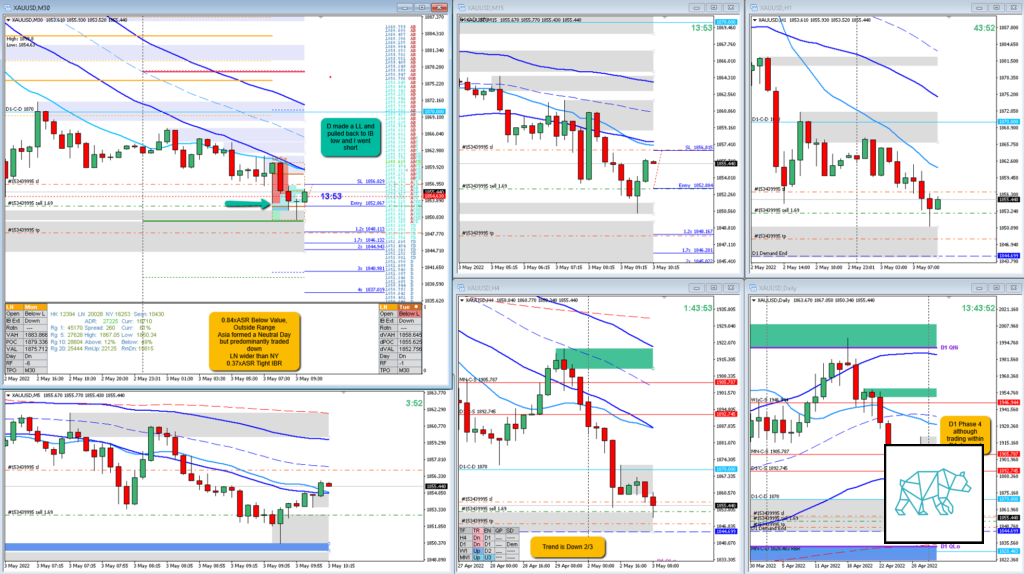

Late-Sustained Auction (Bad Trading Idea)

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #Gold #XAUUSD

- Result

- -1R

- Open Sentiment

- 0.84xASR Below Value, Outside Range

- Asia formed a Neutral Day but predominantly traded down

- LN wider than NY

- IBR

- 0.37xASR Tight IBR

- Trend

- Trend is Down 2/3

- H4: Down

- D1: Down

- W1: Up

- Hypo

- 2

- Short

- Late-Sustained Auction

- Attempted Setup

- Late-Sustained Auction

- Entry Technique

- D made a LL and I went in short at IB low

- SL placement

- Average SL (400)

- TPO period for Entry

- D TPO

- Trade Duration

- 0h32m

- Long/Short

- Short

- Leading Narrative

- Asia formed a Neutral Day but predominantly traded down

- D1 closed within D1 demand and made a LL after already previous day exceeding ADR by 1.64

- Trend is Down 2/3

- IB extension down and D making LL

Actual Development

- D closed within IB as a Dragonfly Doji, E traded deeper within IB failing the auction and taking out my SL

Good points

- Taking my stop — I was thinking to cut the trade and reverse to go long. But I need to be comfortable again to just take my stop as I want to walk away from trades and do other things. So I did well on that part.

- Not feeling bothered by having made this mistake. Learn and move on.

Bad Points

- Screenshot software froze up and took awhile to restart so I was late taking a screenshot but luckily managed before my SL got hit

- Large imbalance at the open

- Trading right into D1 demand without having C or D closing below IB for a Late-Sustained Auction entry — jumped the gun on the trade

- H4 Supply low in distribution curve more likely to get taken out

- Did not write my DRC due to being busy with other work

Next Day Analysis

- Target hit?

- Yes, ‑1R

- Time-based Exit?

- -1R

- Overlap Noise?

- -1R

- End of Day?

- -1R

- Highest R multiple?

- 0.2R

TAGS: Below Value, Outside Range, Large Imbalance, Trend is Down 2/3,

Premarket prep on the day: