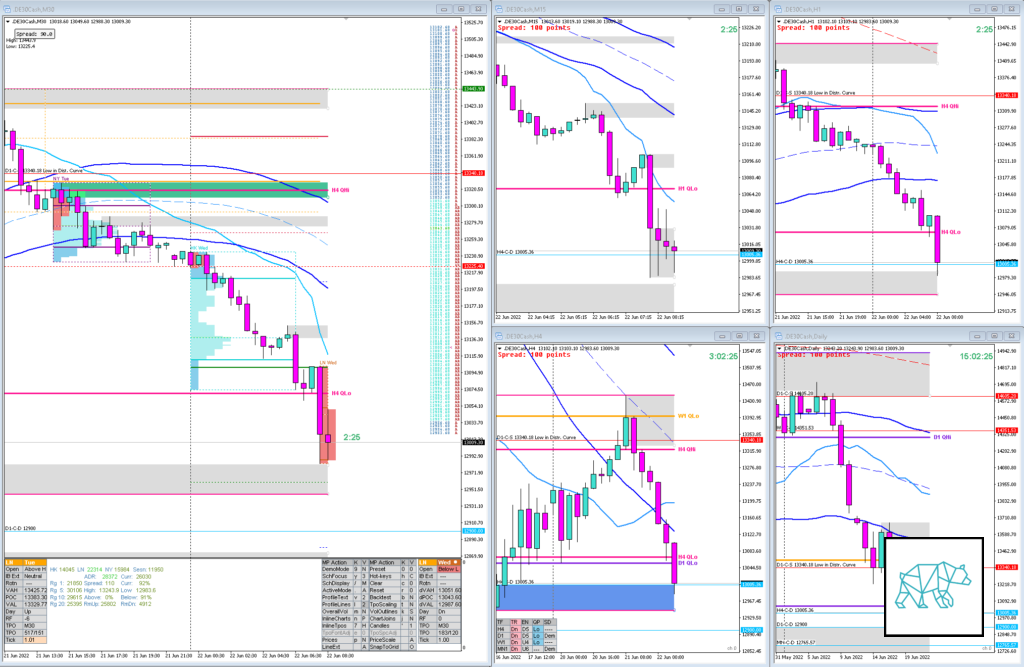

Posted at 10:07h, 22 JuneC extended and closed below IB in effect giving clues to a sustained auction

D TPO formed a Poor Low (which often gets taken out) before closing as a Bullish Inside Bar within IB technically Failing the Auction. Only Bull Engulf is on M5 and with the Poor Low and ADR exhaustion not far below and Strong DT, I decided to stay out and document the trade.

As I am writing M5 closed above VWAP but has not cleared it yet.

Will monitor progress.