22 Apr 20220421 Trade Review DAX

Who says you can’t buy the top?! 🙂

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

- Result

- 1.2R

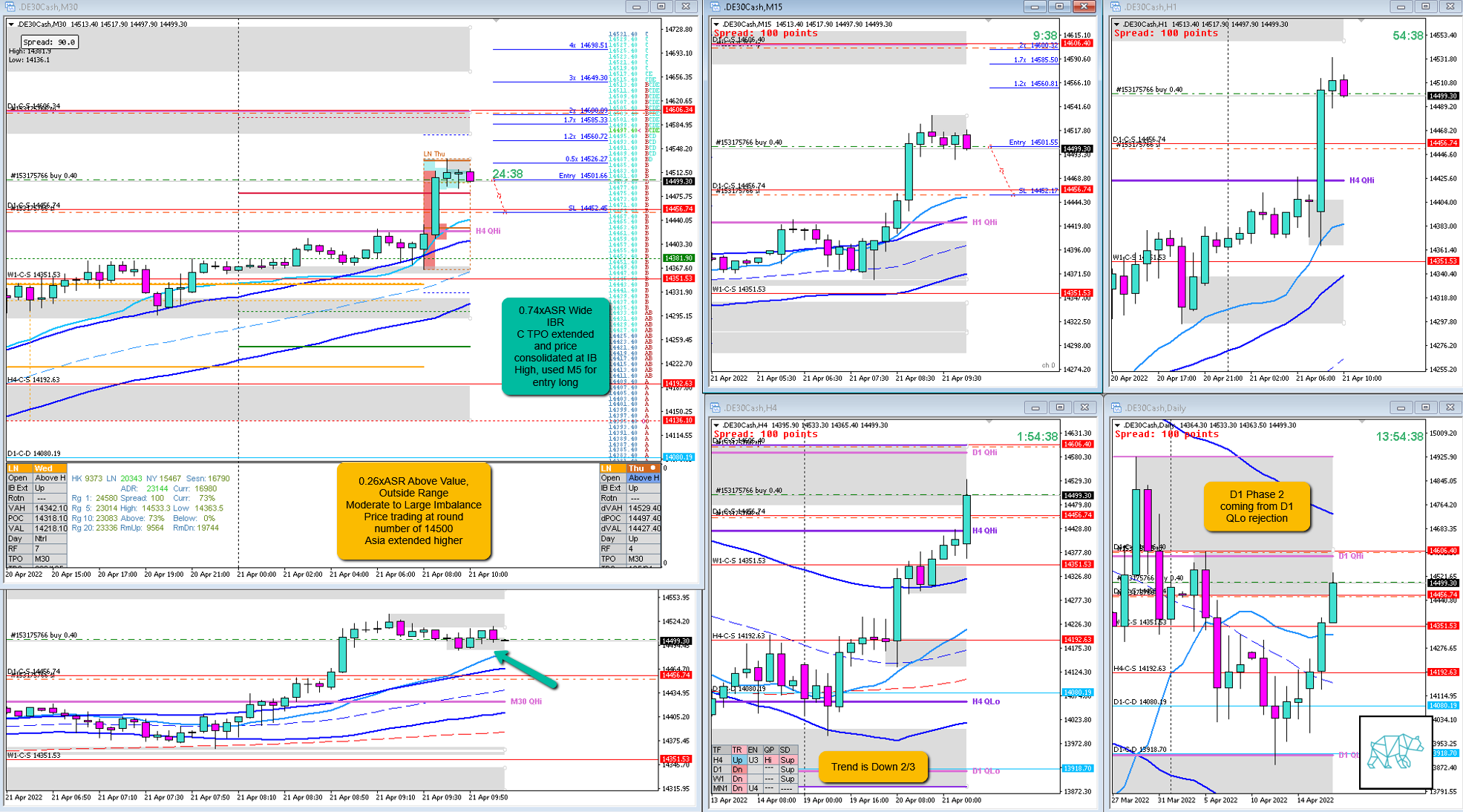

- Open Sentiment

- 0.26xASR Above Value, Outside Range

- Moderate to Large Imbalance

- Price trading at round number of 14500

- Asia extended higher

- IBR

- 0.74xASR Wide IBR

- Trend

- Trend is Down 2/3

- H4: Up

- D1: Down

- W1: Down

- Hypo

- 2

- Long

- Strength From Within IBR

- Attempted Setup

- Strength From Within IBR

- Entry Technique

- C extended above IB and then price consolidated at IB high

- Used M5 for entry

- SL placement

- Standard SL (5000)

- TPO period for Entry

- E TPO

- Trade Duration

- 1h10m

- Long/Short

- Long

- Leading Narrative

- D1/H4 Phase 2, no arrival at D1 QHi

- Wide IBR with price consolidation at IB high

Actual Development

- E closed above IB, F closed as a Bearish Inside Bar although no failed auction, F hit Target

Good points

- Staying with the trade even though F closed as a Bearish Inside Bar

- Understanding the narrative even though trading into D1 QHi as well as larger timeframe supply

- Good reading of the profile and price action

Bad Points

- Price would’ve hit 2R although then it started reversing (hard)

- Although the trade worked out in hindsight this was a very risky trade and not the most probable.

Next Day Analysis

- Target hit?

- Yes, 1.2R

- Time-based Exit?

- 1.9R

- Overlap Noise?

- 1.9R

- End of Day?

- -1R

- Highest R multiple?

- 2.1R

TAGS: Above Value, Outside Range, Moderate to Large Imbalance, Trend is UP 2/3,

Premarket prep on the day:

Daily Report Card:

No Comments