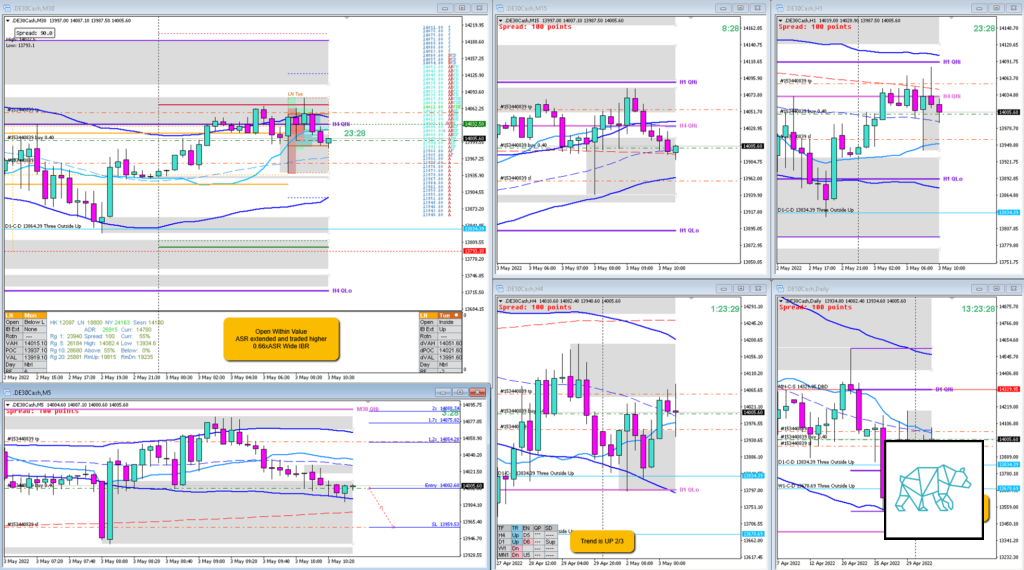

Strength From Within IBR (Bad Trading Idea

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

- Result

- -1R

- Open Sentiment

- Open Within Value

- ASR extended and traded higher

- 0.66xASR Wide IBR

- Trend

- Trend is Up 2/3

- H4: Up

- D1: Up

- W1: Down

- Hypo

- 2

- Long

- Strength From Within IBR, possible Late-Sustained Auction

- Attempted Setup

- Strength From Within IBR

- Entry Technique

- M5 consolidation

- SL placement

- Average SL (4300)

- TPO period for Entry

- F

- Trade Duration

- 0h47m

- Long/Short

- Long

- Leading Narrative

- Trend is UP 2/3

- Open Within and price extended above IB

- Price pulled back within IB and value

Actual Development

- F closed as a Bullish inside Bar but then price continued lower fulfilling the failed auction taking out my SL

Good points

- Taking the trade and walking away

Bad Points

- Price had failed to close above IB and started consolidating giving more clues to the failed auction.

- Did not wait for a full price action confirmation before going long

- Suffice to say I wasn’t functioning well yesterday. I had taken note but still thought I was okay to execute trades. Clearly I was not. Live and Learn.

Next Day Analysis

- Target hit?

- Yes, ‑1R

- Time-based Exit?

- -1R

- Overlap Noise?

- -1R

- End of Day?

- -1R

- Highest R multiple?

- 0.5R

TAGS: Open Within Value, Trend is Up 2/3,

Premarket prep on the day: