This is my premarket prep for today’s European session for DAX. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

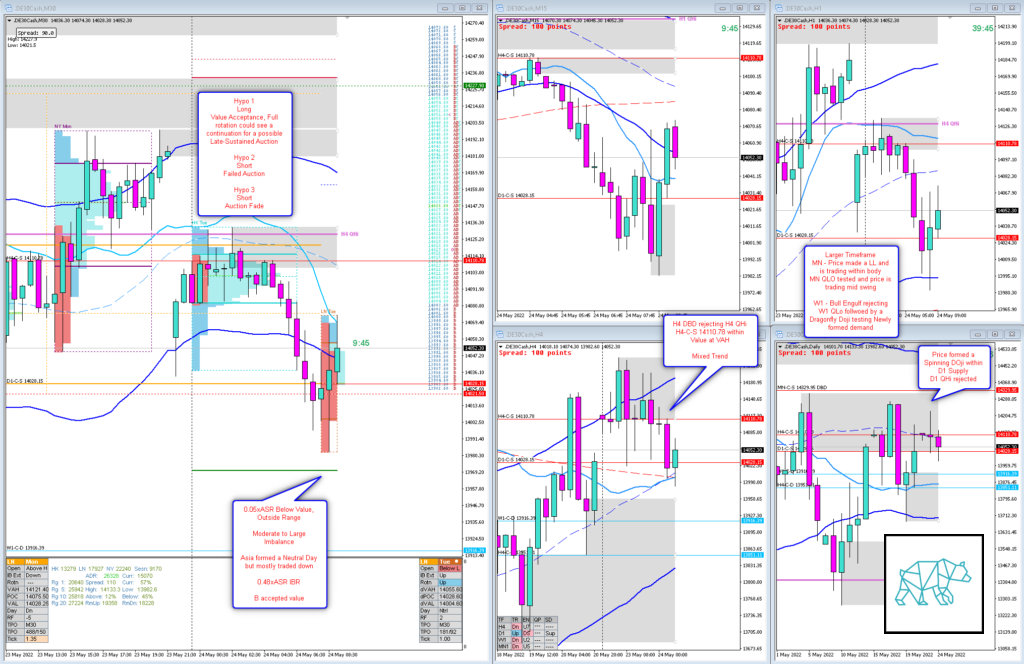

Larger Timeframe

- MN

- Price made a LL and is trading within body

- MN QLo tested and price is trading mid swing

- W1

- W1 Bull Engulf rejecting W1 QLo followed by a Dragonfly Doji testing newly formed demand

Narrative

- D1

- Price formed a Spinning Doji within D1 Supply

- D1 QHi rejected

- H4

- H4 DBD rejecting H4 QHi

- H4-C‑S 14110.78 within VAL at VAH

- Trend

- Mixed Trend, Down, Up, Down

- Market Profile

- 2 overlapping values within overall range

- LN Open

- 0.05xASR Below Value, Outside Range

- Moderate to Large Imbalance

- Asia formed a Neutral Day but mostly traded down

- 0.48xASR IBR

- B accepted value

Additional Notes

- N.A.

Hypos

- Hypo 1

- Long

- Value Acceptance, full rotation could see a continuation for a possible Late-Sustained Auction

- Hypo 2

- Short

- Failed Auction

- Hypo 3

- Short

- Auction Fade

Clarity

- 3

Mindful Trading (lack of sleep?)

- Feeling a bit jittery, drank too much coffee

Focus Points for trading development

- Monthly Goals

- Either hit SL or target, reassess after Trading Window Close

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- Risk Management

- 2 consecutive days of lack of sleep = NO TRADING