20 Apr 20220420 Premarket Prep Gold

#fintwit #orderflow #daytrading #premarketprep #XAUUSD #GOLD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

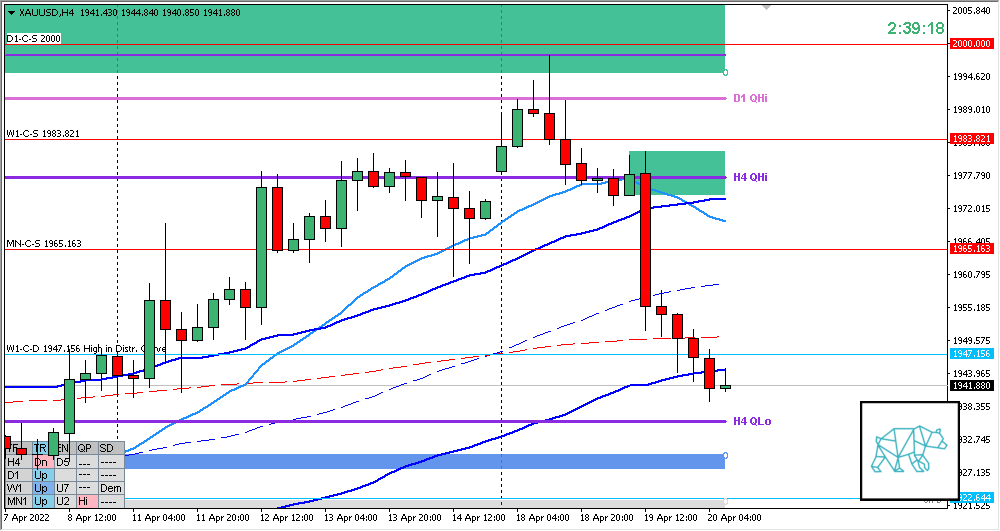

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Larger Timeframe

- MN

- Last month closed as a MN Inverted Hammer

- Currently price is trading above last month’s body but within range and started reacting off MN Supply

- W1

- W1 Three Outside Up with price making a HH although started reacting off W1 Supply and QHi and price has returned to newly formed W1-C‑D 1947.156 High in Distr. Curve

Narrative

- D1

- D1 consolidation and break down at D1 QHi after a near-test of round number of 2000

- Prev. Day Exceeded ADR by 1.55

- H4

- H4 Phase 4 arriving at OLD H4 demand, no arrival at H4 QLo (yet)

- Trend

- Trend is Up 2/3 (Trend Change)

- Market Profile

- 4 values created within overall range with the last below the previous and price is currently trading overextended below value

- LN Open

- 2.06 ASR Below Value, Outside Range

- Huge Imbalance

- 0.25xASR Tight IBR

- Asia Traded down

Additional Notes

- N.A.

Hypos

- Hypo 1

- Short

- Late-Sustained Auction

- Hypo 2

- Long

- Auction Fade

- Hypo 3

- Short

- Failed Auction, risky tight IBR, might have to monitor for continuation

- Hypo 4

- Long

- Failed Auction, risky tight IBR

Clarity

- 2

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- No early exits, either hit SL or target

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- Risk Management

- 2 consecutive days of lack of sleep = NO TRADING

No Comments