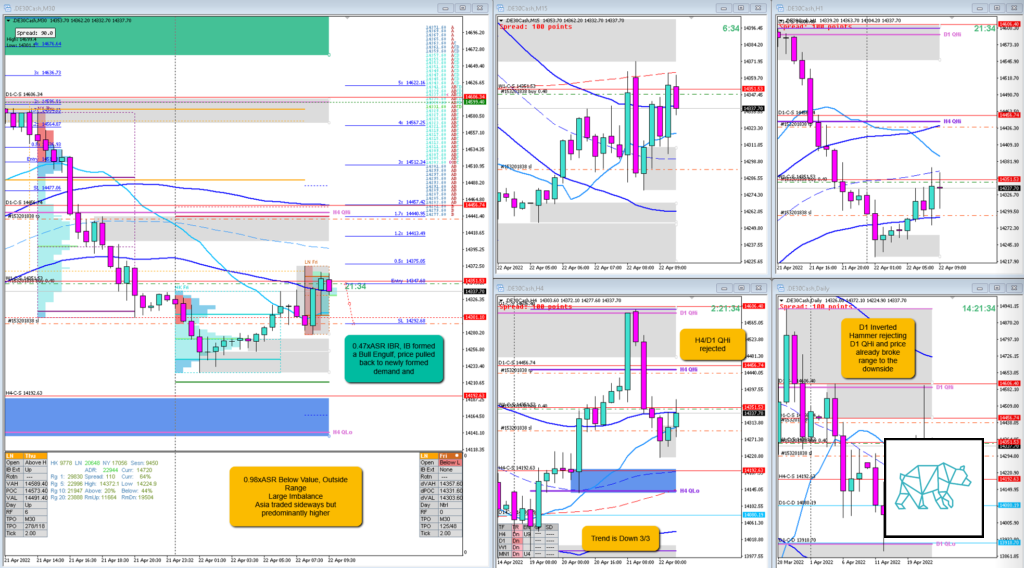

Mean Reversion, Sustained Auction (Bad Trading Idea)

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

- Result

- -1R

- Open Sentiment

- 0.98xASR Below Value, Outside Range

- Large Imbalance

- Asia traded sideways but predominantly higher

- IBR

- 0.47xASR IBR

- Trend

- Strong DT

- H4: Down

- D1: Down

- W1: Down

- Hypo

- 1

- Long

- Sustained Auction

- Attempted Setup

- Early entry reversal to sustained auction

- Entry Technique

- Re-test of newly formed demand (Bull Engulf)

- SL placement

- Standard SL (5500)

- TPO period for Entry

- D TPO

- Trade Duration

- 0h17m

- Long/Short

- Long

- Leading Narrative

- Possible developing a H4 Inside Up

- D1 Inverted Hammer

- Open sentiment

- Possible Friday profit-taking

Actual Development

- D TPO closed down as a Bear Engulf taking out SL ‑1R

Good points

- Early entry to monitor for an extension to confirm the sustained auction. This did not come.

Bad Points

- For a mean reversion trade I need a break of IB

- Going long in a strong DT after D1 formed an inverted hammer rejecting D1 QHi and price broke the range to the downside

- Relying too much on inverse correlation with Gold

Next Day Analysis

- Target hit?

- No, ‑1R

- Time-based Exit?

- -1R

- Overlap Noise?

- -1R

- End of Day?

- -1R

- Highest R multiple?

- 0.2R

TAGS: Below Value, Outside Range, Large Imbalance, Trend is Down 3/3, Prev. Day Exceeded ADR,

Premarket prep on the day:

Daily Report Card: