Failed Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

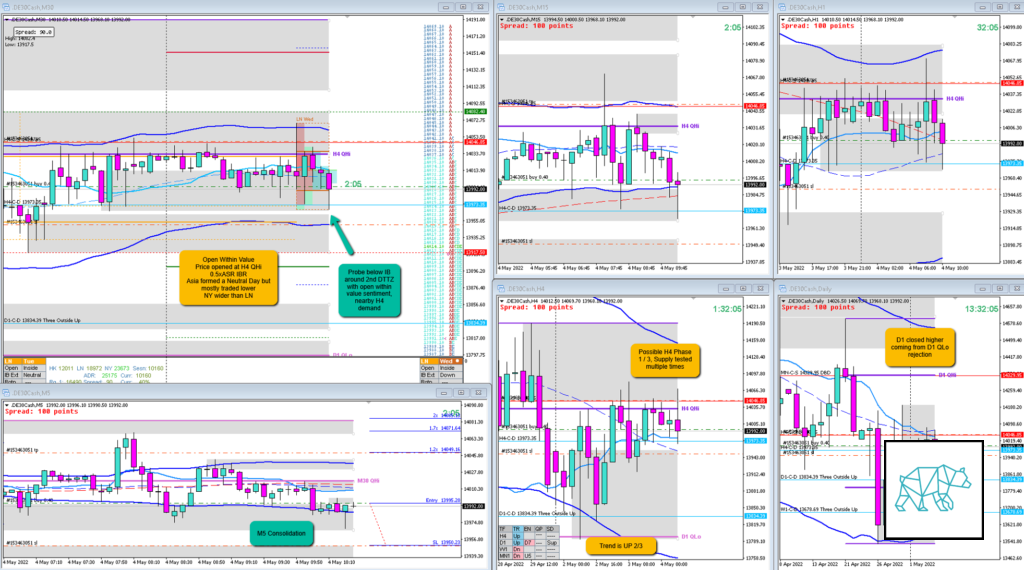

- Result

- 0.5R

- Open Sentiment

- Open Within Value

- Price opened at H4 QHi

- 0.5xASR IBR

- Asia formed a Neutral Day but mostly traded lower

- NY wider than LN

- Trend

- Trend is UP 2/3

- H4: Up

- D1: Up

- W1: Down

- Hypo

- 1

- Long

- Failed Auction

- Attempted Setup

- Failed Auction

- Entry Technique

- M5 consolidation after extension down during E TPO

- SL placement

- ASR Short (4500)

- TPO period for Entry

- E TPO

- Trade Duration

- 0h33m

- Long/Short

- Long

- Leading Narrative

- Possible H4 Phase 1 / 3, Supply tested multiple times

- D1 closed higher coming from D1 QLo rejection

- Open Within Value and probe below around 2nd DTTZ

Actual Development

- E Closed within IB, F closed as a possible consolidation and failed to close above VWAP or take out LTF supply and I jumped out for a measly 0.5R

Good points

- Taking the trade

- 1.7R at IB High

Bad Points

- Not taking my stop, SL or target. I realized I was “wearing horse blinders” and thought to just quit for the week.

- Price would’ve hit target and more

Next Day Analysis

- Target hit?

- No, 0.5R

- Time-based Exit?

- 0.8R

- Overlap Noise?

- 1R

- End of Day?

- 6R

- Highest R multiple?

- 6R

TAGS: Open Within Value, Trend is Up 2/3,

Premarket prep on the day: