21 Apr 20220420 Trade Review Gold T2

Play: Reversal

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #Gold #XAUUSD

- Result

- 0.7R

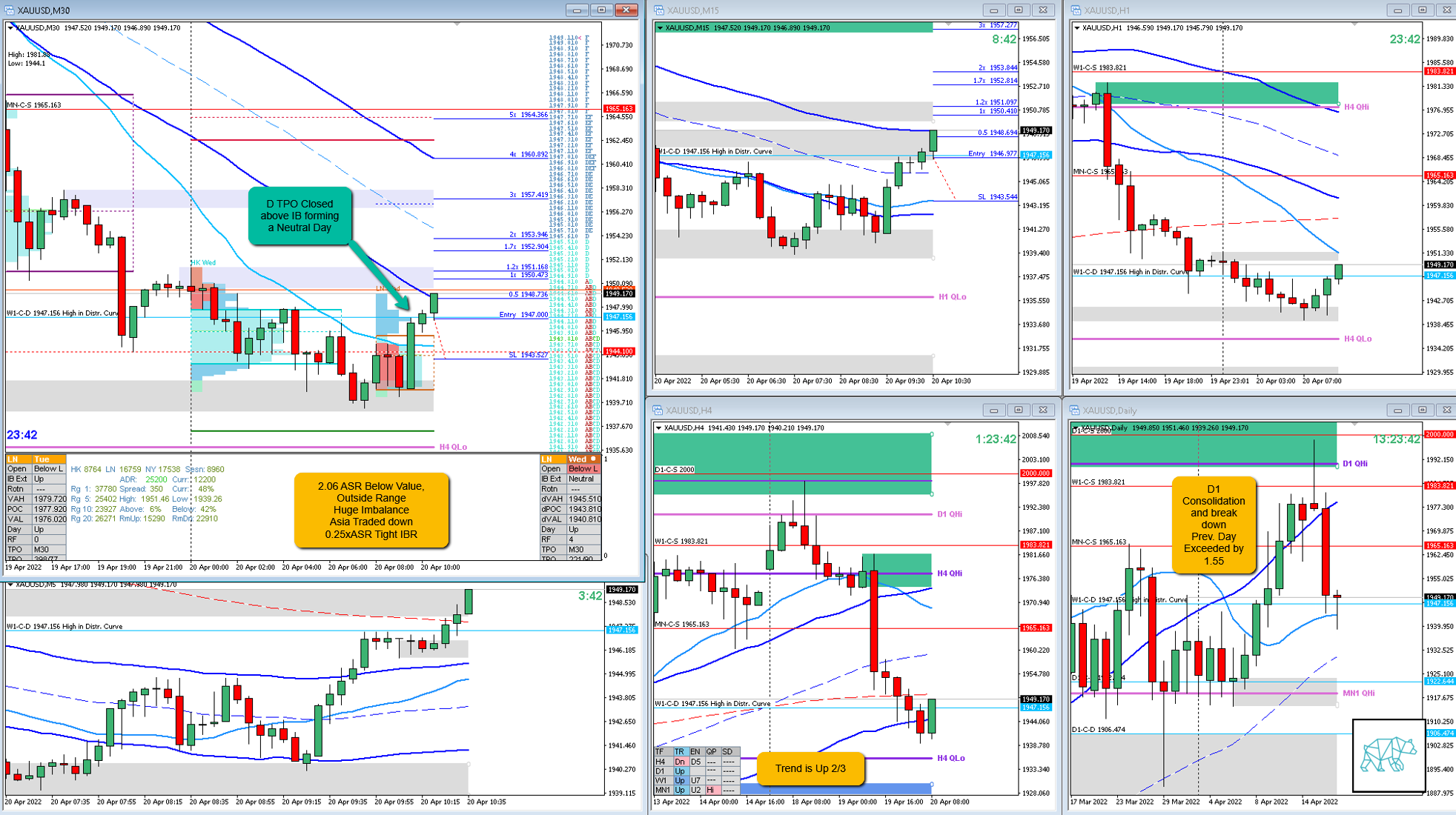

- Open Sentiment

- 2.06 ASR Below Value, Outside Range

- Huge Imbalance

- Asia Traded down

- IBR

- 0.25xASR Tight IBR

- Trend

- Trend is Up 2/3

- H4: Down

- D1: Up

- W1: Up

- Hypo

- 4

- Long

- Failed Auction, risky tight IBR

- Attempted Setup

- Reversal

- Entry Technique

- D TPO closed as a Bull Engulf, coinciding with a M30 VWAP in DT BO

- SL placement

- Average SL (3500)

- TPO period for Entry

- E TPO

- Trade Duration

- 0h33m

- Long/Short

- Long

- Leading Narrative

- Prev. Day Exceeded ADR

- Trend is UP 2/3

- Yesterday’s low nearby, price action rejection, M30 VWAP in DT BO

Actual Development

- E closed higher, F made a HH hitting H1 Supply coinciding with H1 VWAP and I took profits at 0.7R

- Price continued higher and eventually formed a H4 Bull Engulf.

- Trade would’ve gone to over 2R

Good points

- Not being bothered by getting stopped out on the short and reversing to go long after D TPO closed as a Bull Engulf

Bad Points

- Taking profits too soon — I thought a sustained auction wasn’t probable due to the Neutral Day implication

Next Day Analysis

- Target hit?

- No, 0.7R

- Time-based Exit?

- 1.7R

- Overlap Noise?

- 1.9R

- End of Day?

- 3.1R

- Highest R multiple?

- 3.1R

TAGS: Below Value, Outside Range, Huge Imbalance, Prev. Day Exceeded ADR, Trend is UP 2/3, Tight IB,

Premarket prep on the day:

Daily Report Card:

No Comments