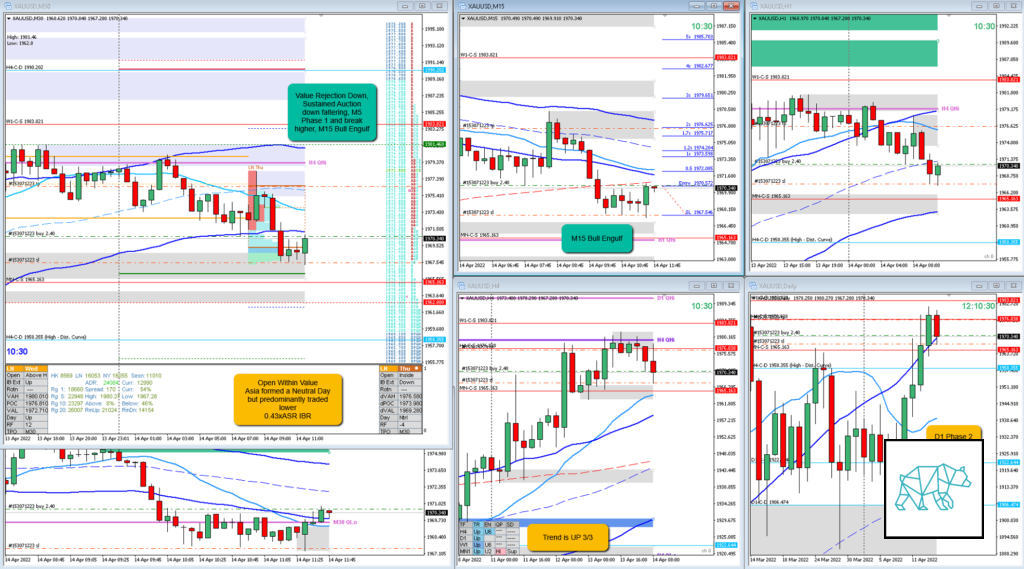

Play: Auction Fade to Failed Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #Gold #XAUUSD

- Result

- 1.2

- Open Sentiment

- Open Within Value

- Asia formed a Neutral Day but predominantly traded lowe

- IBR

- 0.43xASR IBR

- Trend

- Strong UT

- H4: Up

- D1: Up

- W1: Up

- Hypo

- 4

- Long

- Auction Fade

- Attempted Setup

- Auction Fade to Failed Auction

- Entry Technique

- M5 Phase transition to Phase 2, M15 Bull Engulf breaking out

- SL placement

- Tight SL (300)

- TPO period for Entry

- H TPO

- Trade Duration

- 0h6m

- Long/Short

- Long

- Leading Narrative

- D1 Phase 2

- Strong UT

- LTF Phase 1 and break out after a sustained auction started faltering from value rejection

Actual Development

- Price quickly hit target 1.2R

Good points

- I was short but then cut that trade for ‑0.8R loss and immediate reversed

- Using tight SL placement just below LTF formation slightly cutting through wick though

Bad Points

- Price went higher and even hit 3R

- Did not plot H4 demand even though OLD I should’ve plotted it on my chart

Next Day Analysis

- Target hit?

- Yes, 1.2R

- Time-based Exit?

- 1.2R

- Overlap Noise?

- 1.6R

- End of Day?

- -1R

- Highest R multiple?

- 3R

TAGS: Open Within Value, Trend is UP 3/3, Hypo 4 at 2nd DTTZ,

Premarket prep on the day:

Daily Report Card: