16 Apr 20220414 Trade Review DAX

Posted at 08:55h

in Bad Trading Idea, DAX Trade Review, Failed Auction, Return to Value, Trade Reviews

0 Comments

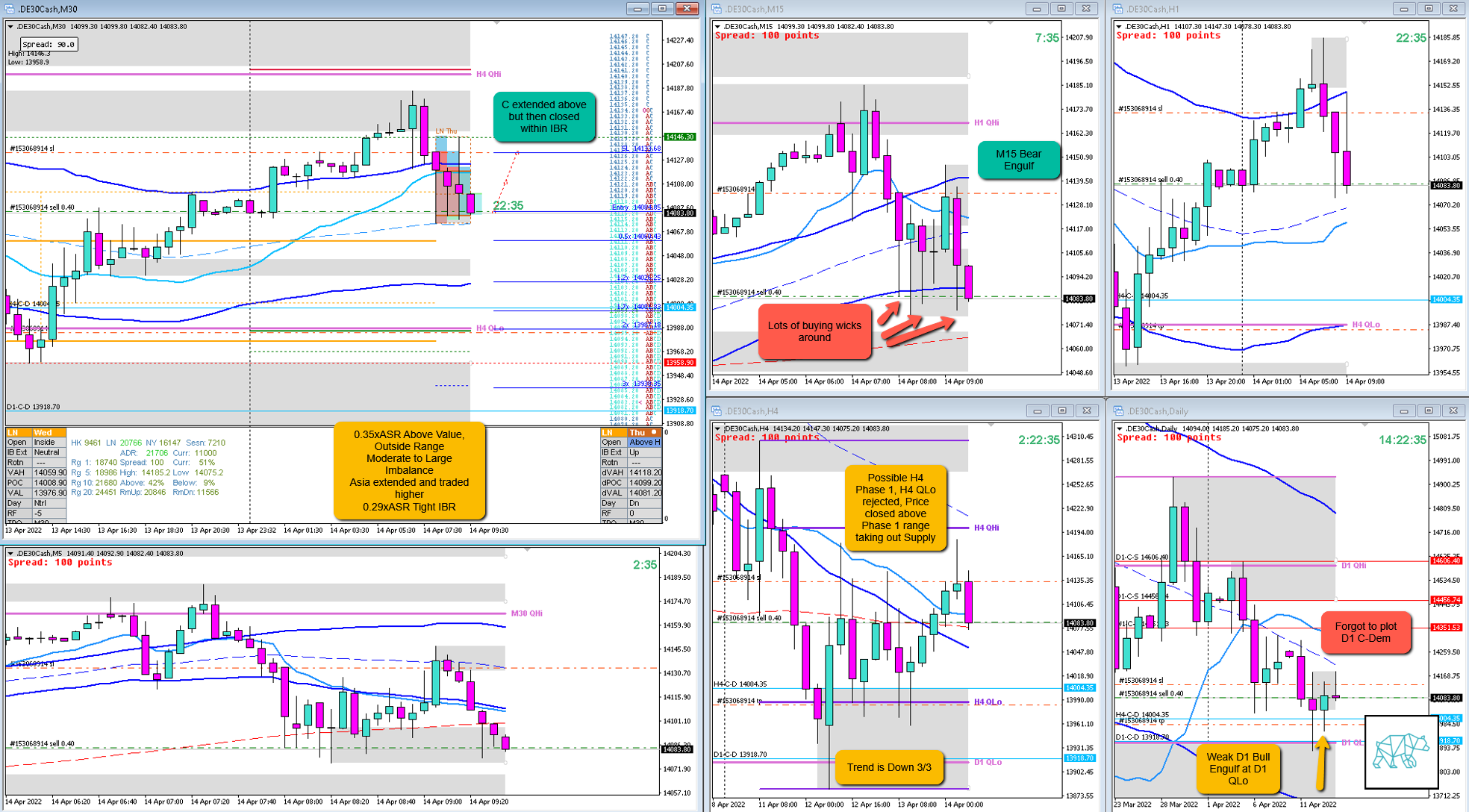

Play: Failed Auction (Bad Trading Idea)

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

- Result

- -1R

- Open Sentiment

- 0.35xASR Above Value, Outside Range

- Moderate to Large Imbalance

- Asia extended and traded higher

- IBR

- 0.29xASR Tight IBR

- Trend

- Strong DT

- H4: Down

- D1: Down

- W1: Down

- Hypo

- 1

- Short

- Failed Auction, could possibly monitor for a value

- Attempted Setup

- Failed Auction

- Entry Technique

- M15 Bear Engulf within IBR

- SL placement

- Standard SL (5000)

- TPO period for Entry

- D TPO

- Trade Duration

- 1h24m

- Long/Short

- Short

- Leading Narrative

- Strong DT

- Failed Auction in C

Actual Development

- Price extended to the opposite time in E and made a LL in F but did not accept value.

- With newly formed D1 C‑dem at VAH this would’ve been hard to do anyway and price reversed which was more likely.

Good points

- Taking a trade as per Hypo 1 — even though this was inherently misaligned with the most likely narrative unfolding as I will get to underneath

Bad Points

- Where to start….

- Was not feeling the sharpest all week but since I had a few good trades I thought I was okay. EDIT: Actually, I had one more bad trading idea earlier in the week that happened to close into profit.

- Was listening to upbeat music which made me hyper and I was too eager to take a trade instead of fully grasping the narrative

- Bad entry (too close to IB low)

- Forgot to plot new D1 C‑dem coinciding with VAH so didn’t do well on my premarket prep

- Went against all the buying wicks that were an indication of possible absorption to the opposing side or at least that something was up.

- Noted a possible H4 phase 1, price closing above the range, H4 Qlo rejection, and then still going against it.

- Kinda working off autopilot which works well under normal circumstances. But this day I wasn’t sharp. Either way this is why we have risk management in place and I didn’t do too much damage.

Next Day Analysis

- Target hit?

- No, ‑1R

- Time-based Exit?

- 0.5R

- Overlap Noise?

- -1R

- End of Day?

- -1R

- Highest R multiple?

- 0.9R

TAGS: Above Value, Outside Range, Moderate to Large Imbalance, Trend is Down 3/3,

Premarket prep on the day:

Daily Report Card:

No Comments