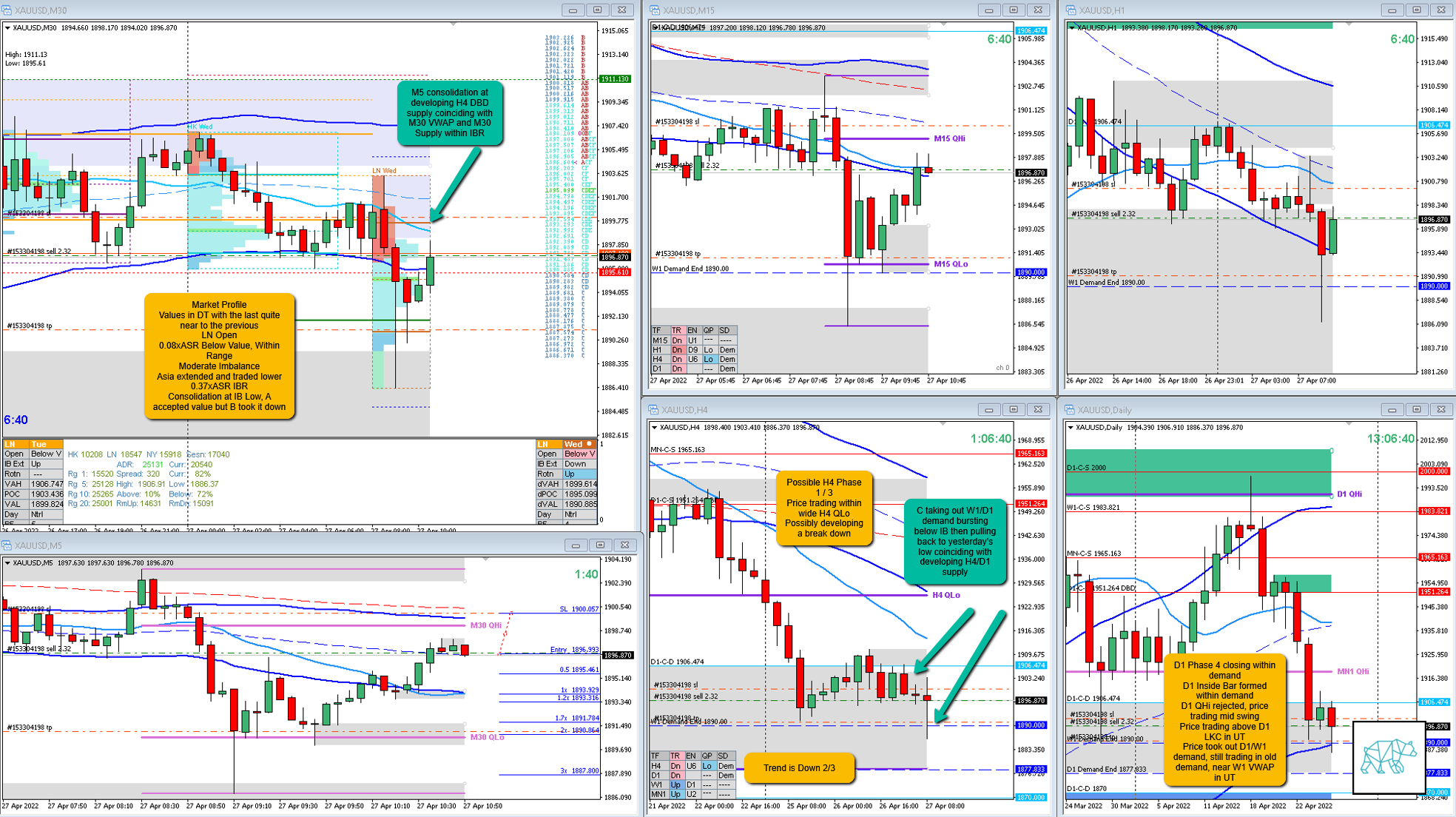

28 Apr 20220427 Trade Review Gold T2

Late-Sustained Auction (from within IBR)

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #Gold #XAUUSD

- Result

- 0.6R

- Open Sentiment

- 0.08xASR Below Value, Within Range

- Moderate Imbalance

- Asia extended and traded lower

- Consolidation at IB Low, A accepted value but B took it down

- IBR

- 0.37xASR IBR

- Trend

- Trend is Down 2/3

- H4: Down

- D1: Down

- W1: Up

- Hypo

- 2

- Short

- Sustained Auction, Late-Sustained Auction

- Attempted Setup

- Late-Sustained Auction

- Entry Technique

- M5 consolidation at developing H4 DBD supply coinciding with M30 VWAP and M30 Supply within IBR

- SL placement

- Standard SL (4900)

- TPO period for Entry

- F TPO

- Trade Duration

- Long/Short

- Short

- Leading Narrative

- Open sentiment

- C taking out W1/D1 demand bursting below IB then pulling back to yesterday’s low coinciding with developing H4/D1 supply

- Trend is Down 2/3

Actual Development

- F closed below IB after testing IB although it closed as a weak Three Inside Up and when M5 started consolidating I took off the trade for 0.6R

Good points

- Understanding the opportunistic nature of the trade

Bad Points

- Not in line with the overall narrative for the session as price continued higher

- W1 demand popping could see a bigger adverse reaction — I noticed this already with popping of medium timeframe SD zones

Next Day Analysis

- Target hit?

- No, 0.6R

- Time-based Exit?

- -0.2R

- Overlap Noise?

- -1R

- End of Day?

- -1R

- Highest R multiple?

- 1R

TAGS: Below Value, Within Range, Moderate Imbalance, Trend is Down 2/3,

Premarket prep on the day:

Daily Report Card:

No Comments